I hope you’re well.

Let’s review Calgary Real Estate market data for a simple overview of what’s happening in our market.

If you’re planning to purchase, sell or refinance, you’ll want to perk up because this matters.

If you own your home, I think understanding large market movements is worth this XX min read.

We work backward from supply and demand fundamentals when understanding/anticipating Real Estate movements. To help understand housing supply, let’s look at Calgary Real Estate Board (CREB) data:

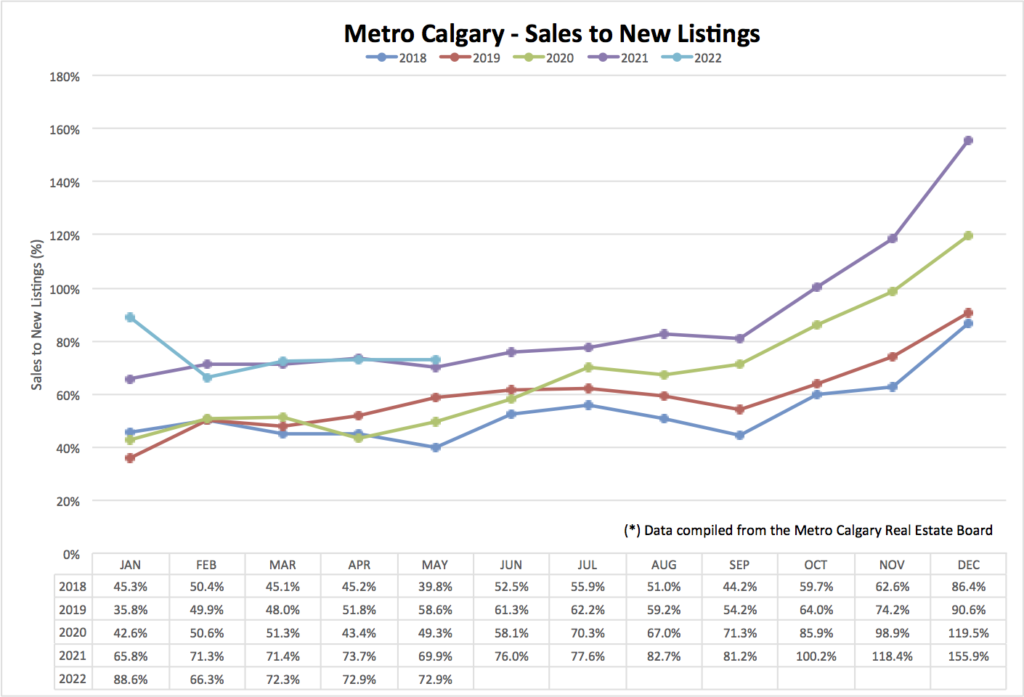

1. Sales to new listings.

2. Absorption rate.

3. Average price.

Detached Homes:

Sales To New Listings Ratio:

This chart helps readers understand changes in near-term future supply.

For example, look back at October, November and December 2021 sales to new listings ratio. It was at or above 100%.

This was indicating that more homes were exiting the market than listings were coming on. Fast forward a couple months to Feb/March 2022, and HOUSING BOOM.

Today, the sales to new listings ratio is still higher, relative to prior years which indicates no major build up of inventory.

Even though sales are down 12.5% month over month, listings are lower by about the same percentage.

Here are some broken out statistics for you:

