Hi everyone!

I think it’s important to understand several key Calgary Real Estate metrics to make sense of our market. Not only that, understanding this information also helps you anticipate near term price movements.

Deciding to enter the market as a buyer or seller is a big decision. I encourage you to understand the metrics below AND consult with myself and team of trusted Realtors.

I think deciding WHO you work with is incredibly important and financially advantageous for you over the short and long term.

Please continue reading with me …

Laws Of Supply & Demand:

Real Estate, like any commodity, is subject to the laws of supply and demand.

Demand for Real Estate is created by positive employment outlook, net migration to Calgary, favourable Mortgage lending environment, Governmental incentives, personal justifiability relative to renting, and prospects of positive long term investment.

Supply in Real Estate can be anticipated by understanding long term Real Estate cycles (Real Estate is NOT linear), and the below statistics.

I encourage those of you confident in their future employment prospects, who have savings for a down payment, to look at opportunities to purchase at a time when many people are fearful. I think understanding the data available to you is helpful in mitigating your own fears of purchasing today (if you have them).

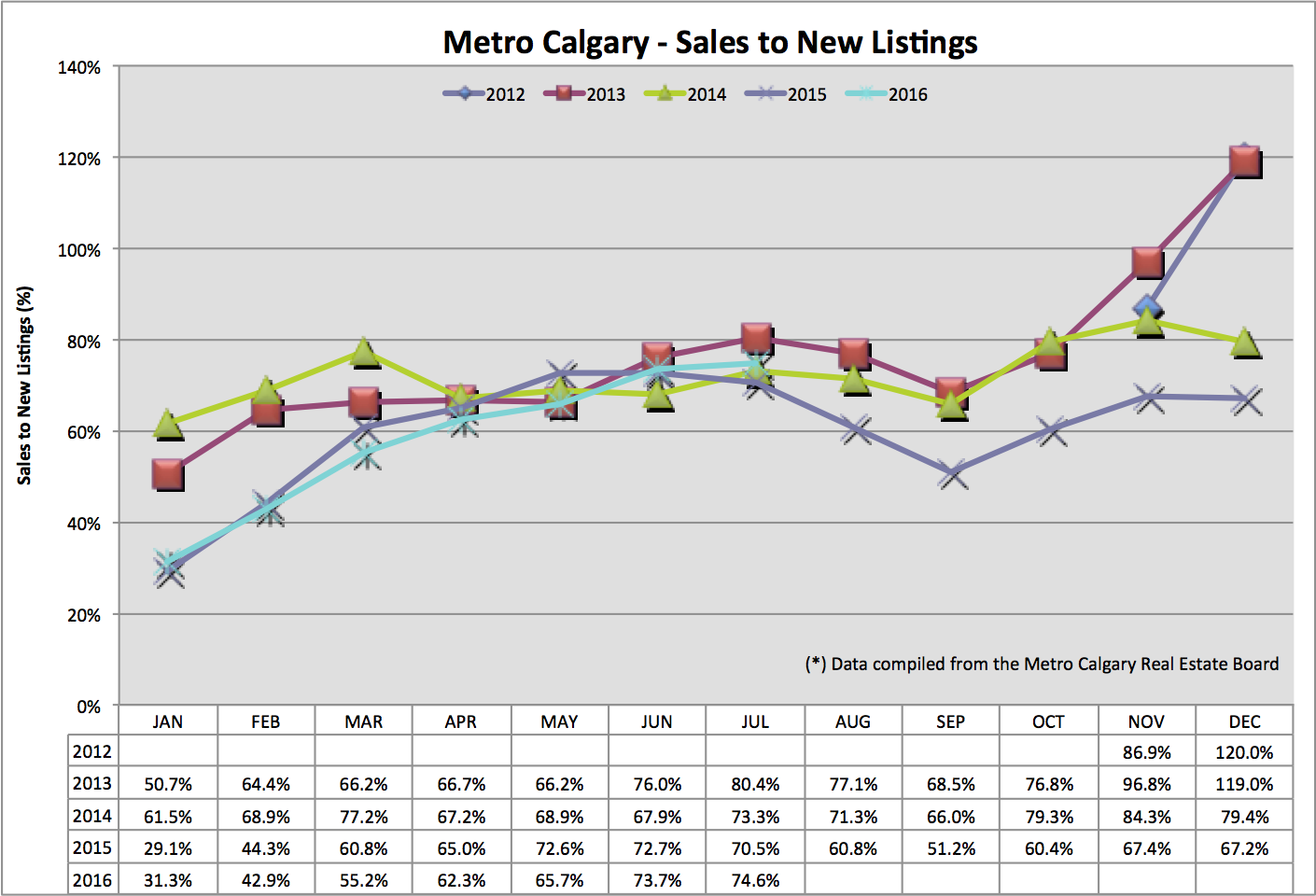

Sales To New Listings Ratio:

This ratio looks at the number of new listings added to the market compared with homes being sold or leaving the market. For context, a decreasing ratio indicates an increase in future home supply. A increase in supply puts downward pressure on home pricing.

This ratio has been closely following 2015. You’ll note a fairly steep decrease in the sales to new listings ratio in August and September in 2015 (increasing supply). You’ll also note the corresponding decrease in average sales price.

Keep a close eye on this ratio IF you plan on entering the market in the Fall of 2016.

Absorption Rate:

This ratio tells us the relationship between total home sales and total home listing inventory. The absorption rate tells us in months, how long it would take to liquidate all single family home listings at the current sales rate for that particular month.

