Pay attention here …is a tight Spring market starting to take shape?

Last month I noted trends toward a more balanced market. The data has reversed course, with the market now pointing towards less near term supply.

If past is prologue, the Spring market of 2025 could start to shape up as very competitive, again.

Here’s been my experience in a competitive market …1) buyers are making very fast decisions, 2) buyers are writing over list offers, 3) buyers are wanting to remove conditions from their offers.

If you’re thinking about making a Real Estate change (you’re a buyer or seller-and-buyer)—note what has changed in the data. This might influence your timing.

Detached Housing:

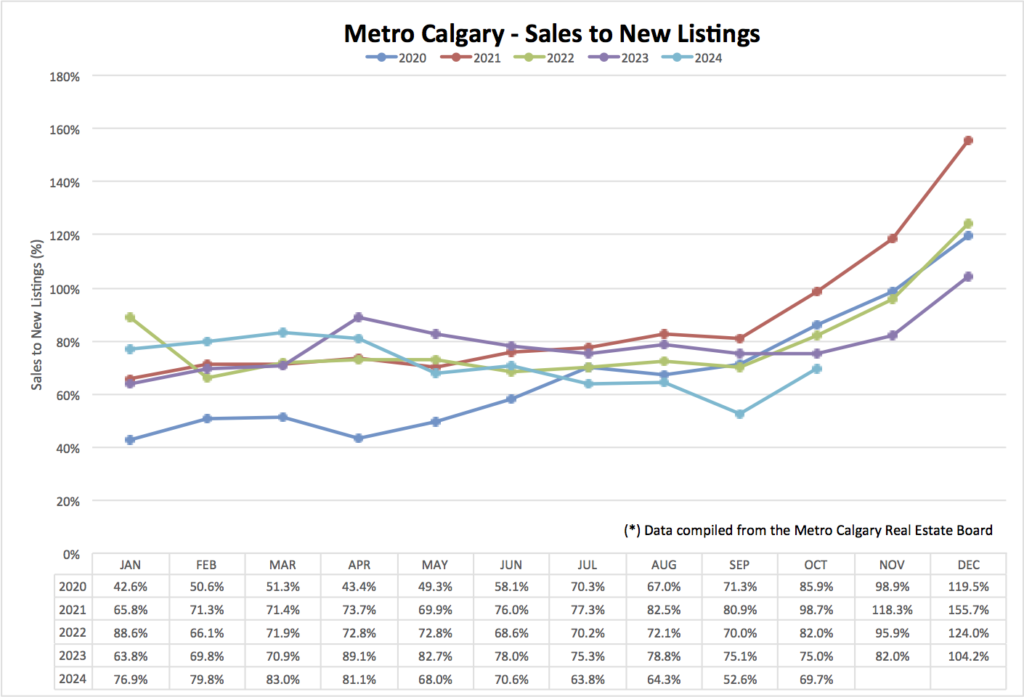

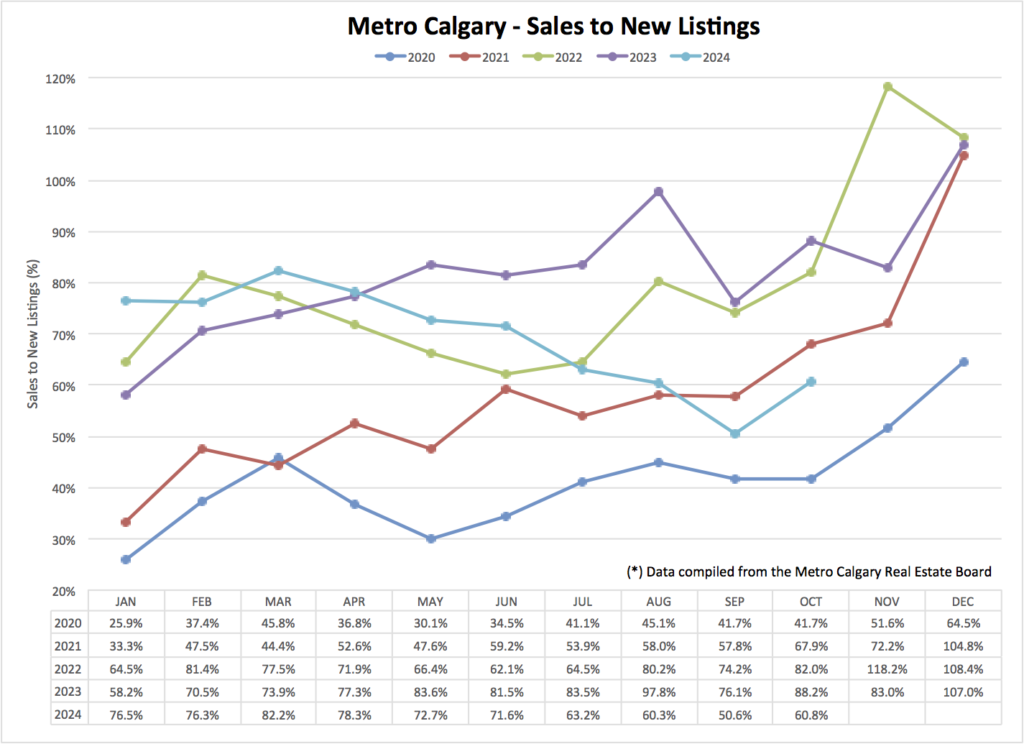

Sales To New Listings:

We can see a noticeable down trend of the sales to new listing ratio from April-September. This means there was a slow accumulation of inventory for sale.

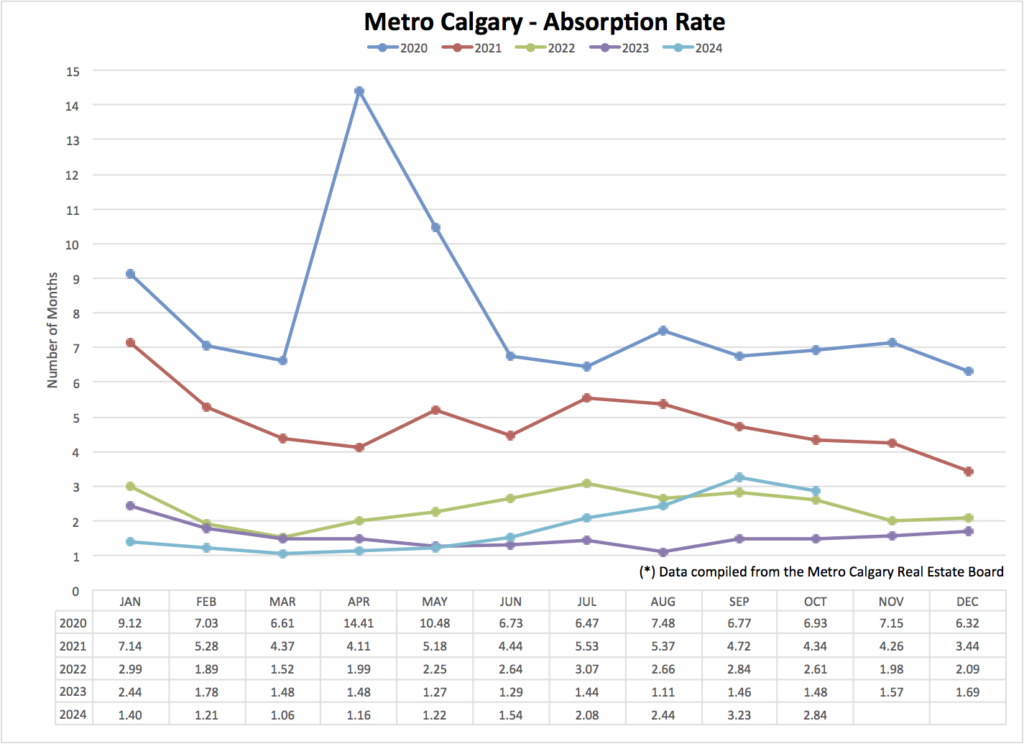

If you look at the absorption rate chart (one section lower) for that same time period (April-September) we can see the absorption rate rising gently.