Sales: April 2022 – 1,851

Sales: May 2022 – 1,620

New listings: April 2022 – 2,540

New listings: May 2022 – 2,221

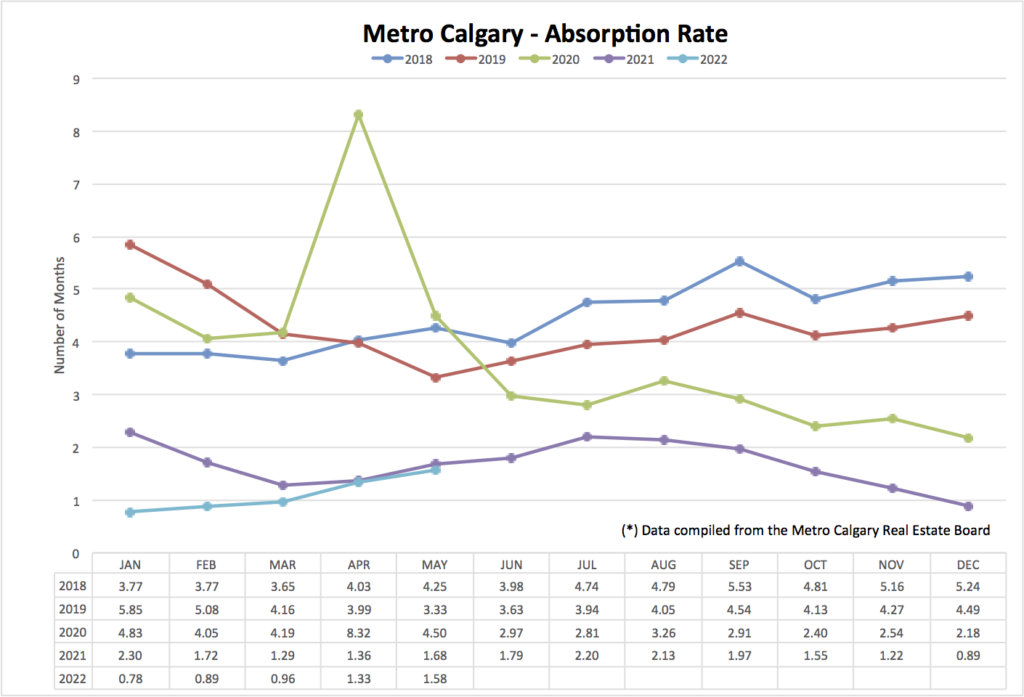

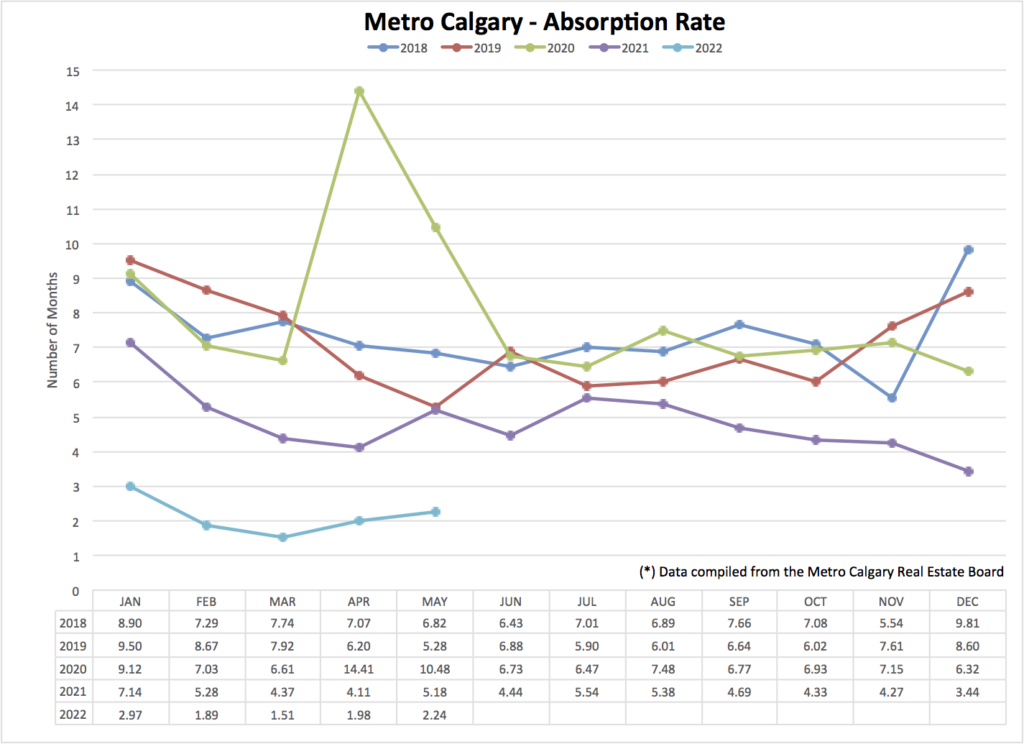

Absorption Rate:

Calgary’s detached absorption rate remains shockingly low, but is rising from crisis levels. In general, between 2-4 months absorption is a “balanced” market.

This is the one of the top indicators of price direction of all stand alone Real Estate statistics. When looking backward at this data, it is showing some upward price pressure for detached Calgary homes. Let’s see what happens moving forward?

I am seeing purchase contracts coming across my desk that have financing and home inspection conditions (thankfully).

The “requirement” that purchase offers do not have any conditions seems to be fading. I’m also seeing buyers ask for price reductions due to inspection, which was unthinkable only a couple months ago.

The market is still very strong, but now off peak intensity.

