I think this part of the year, heading into Christmas, is a leading indicator of how the notoriously busy Spring market will shape up the following year.

Here’s what we’ll cover in today’ post:

- How to anticipate near term price movements, based on data.

- My personal thoughts and opinion on the data.

- Tying recent Mortgage rule changes into current Real Estate data.

Quoted numbers below are from the recent CREB report, here.

I aggregate all of this information to help you make sense of what’s happening in Calgary’s home pricing. Why? Well, I’m asked what’s happening in the market all the time. It’s nice to have an opinion, based on data, to bring to people.

Let’s all remember, Real Estate is an emotional beast. And I think bringing a bit of data into the emotional realm, for making important Real Estate decisions, is prudent.

Shameless self promotion here: I also bring you this data to earn your trust to advise you through your next Real Estate transaction. I think the value of a full time Mortgage Professional is growing as the Mortgage market increases in complexity. The day’s of quoting a “catch-all” interest rate are gone. My Google reviews are growing, and so is my list of very satisfied past clients. I hope to earn your business too.

Now that’s over, onto the data :-)

Single Family Detached Housing Data Review:

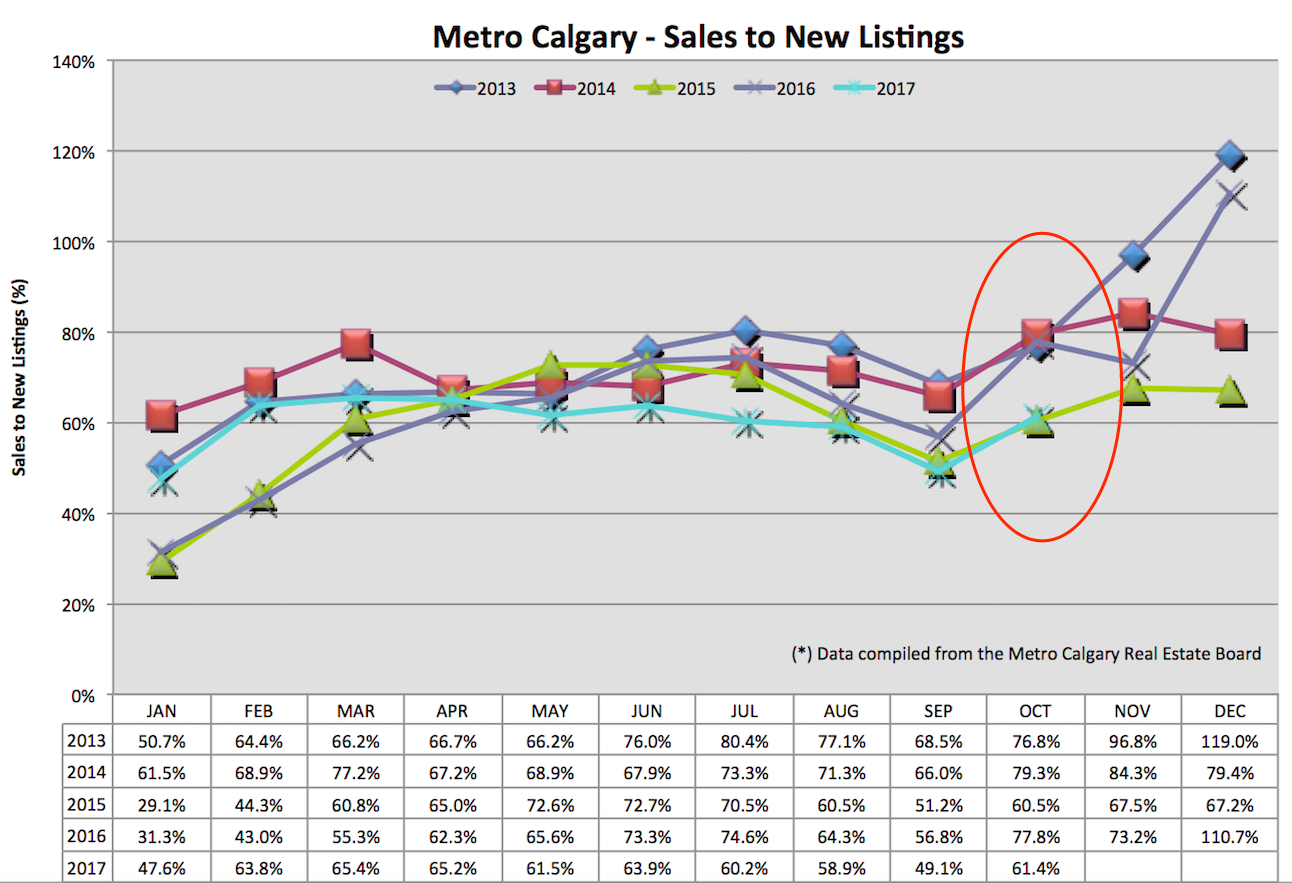

Sales To New Listings Ratio:

