Many people I speak with want to see, all else being equal, how the new qualifying interest rate would change home purchasing power.

Before we get started, let’s cover off on the following:

- New Mortgage rule change taking effect.

- What goes into Mortgage qualifying?

- What is the difference before-and-after the Mortgage rule change?

New Mortgage Rule Change Taking Effect:

The interest rate at which people qualify to purchase their home, for any term or Mortgage product, is changing to the Bank of Canada’s 5-year posted interest rate. Today that rate is 4.64%.

Currently, if a customer wanted anything other than a 5-year fixed rate, this qualifying rule was already in effect. Until October 17th, if a client wanted a 5-year fixed rate, they could use that rate in qualification for their Mortgage.

On, and after, October 17th 2016 the Bank of Canada posted 5-year fixed rate is now a blanket qualifying interest rate, for all Mortgages, and across our country.

Said another way, Mortgage applicants need to be able to qualify for their Mortgage as if their interest rate is 4.64%. Once that hurdle is satisfied, access to regular market rates is available.

What Goes Into Mortgage Qualifying?

There are two simple ratios that Mortgage lenders use to determine home affordability. One ratio is called the Total Debt Servicing Ratio (TDS). The other ratio is called the Gross Debt Servicing Ratio (GDS).

TDS looks at your ability to debt service the following items:

- Mortgage payment

- Tax

- Heat

- 1/2 condo fees (if applicable) and

- Other debt (credit card, auto loan etc).

When changing from the before-to-after scenario’s (below), I maintained the same down payment amount, amortization (25 years), and monthly cost for heat ($100).

The only variables I changed were the qualifying interest rate, purchase price and property taxes. With as little difference as possible, I wanted to see the effect the new qualifying interest rate had on purchase price (Mortgage affordability).

What Is The Difference Before-And-After The Mortgage Rule Change? (click images to enlarge)

Let’s look at each borrower now:

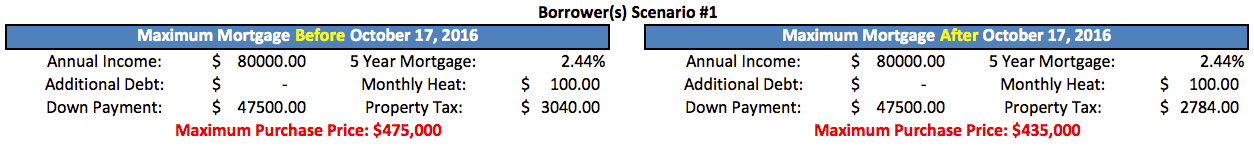

Borrower #1:

This would be a first time home buyer:

- Family income: $80,000

- No additional debt.

- 10% down payment.

- Insurance premiums included.

The resulting price change is down 8.42% from before to after.

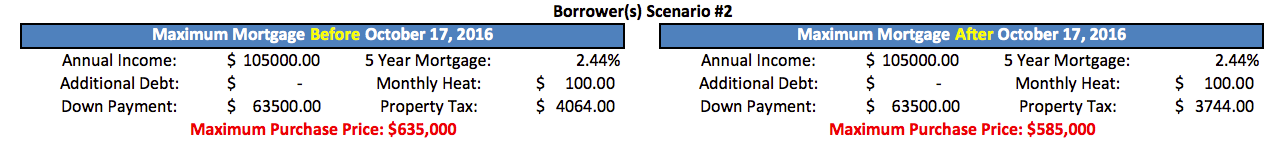

Borrower Scenario #2:

This scenario might be a first time home buyer OR an existing home owner looking to move up:

- Family income: $105,000

- No additional debt.

- 10% down payment.

- Insurance premiums included.

The resulting price change is down 7.78% from before to after.

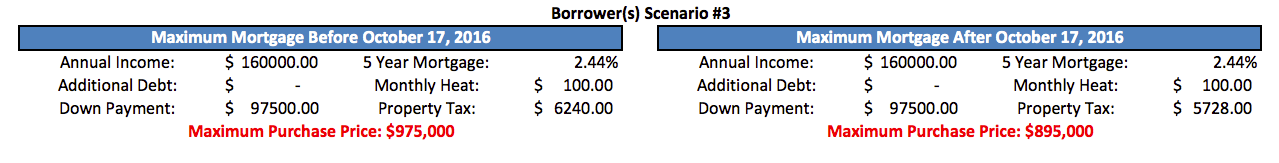

Borrower Scenario #3:

- Family income: $160,000

- No additional debt.

- 10% down payment.

- Insurance premiums added.

The resulting price change is down 8.2% from before to after.

So, What Does This Mean For Property Values?

In my humble opinion, here’s how I understand anticipating the housing market’s reaction …

By design, the bar to enter the “property ladder” for first-time homebuyers has adjusted up. I think raising ANY proverbial bar, leaves people unable to overcome the new hurdle.

I think this idea, in and of itself, will result in overall downward pressure on home prices in Calgary.

Existing home owners also face the new penurious qualifying criteria. Their financial horsepower, that allowed them to enter home ownership, might not warrant their “move-up” intentions. This removes a sale of a property, and a subsequent purchase of a new property, from the market.

If existing home owners evaluate the market, they might decide that listing their home is not a wise decision, at this time. Due to already lower than anticipated listing inventory today, I think this is the thought of many.

Pricing is derived from both supply and demand. As home purchase demand continues to squeeze Calgary’s market, supply becomes important to understand.

I anticipate near term supply using two major metrics: Sales To New Listings Ratio and Absorption Rate.

If anything, I anticipate a very short burst of activity before this weeks October 17th rule change deadline. I also do not anticipate increased supply due to this Mortgage rule change …

However, I think one very important number to be aware of is the Mortgage arrears trend in Calgary. If people are in a position to NEED to sell their home, this results in increased supply and aggressive pricing.

All else being equal, decreasing demand, with no anticipated increase in supply, does put downward pressure on home pricing. And that my friends, was the TOP agenda item of the Department of Finance (particularly for the Vancouver and Toronto Real Estate markets).

Conclusion:

We covered the change in Mortgage qualifying, what goes into Mortgage qualifying and three examples of the purchase price results for today’s buyers (before and after).

Like the examples listed above, I am also predicting downward pressure on home values. Even if housing supply remains at current levels, down pressure is exerted.

Continue to visit my blog for more updates and industry opinions.

Talk soon,

C. Moore

P.S.

Thanks for reading …if you like this kind of content, let me know by clicking “Like” above, comment below, send me an email, call and or email this link to a friend. Cheers!