A HIGH absorption rate indicates low sales volume and higher inventory levels. A low absorption rate indicates higher sales volume and lower inventory of homes for sale.

For context, between 2-4 months absorption rate is a “balanced” market.

Note the relationship between a increasing absorption rate and decreasing average price. Also note, the trend line in 2015 and how we are following this trend in 2016. Understanding this helps you anticipate near term Real Estate price movement.

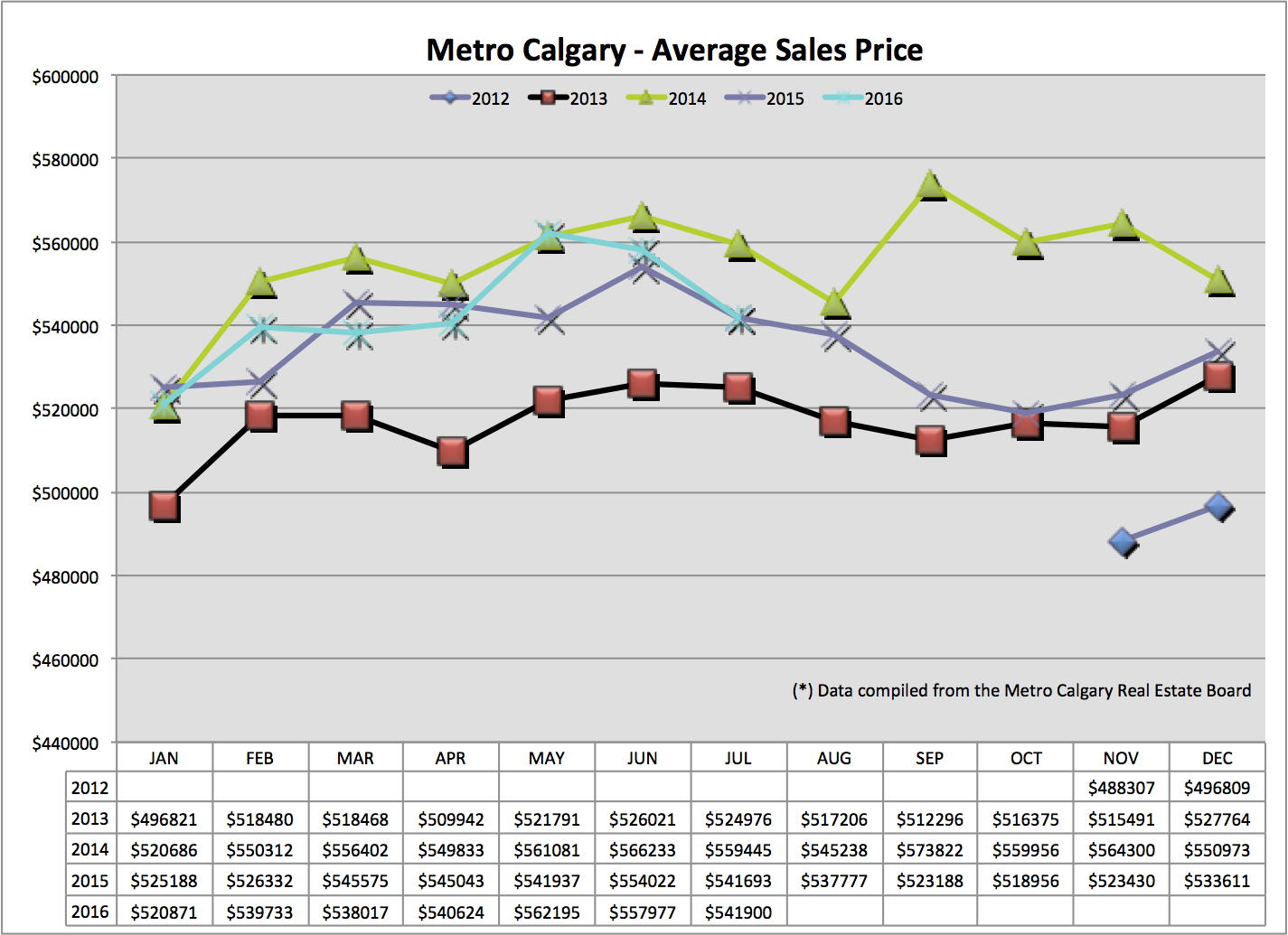

Average Price:

Here is the updated average home price for 2016. Again, note the trend line and how we are closely following 2015. What do you see happening this Fall for single family homes in Calgary?

Interest Rate Barometer:

Fixed interest rates are derived from the Canadian Bond market. To anticipate near term interest rates I look at the bond yields. the blue line below helps me anticipate interest rates, based on these movements. I have also included a NEW consumer friendly image that indicates the likelihood of any fixed interest rate movement.

Interest Rate Context:

Below is a simple graph for your context of where interest rates have been over the past five years. You’ll note at some points in the past the significant spread between fixed and adjustable rate Mortgages. During these times of large spreads, I recommend considering an adjustable rate Mortgage, if that is not the clients first instinct to consider. Today, the spread between fixed and adjustable rate Mortgages is quite narrow.

Sharing Is Caring:

Please let me know you appreciate this information by sharing it in your various social media outlets. Of course, considering my professional services for your next Mortgage need (purchase, refinance or renewal) is the largest indication you appreciate this content :-).

Please call or email with you Mortgage questions or inquiries.

Talk soon,

Chad Moore