This ratio considers new home entering the market (new listings) and homes exiting the market (sales/expired listings). A sales to new listings ratio of 100% means one home is added and one home is lost. Anything lower than 100% indicates accumulating inventory.

Calgary’s sales to new listings ratio moved in a direction that contains less future listing inventory. The increasing direction of this ratio is a “good” thing for future pricing. However, consider the context of which the 2017 data is compared …it’s similar to the doldrums of 2015. You remember 2015, right? It was ground zero for massive lay-offs and tanking oil prices. You’ll also note the divergence in the sales to new listings ratio in 2016. This was a leading indicator for a busy Spring 2017 market, which Calgary experienced.

The opportunity for buyers is great valued homes. The opportunity for sellers is understanding the importance of initially pricing your home.

Again, this data point is directionally positive, just lower than our previous years data.

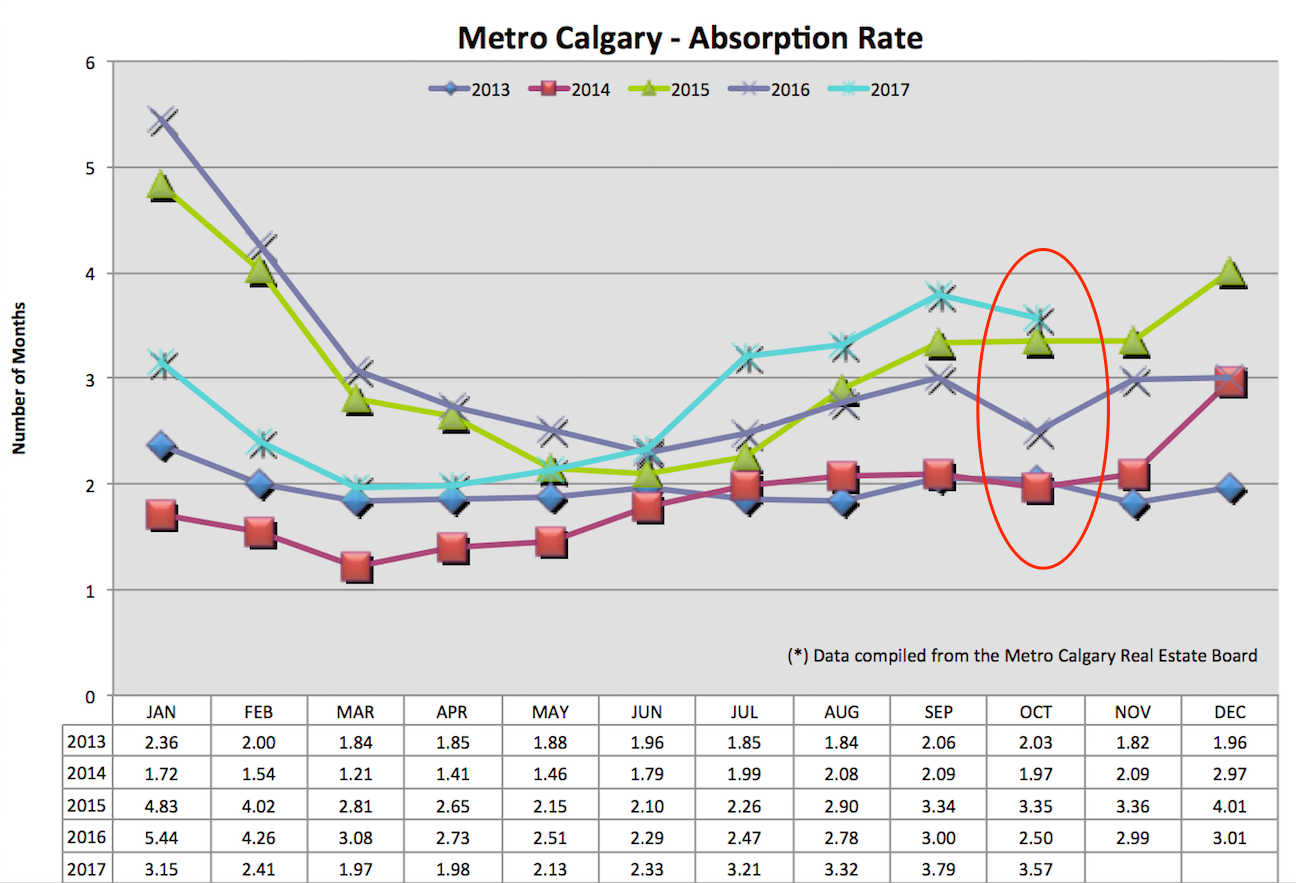

Absorption Rate:

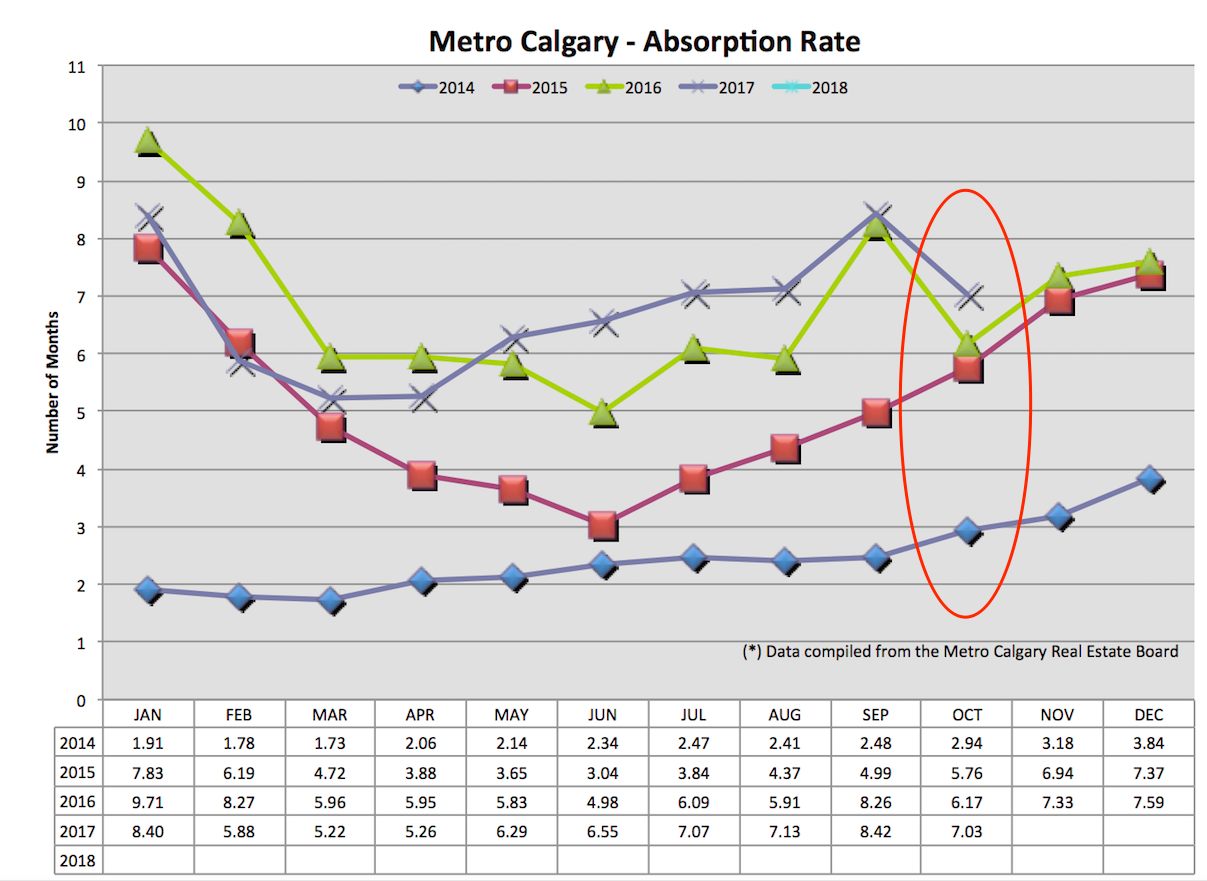

This ratio combines sales and listing inventory. This number tells us, in months, how long it would take to sell all listing inventory, at the pace of that month’s sales. For context, 2-4 months is a “balanced” market. Higher absorption rate is a buyers market. The opposite is true for a low absorption rate.