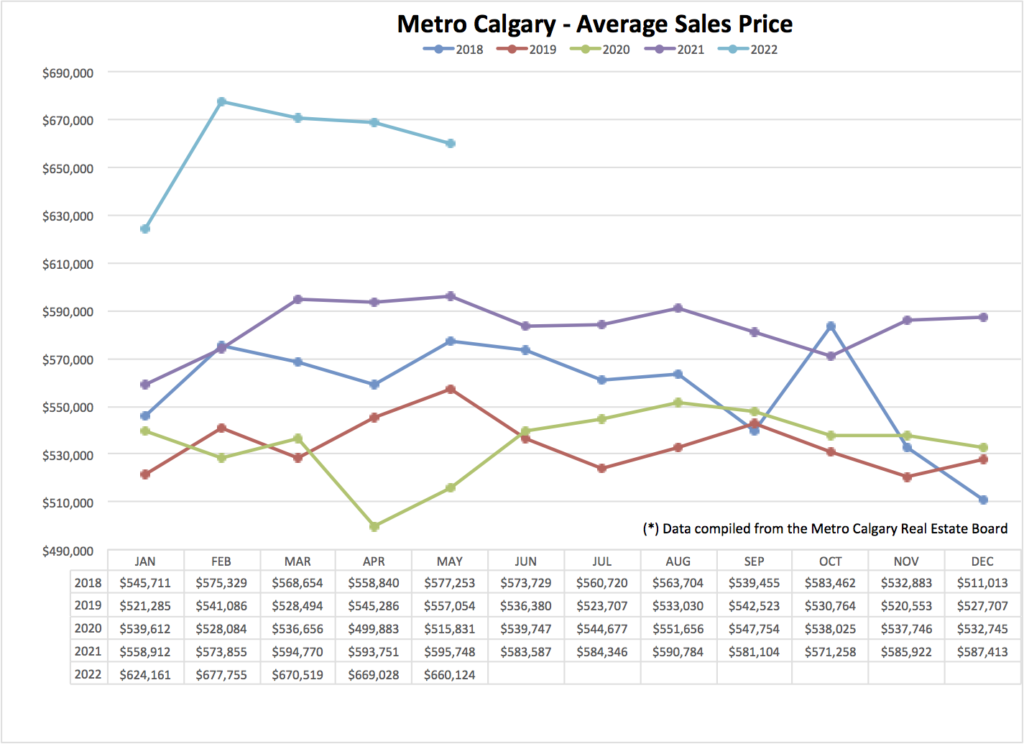

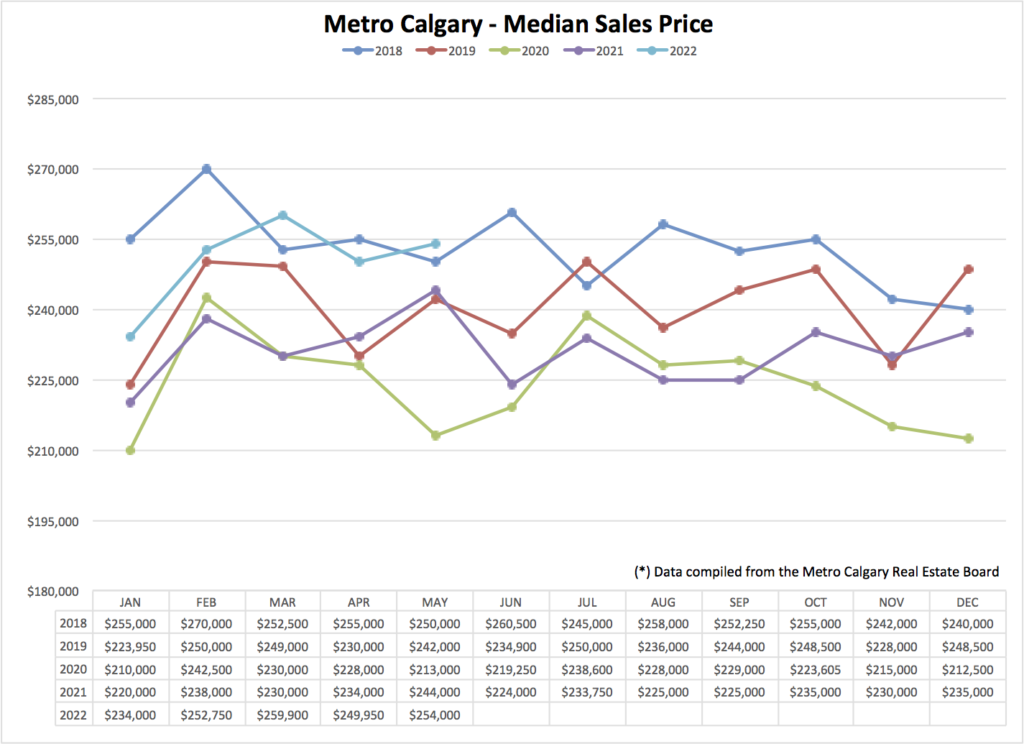

Average Price:

With the sales to new listings ratio coming back to earth and the basement bottom absorption rate trending higher, average detached price seems to have peaked.

