The Divergence Continues …

Whoever asks me, “how’s the market” I respond with “it depends”.

Because I think it does. There is low supply and upward pricing pressure on Single Family Detached homes. There a lot of supply and downward pricing pressure on apartment style homes (condos).

How’s the market you ask? Well, you’ll find some recent data that will explain everything for you! Let’s look at three data points to help determine where we are and anticipate near term price movements.

Single Family Detached Home Data:

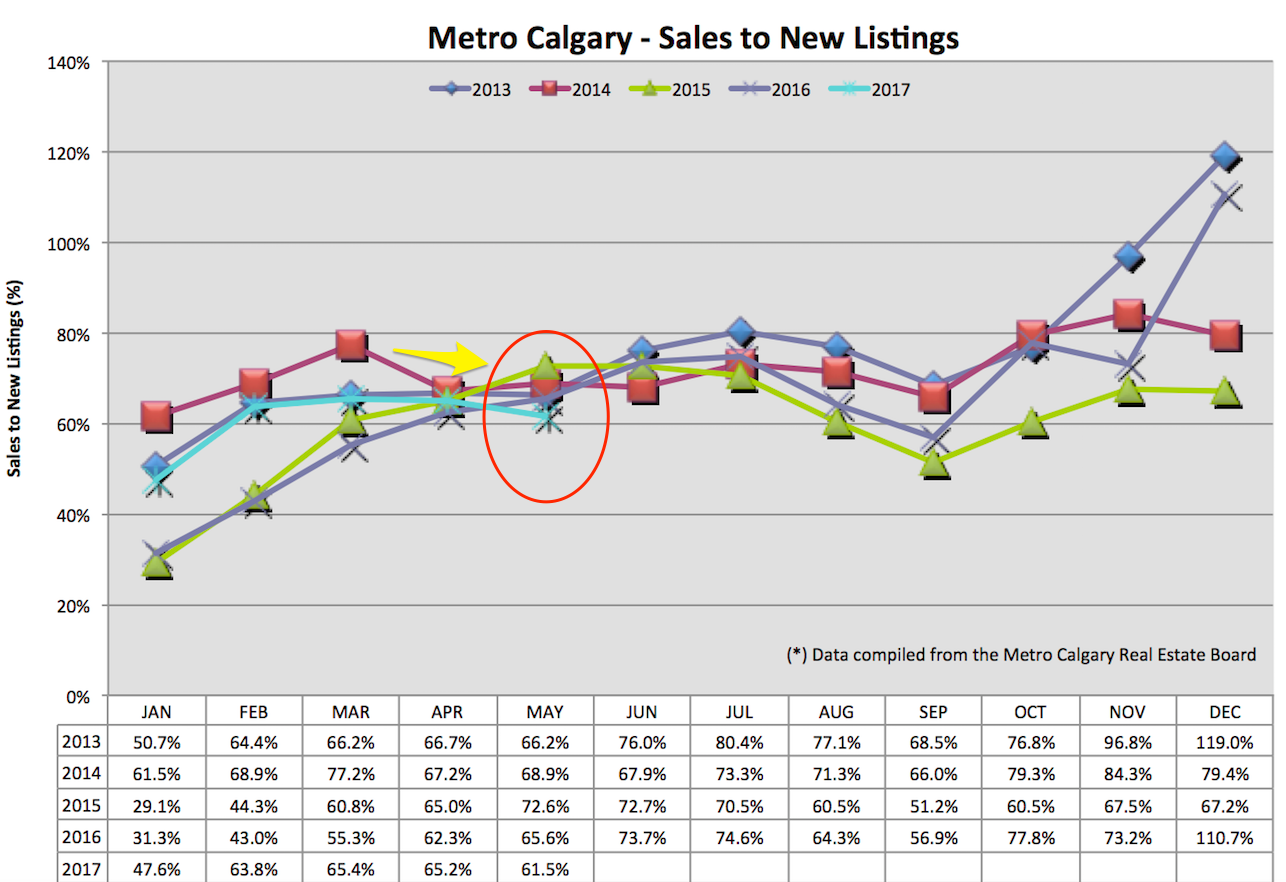

Sales To New Listings Ratio:

If this ratio moves down, that is an indicator there is more supply coming on the market relative to homes selling. Expect more listings. More listings mean increased supply and downward pressure on home values. The opposite is true. An increasing ratio indicates more homes are leaving the market relative to new listings for sale. Resulting in upward pressure on pricing.