Month over month, the absorption rate is down which means better news for the pace of new home listings and home sales in Calgary. That’s a win!

However, consider this information with the context of previous years. Calgary’s current detached absorption rate is higher than 2015. As referenced above, 2015 was not a good year for home prices.

Housing supply has been a saving grace since the oil shock, starting August 2014. Despite the crippling buyer demand Calgary’s been facing (job loss, high unemployment, negative net migration), housing supply has not piled on.

In an era of Mortgage rule tightening, continued down pressure on buyer demand is persistent. Keenly watching housing supply is a HUGE factor in understanding near term pricing.

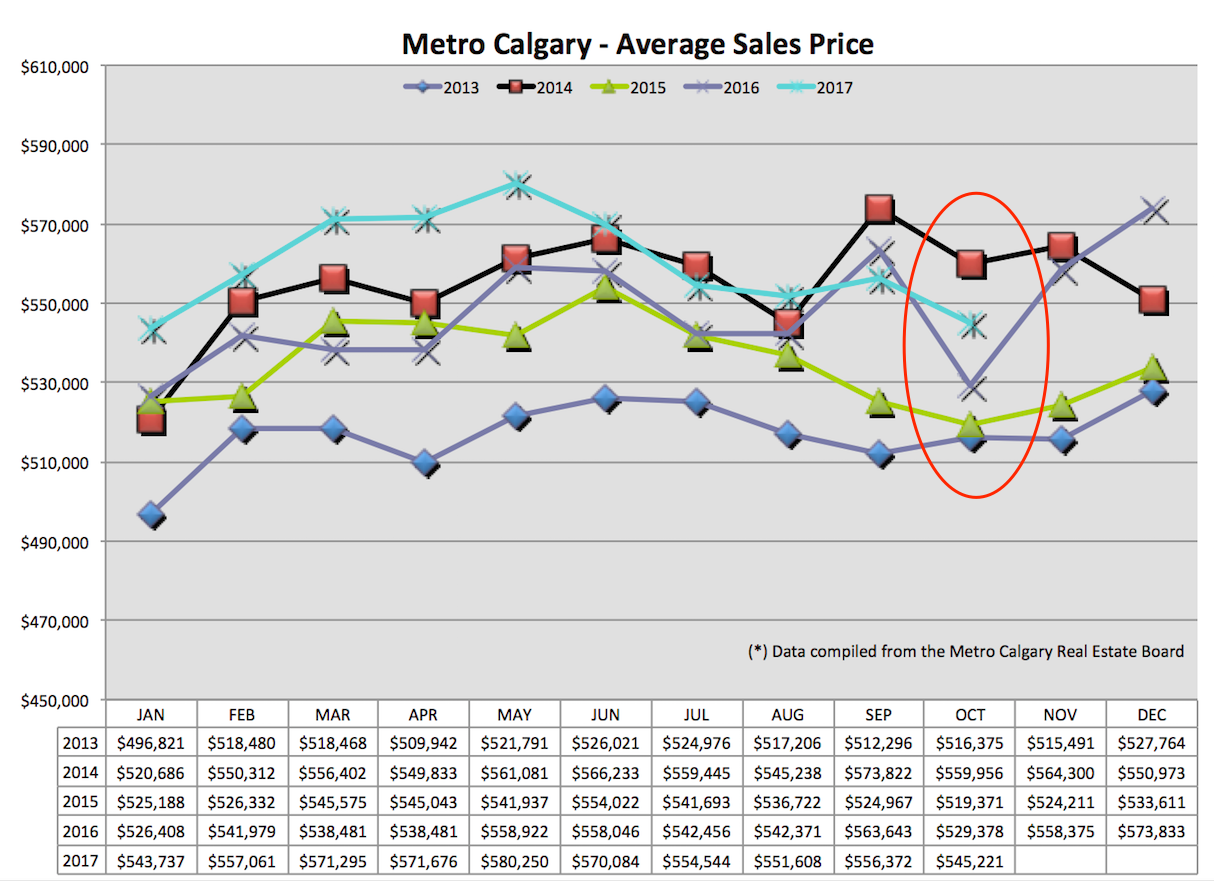

Average Home Price:

The above two data sets point to down pressure on home pricing. Yet, prices are up! Regardless of home price trajectory, take the information with a grain of salt. Why? Because the average price can be influenced by large or small swings of property sales on the top or lower end of Calgary’s home price scale.

