[This is a snipit of content from the Bank of Canada’s Monetary Policy Report – July 2016. Download the full Monetary Report here]

****

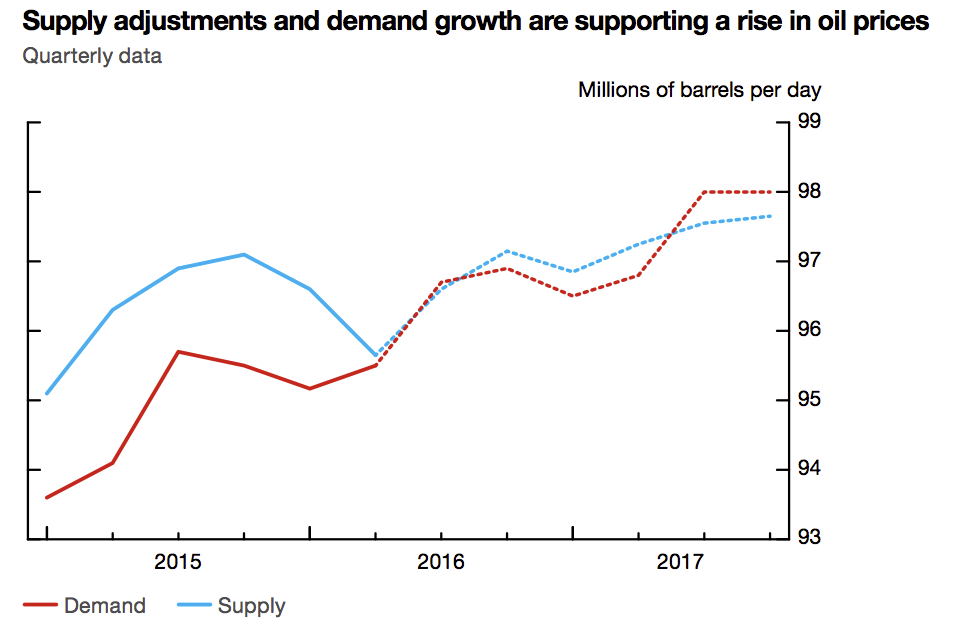

There is gathering evidence that the needed supply-demand adjustment in the global oil market is progressing (Chart above).

In this context, the upside risks to oil prices identified in previous Reports have already partially materialized: the price assumption has risen by about US$10 per barrel relative to the April Report, although this increase was also partly a result of temporary supply disruptions.

By convention, the Bank assumes that oil prices will remain near their recent average levels: US$50, US$49 and US$36 per barrel, respectively, for Brent, West Texas Intermediate (WTI) and Western Canada Select (WCS).

The substantial reductions in investment since 2014, coupled with rising demand, continue to pose an upside risk to prices over the projection horizon, although ongoing cost-cutting initiatives and technological advances limit this upside potential.

The projected stability of the non-energy commodity price index masks divergent pressures on component prices. Lumber prices are expected to be a source of strength, benefiting from stronger housing markets in the United States and China. In contrast, there is the potential for downward pressure on base metals prices as several new mining projects come on line globally.

****

I think a lot of job loss has happened in Calgary’s Oil & Gas employment sector already. For those who remain working, I think more and more confidence in their future earning potential is growing.

I think employment confidence is a HUGE factor when considering entering the housing market as a first time home buyer.

I suspect more people “waiting to see” if they are laid off AND if housing prices are bottoming might find neither are as “scary” as they might have initially thought.

For more information on anticipating Calgary’s near term housing prices, read this blog post.

If you have any questions about Calgary’s housing market, understanding how much you can afford to purchase, questions on your credit – or anything Mortgage related, connect with me. My details are in my footer image below.

Talk soon,

Chad Moore

P.S

If you like my blog content, please let me know by clicking the “Like” button. Also consider sharing this post with your friends on your Social Media. Thank you in advance.