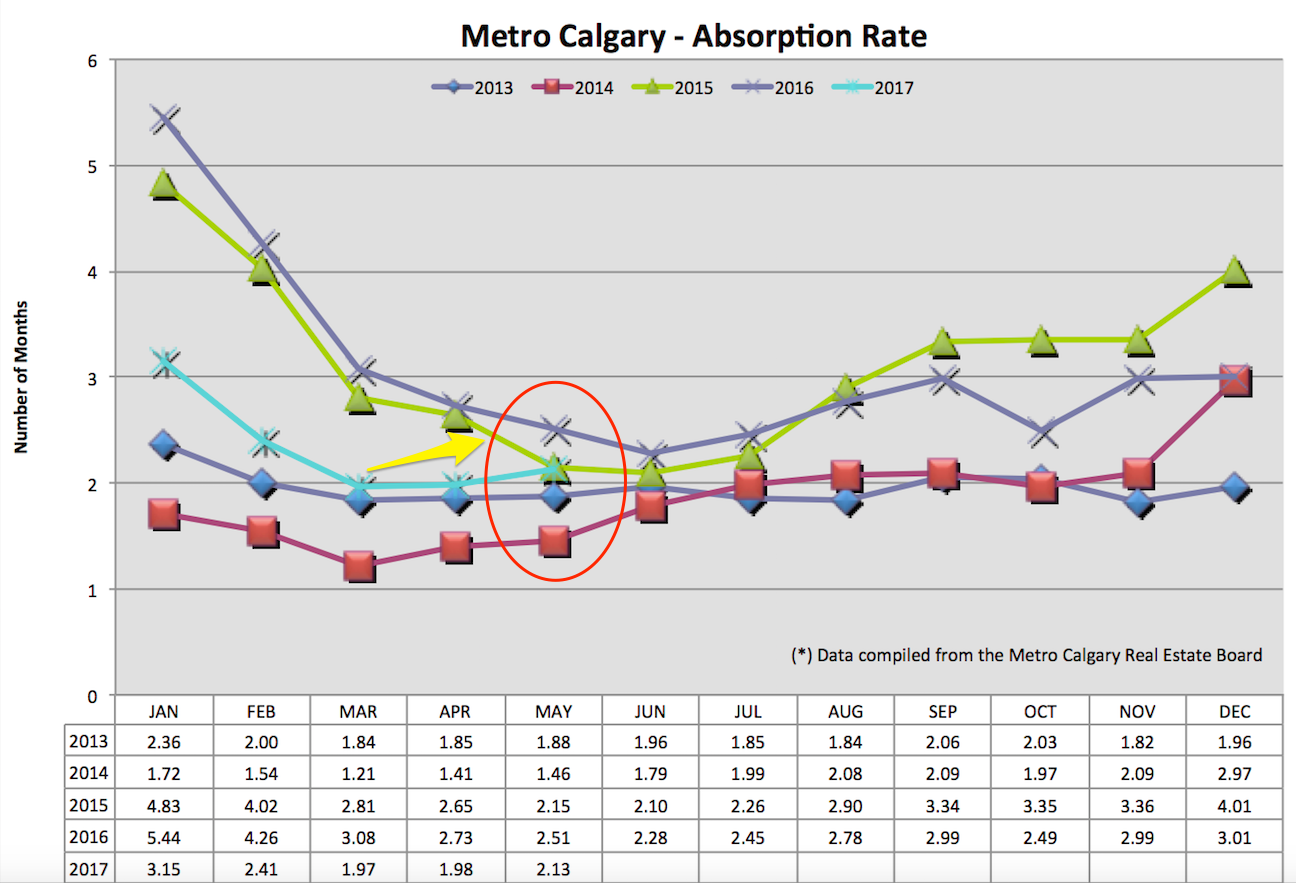

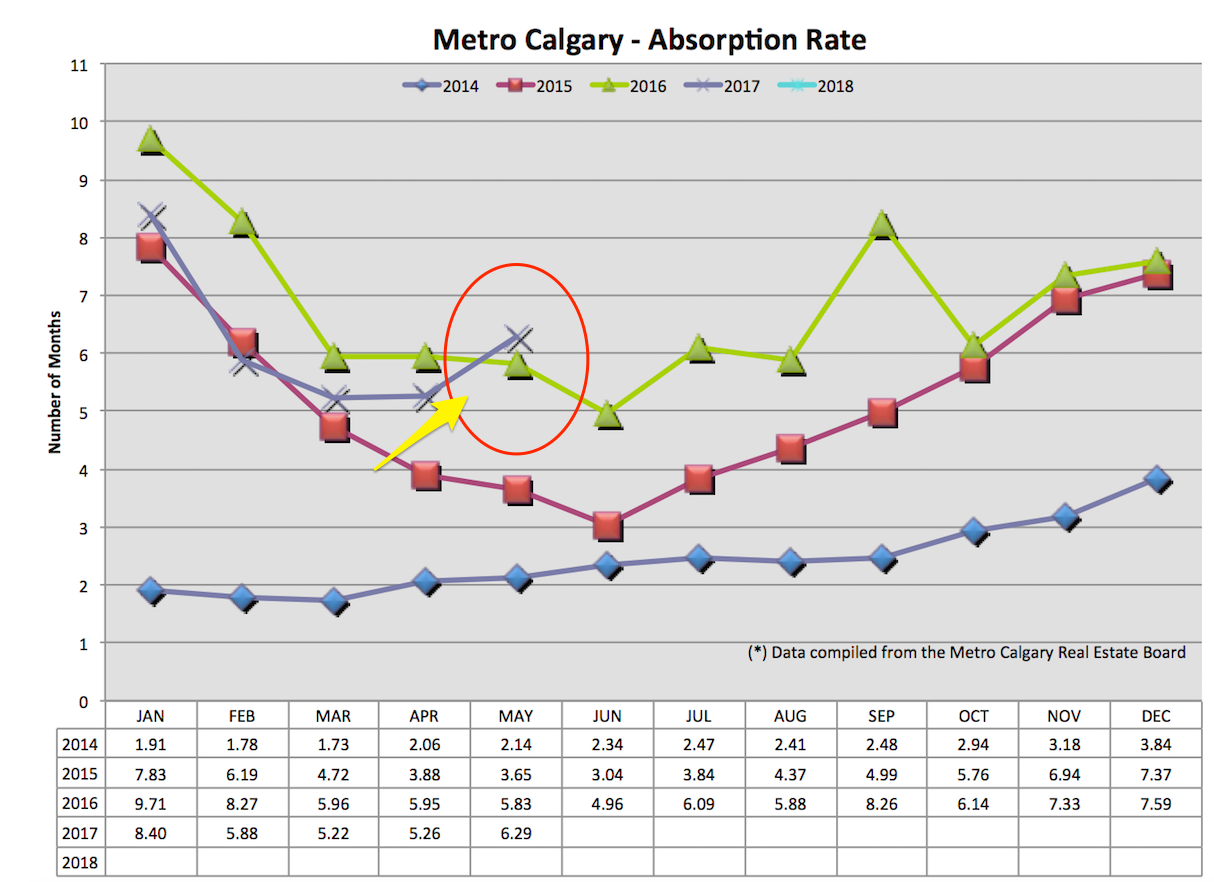

Absorption Rate:

This number tells us in months how long it would take to liquidate ALL the listing inventory, at the pace of that months sales. A decreasing number indicates there is a combination of either high sales volume or low inventory or both. Calgary’s Single Family Detached absorption rate is very low, relative to months/years past. This indicates a “sellers market” with near term upward pressure on home values.