In my thoughts on near term price movement, I combine these data points, local and national economic data. Like you, I do the best I can at the time of answering questions :-)

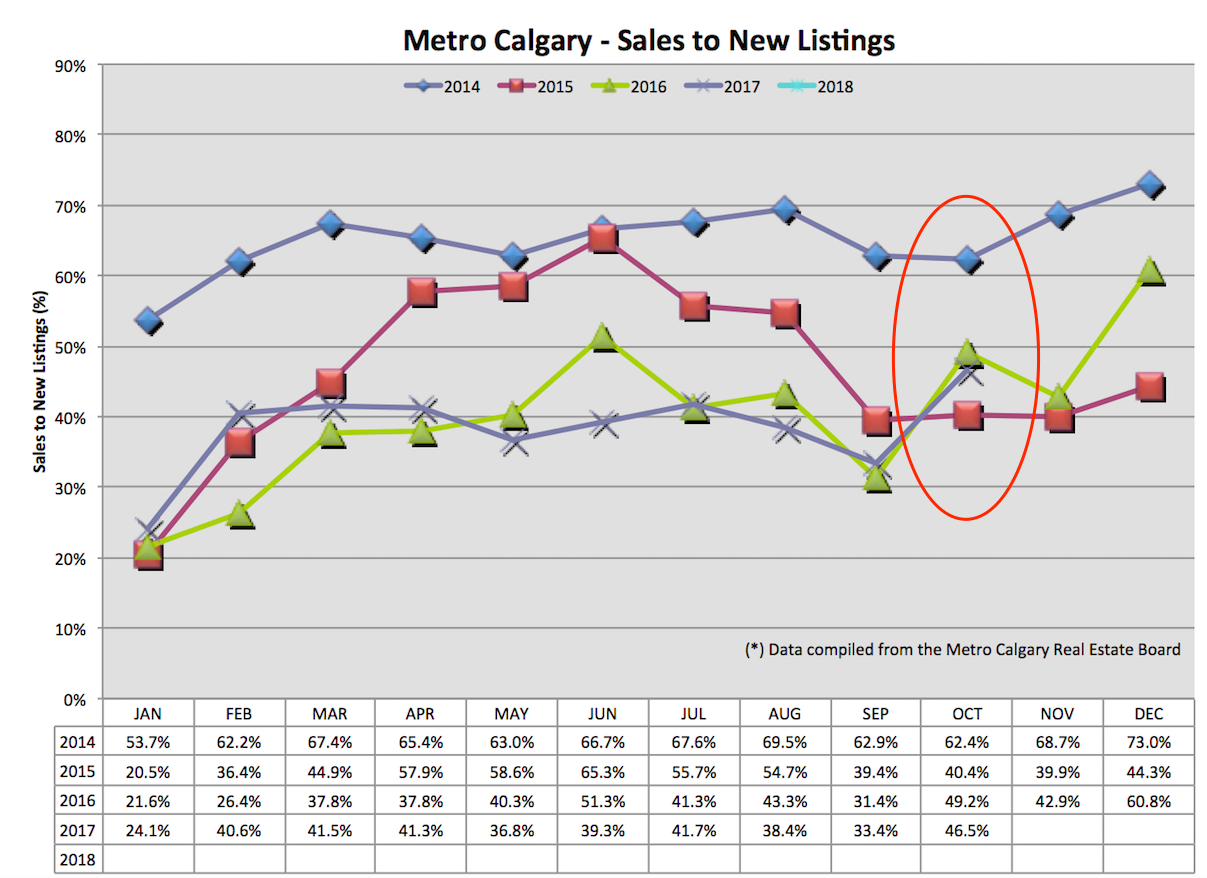

Apartment Data:

Sales To New Listings Ratio:

This ratio jumped month over month, matching last years ratio movement. Continuing this trend will help limit additional condo inventory which will help ease down pressure due to supply.

For context, you can see how different the sales to new listing ratio was for condo’s in 2014. That data set indicated low apartment supply, which helped support up pressure on prices (for context purposes).

Absorption Rate:

The movement of this ratio is in a positive direction (in terms of pricing improvement). The data is still concerning for apartments in Calgary. Seven months absorption is high and indicative of downward pressure on home pricing. Seasonally, it’s reasonable to expect higher absorption rates in which continued pricing challenges might be a reality.