These data points were indicating a trend to a more balanced Real Estate market (I.E., more supply).

For both of these data points, October was a reversal of trend!

And this is worth noting because October-December data set up the coming Spring market of 2025.

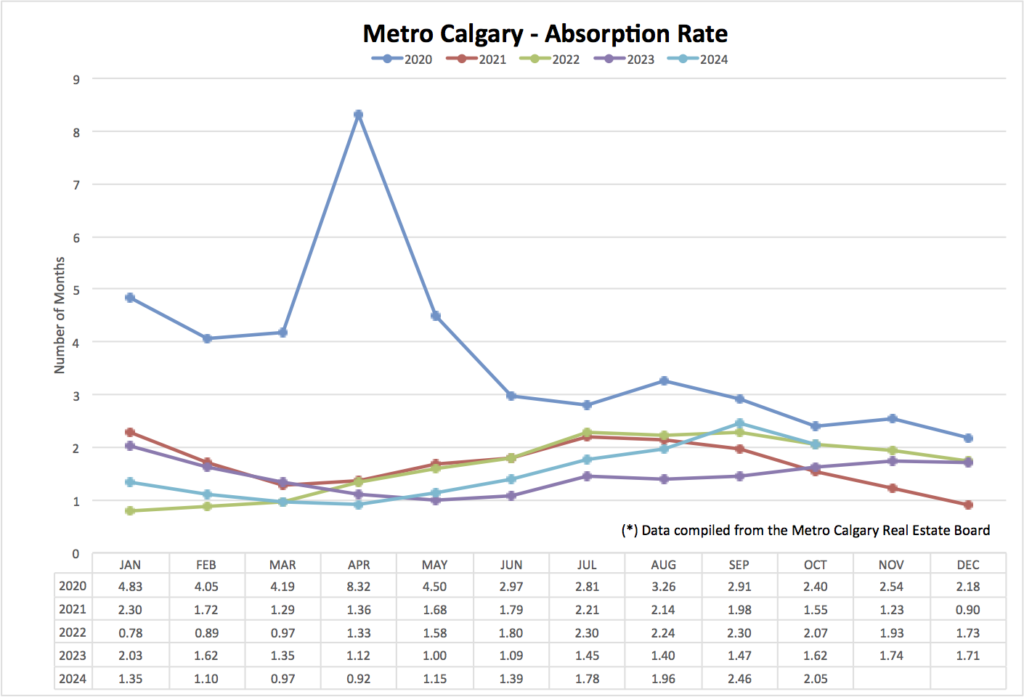

Absorption Rate:

We can see Calgary’s detached absorption rate point lower in October for the first time since March of this year.

The absorption rate tells us, in months, how long it would take to liquidate all of Calgary’s detached homes for sale.

Absorption rate numbers at or lower than 2 months, are extremely low and indicate a sellers market.

Low absorption rates are indicating one or more of the following a) high sales, b) lower new listing inventory and c) likely upward pressure on prices.