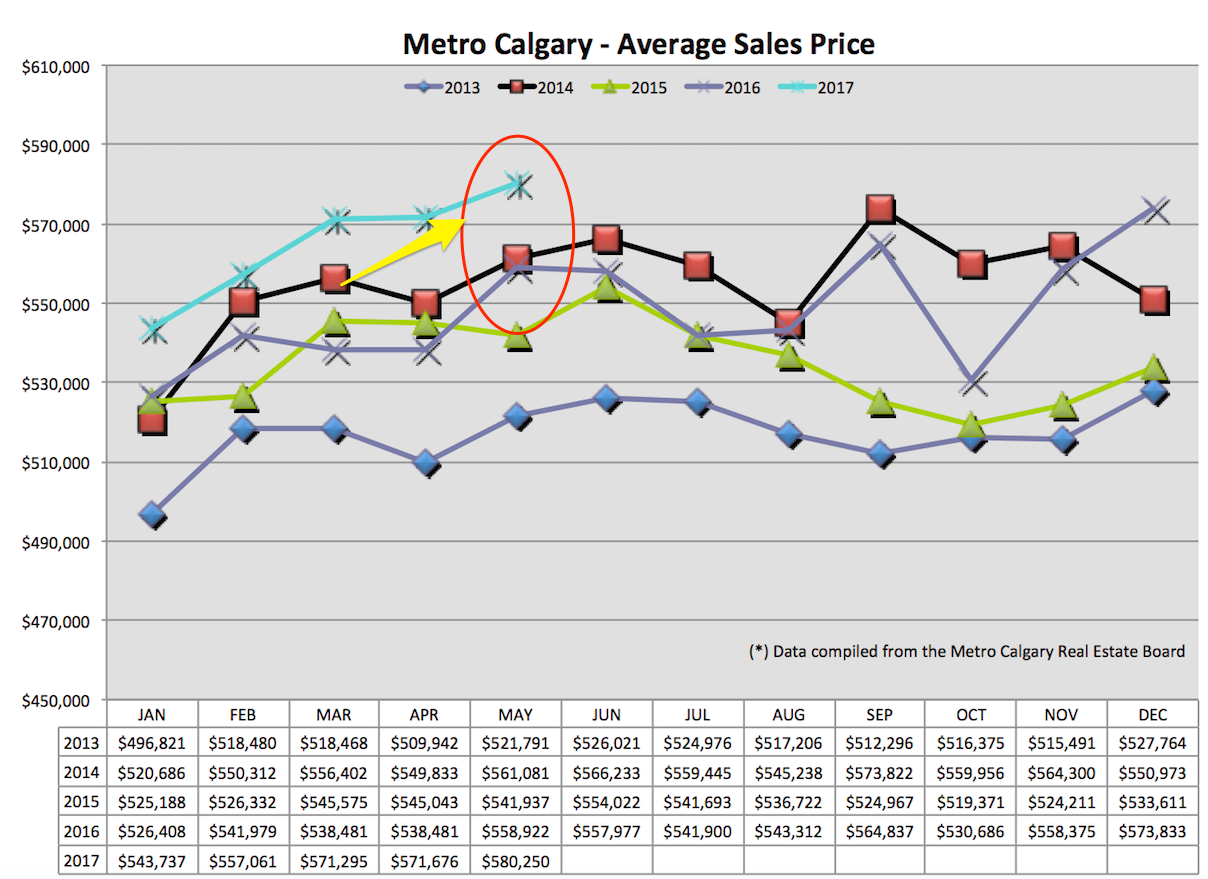

Average Price:

I think the average price statistic is relatively simple for people to understand. Note, this can be skewed with a large volume of high or low end sales. As a result from the past couple of months Real Estate data, the upward pressure we’re seeing on prices today was anticipated beginning as far back as November 2016. I think moving forward, barring any sudden surge of listing inventory (which I don’t see coming) prices with upward pressure will continue.