Supply is one side of the price discovery coin. With fixed and variable interest rates rising, that is a demand headwind. Fundamentally, decreased demand, with supply remaining equal would be down pressure on prices.

However, there are plenty of other demand tailwinds for Calgary Real Estate which are a) attraction of investment dollars from across Canada, b) net positive inter-Provincial migration and c) strong oil and gas industry.

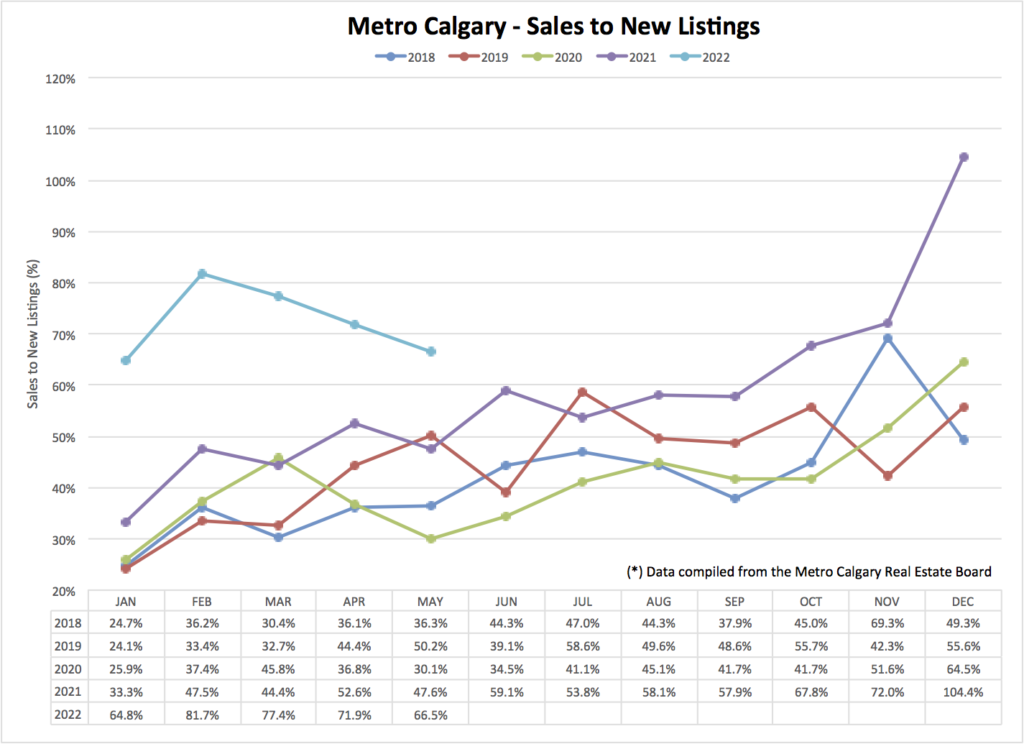

Apartment Housing:

Sales To New Listings:

The apartment sales to new listings data is clearly coming off February peaks and are headed toward longer term tend lines. This is due to a slight decrease in sales and increasing new listings.

Sales April 2022: 642

Sales May 2022: 631

New listings April 2022: 893

New listings May 2022: 949

Absorption Rate:

Apartment absorption rate is still well below recent trend lines! For years, condo apartments were dogged with very high inventory levels. Having Calgary’s apartment absorption rate between 2-4 months is great for that housing segment.

Median Price:

Median sale data is trending close to the top of the near term trends. With less than 1,000 sales per month, the median price figure seems better suited to take very high and low dollar sales out of the data.

Conclusion:

I think Calgary’s Real Estate continues to be the destination of investment money and people moving here from across Canada. This demand could support our current price levels in the face of higher fixed and variable interest rates.

For years, Calgary’s Real Estate market under performed relative to national averages. This kind of value is attractive to many looking to improve their personal balance sheets.

There is no data to track the number of Calgary buyers/investors from out of Province – I wish there was. I can only extrapolate my experience, fellow brokers in my office, and my network of Realtors. I think there is meaningful purchase demand from this “out of town” segment. This will continue to be interesting to track because Ontario and B.C. housing markets are in very bad shape as values are well off their February peak.

I hope this information is helpful!

Talk soon,

Chad Moore

P.S.

Question for you!! As a home owner, how have you decided what order to move? Purchase then sell? Sell then purchase?

I think in a extremely hot or extremely slow market, the order is easier to decide.

In a balanced market, how do you decide to sell or purchase first??

P.P.S.

If you enjoyed this content, and you think someone else might like it, forward this email over to them. Thank you in advance!