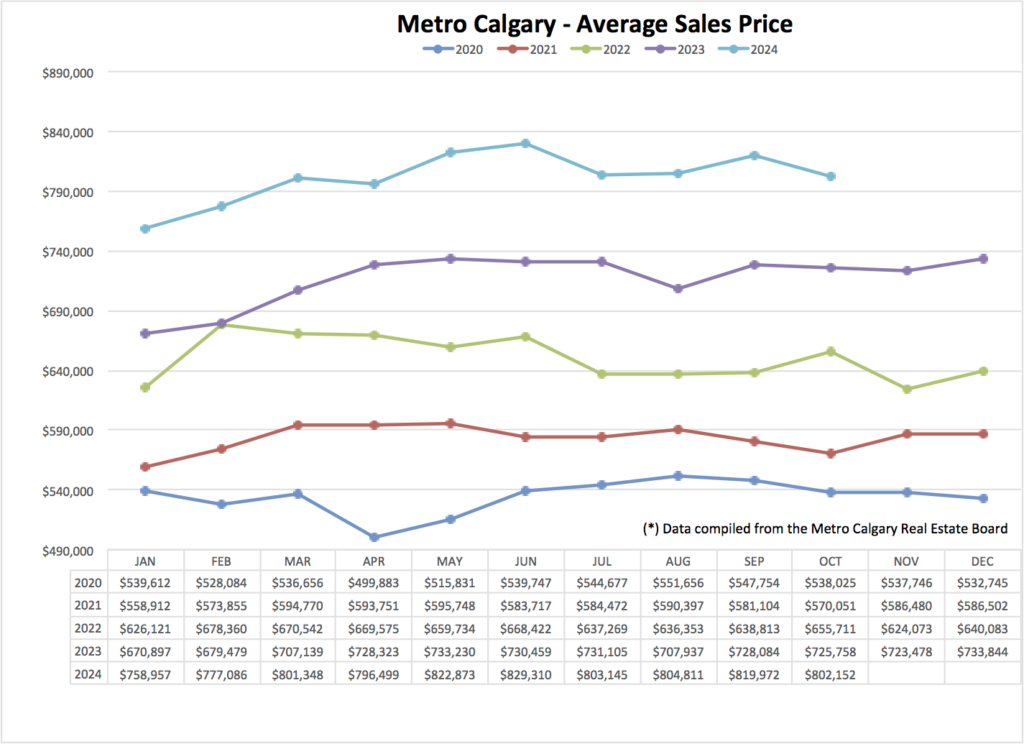

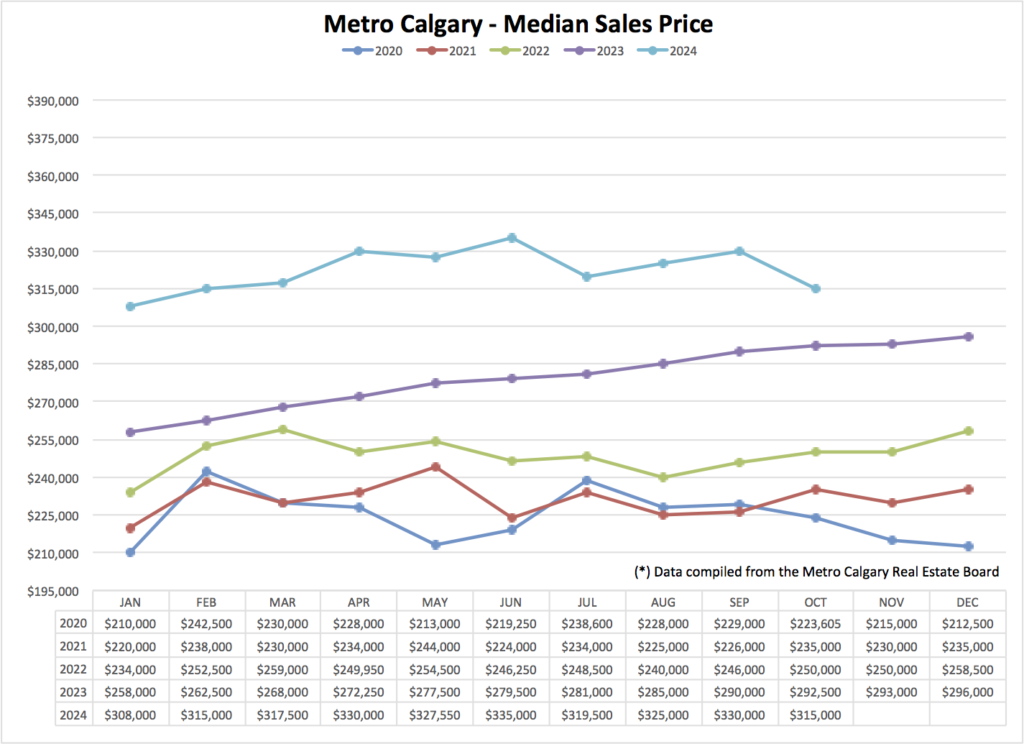

Average Price:

Average price is up year over year about 10%, and essentially flat since April.