Apartment Real Estate Data:

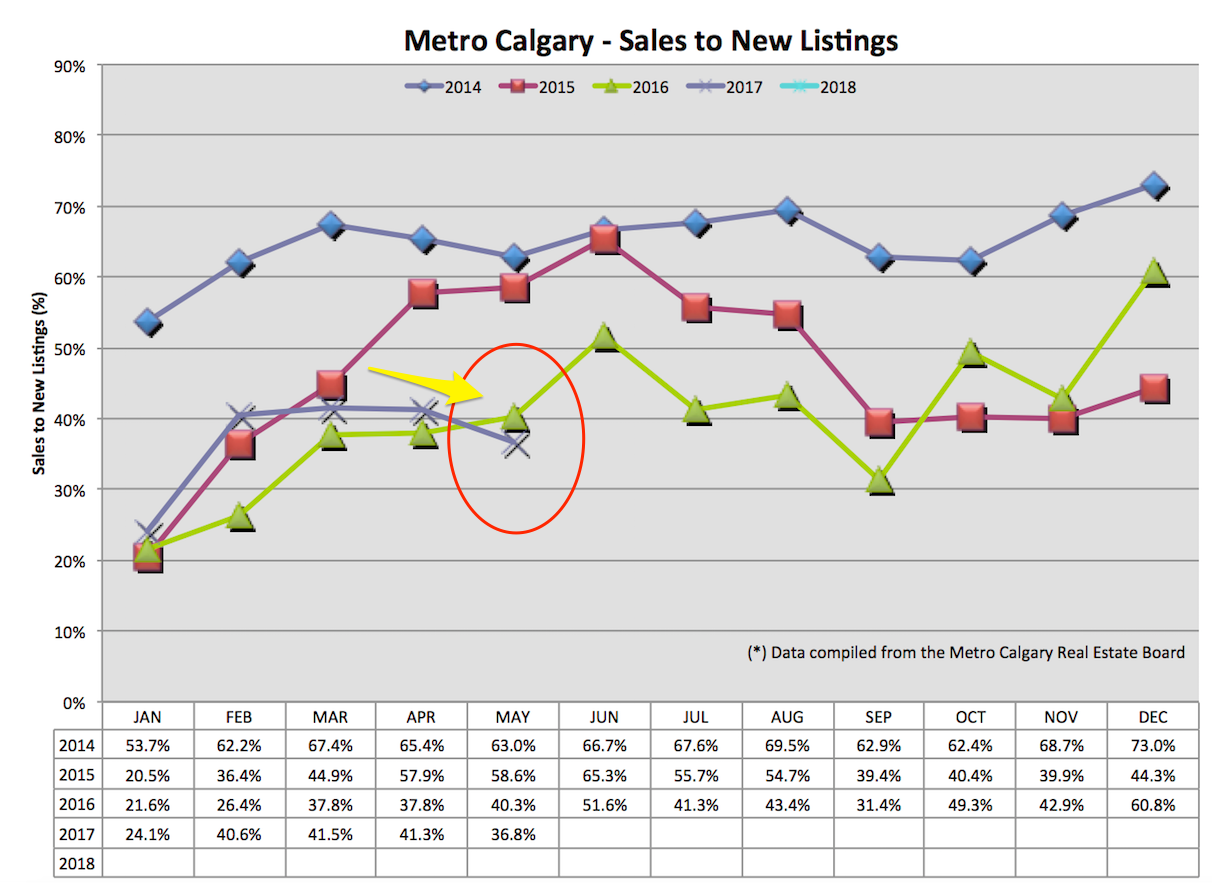

Sales To New Listing:

This data point is down month over month and year over year. There looks to be a reversal of a seasonal trend for this data point. This indicates more listings are entering the market, net of sales leaving the market. This is an indicator of downward pressure on future pricing.

Absorption Rate:

The apartment absorption rate is also increasing month over month and year over year. This also is a reversal of a seemingly predictable trend. This is rising due to increased inventory and lower sales volume (number of units).

