Here’s what’s in today’s blog post for you …

- The sneaky difference between adjustable and variable rate Mortgages.

- A Surprise (not surprising) Market Move.

- Here’s The Conspiracy (see it unfold).

- Update On Current Interest Rates.

The Sneaky Difference Between Adjustable Rate and Variable Rate Mortgage:

With an adjustable rate Mortgage (ARM), a rate increase or decrease directly results in a corresponding Mortgage payment movement.

When the Bank Prime rates move up or down, the adjustable Mortgage payments following suit.

With a variable rate Mortgage (VRM), a rate increase or decrease DOES NOT result in a payment movement! What happens could cost you THOUSANDS without even knowing it!

Here’s what I mean …with a VRM, a Bank Prime rate increase allocates more of the same Mortgage payment amount toward Mortgage interest, with less paying down your Mortgage principle!

To really spell this out for you …at the end of your Mortgage term you might have only paid off a fraction of your actual Mortgage. Therefore, you would be renewing a significantly higher Mortgage amount AGAIN.

A Surprise (not surprising) Market Move:

TD surprisingly raised their interest rates.

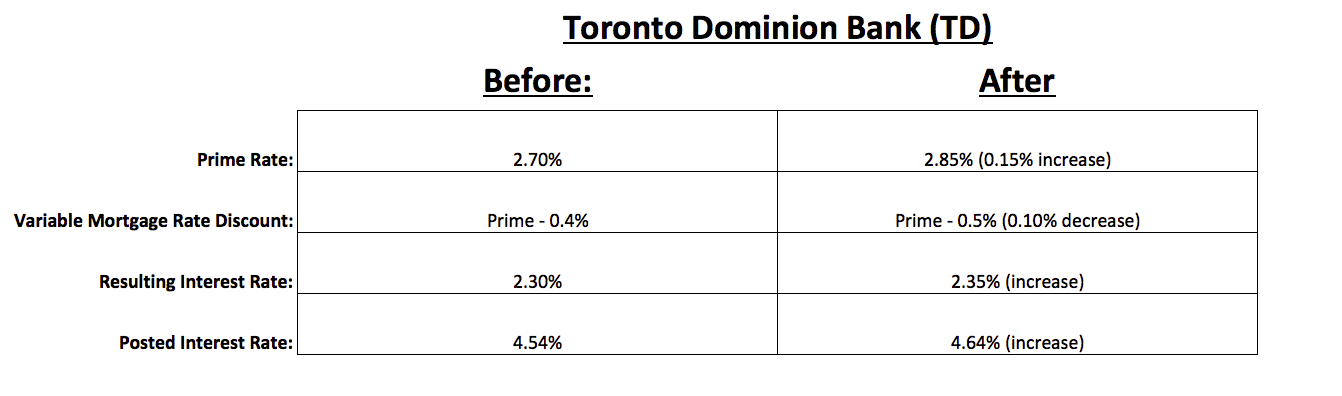

Take a look at how the Prime lending rate increased (without a Bank of Canada movement) and how TD reduced their “discount” to Prime:

Here’s what this means:

- All TD variable rate Mortgage holders see their interest rates increasing (TD makes more money).

- The spin to potentially new TD customers, seeing the discount to the prime lending rate, might be missed (TD makes more money).

- Increase to TD’s Mortgage qualifying posted interest rate. (TD makes more money).

Again, are we at-all surprised?

TD has basically raised capital from ALL of their existing Mortgage holders and tried to pull the wool over the eyes of potential clients.

You’ll also note, TD’s Mortgage payout penalties use their posted interest rates for calculation. Raising this rate INCREASES the penalty amount they charge for existing clients trying to leave the Bank for better terms/conditions.

This falls in line with Bank policy …increase shareholder value through revenue generation and profit. In this case, I’m simply shining a light on how TD is executing on this point.

And to be clear, I have referred clients to TD (when warranted) and I think the staff working at TD are nice people :-). This is simply a function of business in Banking.

[Update: I have been informed TD has sent notices of their rate change to their existing clients with several financing options. I do not know the contents of these notices or the rates they are offering as options. Please contact me to discuss.]

Here’s The Conspiracy (see it unfold) …

Is it possible that other Banks follow suit, raising interest rates like TD has? I think if there is pressure from existing clients and media – basically an uproar – TD might relinquish, reducing their rates again.

If Canadian’s swallow this move, I think other Banks will follow suit, raising their rates in a similar manner.

Here’s What You Might Want To Ask:

Who is advising you to lock in your Mortgage with a fixed rate? Who is advising you to refinance into a lower fixed Mortgage rate?

Do you trust someone from the Bank is actually helping you save, and they make less?

If you would like unbiased, independent advice to help YOU save money, connect with me now.

The fundamental difference between a Bank employee and myself is helping YOU save.

Update On Current Interest Rates:

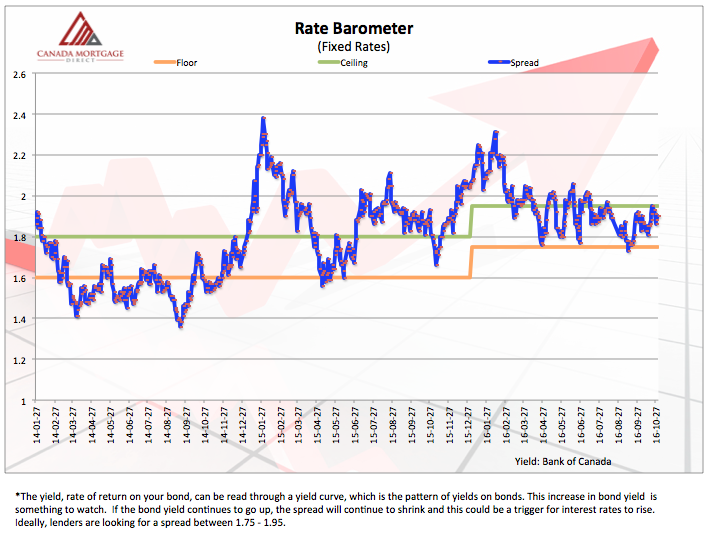

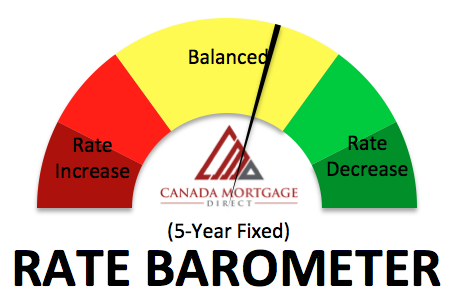

Below are two images. The image with the blue line tracks the spread between interest rates and Canadian bond yields. A decreasing blue line indicates upward pressure on FIXED interest rates. The second image is a consumer friendly indicator of potential interest rate movements.

Conclusion:

The recent Mortgage rule changes, and looming Mortgage rule changes swing more Mortgage pricing control into the Banks favour. I think we are beginning to see them monazite this advantage.

Again, I am not Bank bashing because we ALL need our Canadian Banks to thrive. HOWEVER, I think the thought of trusting your Mortgage to a BANK BRAND is not wise.

Instead, consider first choosing WHO you work with first, THEN the product/institution.

Contact me if you would like unbiased advise on if you should lock in your interest rate from a variable rate or an adjustable rate Mortgage.

Continue to stay close to my blog so you are aware of any Mortgage market or Real Estate changes.

Talk soon,

C. Moore

P.S

If you like this content, please email this link around, click “Like” above or share the original Facebook post. Thank you in advance!