Big average price gains are typically seen in the first several months of the calendar year, and then average prices flatten out for the remainder.

I think buyers should note these trends and consider the timing of entering the market—and what that means.

Buying in the winter typically means, 1) less new listing inventory selection, 2) lower buyer competition, 3) higher interest rates, 4) off peak pricing, and 5) moving in the winter. Pro’s and Con’s.

Buying in the Spring typically means, 1) more new listing inventory added, 2) higher buyer competition, 3) peak pricing, 4) moving in better weather. Pro’s and Con’s.

I’m noting this because I’ve seen many buyers struggle in highly competitive spring markets these past years—and our current market might be indicating we trend there again?

Apartment Homes:

Sales To New Listings:

The apartment sales to new listings ratio was falling off rather steeply from April through September. We can see this ratio bounce higher in October!

One data point is not a trend, but should a rising sales to new listings ratio continue, that indicates a trend to less apartment inventory.

Absorption Rate:

Calgary’s apartment absorption rate has also reversed course, and is pointed lower.

Should this ratio continue it’s downward trend, that is supportive of current pricing.

Median Price:

The median apartment price in Calgary is essentially flat since March of this year. Current data seems to be indicating a mix of price pressure. Anecdotally I’m seeing below list apartment purchases right now.

Demand Summary:

There has been a reasonable amount of Real Estate demand stimulus recently:

- First time home buyer’s can access up to $60K of RRSP’s for down payment (up from $30K).

- Creation of the First Home Savings Account (FHSA).

- First time home buyers can use a 30 year amortization, with less than 20% down payment, to help qualify for a Mortgage.

- Insured Mortgages are available up to $1.5M (up from $1.0M).

- All home buyers can access a 30 year amortization, when purchasing a new home.

- Homeowners can refinance up to 90% of their home value when adding a basement suite or lane home—up to $2.0M.

Lower borrowing costs by the Bank of Canada are also stimulative to Real Estate. The Bank of Canada rate cuts trickle into the narrative of “lower rates mean higher prices.”

I’m hearing reports of Vancouver and Toronto markets picking up (off bottom levels anyway).

Policy makers say they want affordable housing. Look at what policy makers are doing though.

Many level’s of Canadian government enjoy tax revenue from Real Estate.

One demand factor worth noting, and I’ll write more on this soon, is the Federal governments cut to new immigration.

The Real Estate market needs to start with first time home buyers, and cutting immigration will likely impact this segment. By how much? I don’t know.

Conclusion:

October supply data, for detached and apartment homes, has reversed a 7-month trend. The supply for each of these property types looks to be tightening in the near term.

To be noted …the supply trend for the last three months of the calendar year (Oct-Dec) are the set-up for the Spring market of the following year.

It’s possible the combination of rate cuts by the Bank of Canada, and announcements of easing Mortgage qualifying, is proving to be stimulant.

I’m waiving the warning flag for the crazy spring market set up. I’ve seen this three years in a row, starting in 2021. 2024 housing data is eerily similar.

Last month when I wrote you about market data, I was not waiving this flag. Now I am.

It’s highly likely the Bank of Canada will continue cutting interest rates, which is a demand stimulus for Real Estate.

One conflicting statistic that will have some impact on Real Estate demand is the reduction of new immigrants into Canada. This is a rather recent announcement from the federal government.

I’m not sure how this will effect Calgary’s Real Estate market? More to come.

I hope this is helpful!

Talk soon,

Chad Moore

P.S.

How early is too early for a Christmas tree ;-).

P.P.S.

If you’re a home owner and thinking of selling, I think you’ll like the pdf I wrote specifically for you titled, The Ultimate Home Transition Blueprint—Checklist.”

This is a monster document, but I chunked it down into pieces you can consume in small parts. Find that pdf here <—

P.P.P.S.

I went way too hard on rehabbing my knee, and took a major step backwards in my recovery. I played a surprise game of squash, that felt really good. Until the next day, which has turned into the next 10 days. Oops. I’m likely headed to physio. Reminder to all over 40—there’s a price to pay ;-).