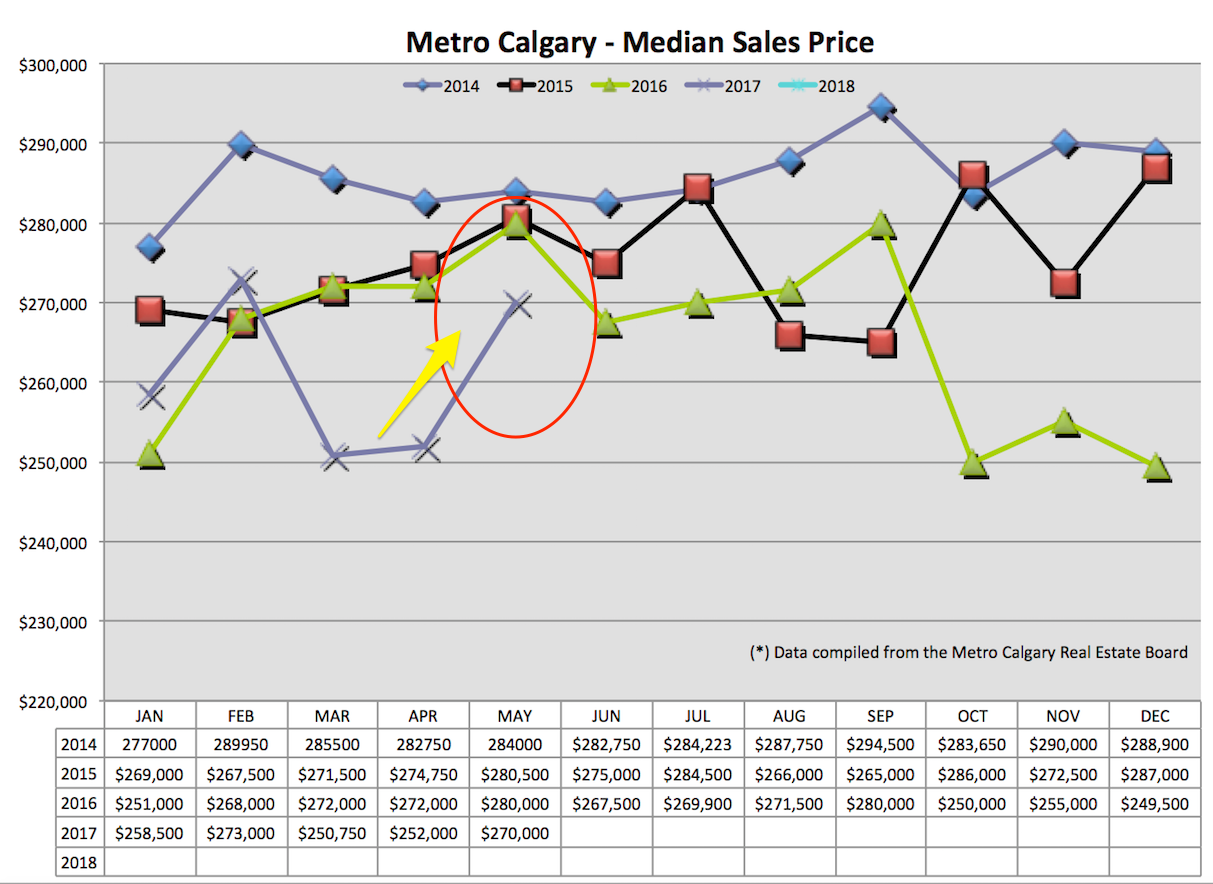

Median Price:

Not surprisingly, the year over year median price is down $10K. What is nice to see is the month over month price increase. However, with less apartment inventory selling, there is a tendency for this segment of data to swing despite leading indicators. #grainofsalt

Conclusion:

I think Calgary’s Real Estate market is the tale of two segments right now. Single family detached and apartment style homes. I remember that Real Estate is a commodity driven asset operating under the laws of supply and demand. Today, there is low supply of detached homes with relativley strong demand. Alternatively, there is increasing supply of apartment condos and weaker demand.

If you have questions about purchasing either (or any) style of property, I invite you to connect with me to discover your home affordability.

Thank you,

Chad Moore

403-809-5447

chad@canadamortgagedirect.com

P.S

If you found this content valuable, please share it on your Social Media by clicking the “Like” button at the top of the post. Thank you!!