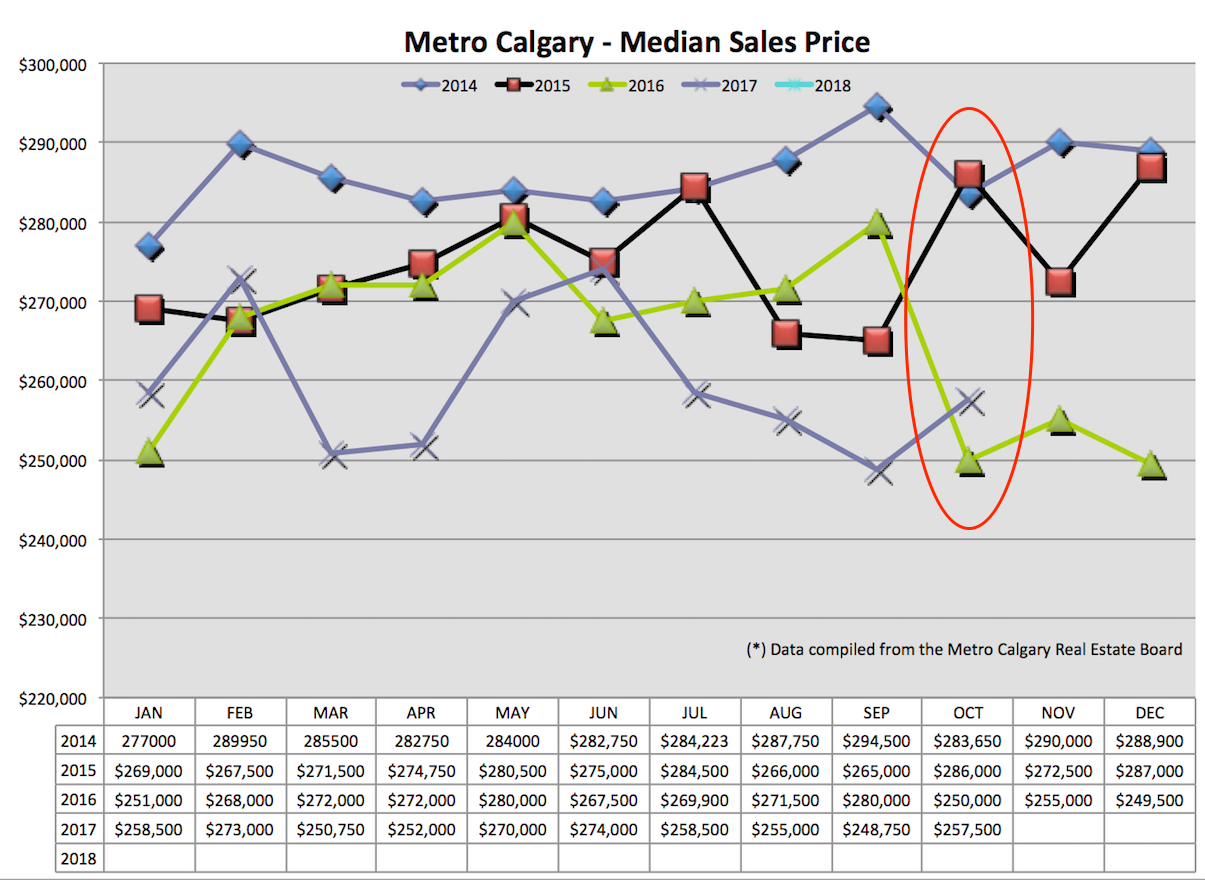

Median Price:

Similarly with single family detached homes, upward price movement is the data point for October 2017. With similar year-over-year sales to new listings and absorption rate as last year, marginal up pricing is logical for me to think. Longer term, I still see challenges with apartment pricing due to increased supply.

Overall Housing Demand:

The above data anticipates near term housing supply. Buyer demand can be found by looking at unemployment rate, wage growth, migration numbers, Mortgage qualifying rules and market sentiment.

The recent Mortgage rule change levels a Mortgage qualifying stress-test for any Mortgage application, effective January 1st, 2018. This raises the bar for Mortgage qualifying.

However, this rule change is not a sudden surprise. I’ve been communicating this potential change since August. Many of my referral partners have also disseminated this information. And frankly, I’m not seeing a lot of housing demand being pulled forward by people trying to circumvent the latest rule change. Or to get in under the wire. Maybe others are seeing an up-tick of activity? Maybe not?

I anticipate a near term pricing blip due to market uncertainty, not necessarily deviation from long term Real Estate fundamentals.

Questions? Comments? Let me know.

Please click “Like” above and share this content.

Thank you,

Chad Moore