Strictly looking at one or two data points from the Calgary Real Estate Board’s (CREB) most recent news release might lead me to believe our detached and apartment sectors are doing A-OK.

Here are some sexy headlines I might see …

“Condo Prices Up year-over-year AND month-over-month”

OR

“Average detached home price’s reach 20 month high!”

I am unable to find factual fault with either of these boisterous statements, however, I encourage you to look into additional housing stats for context.

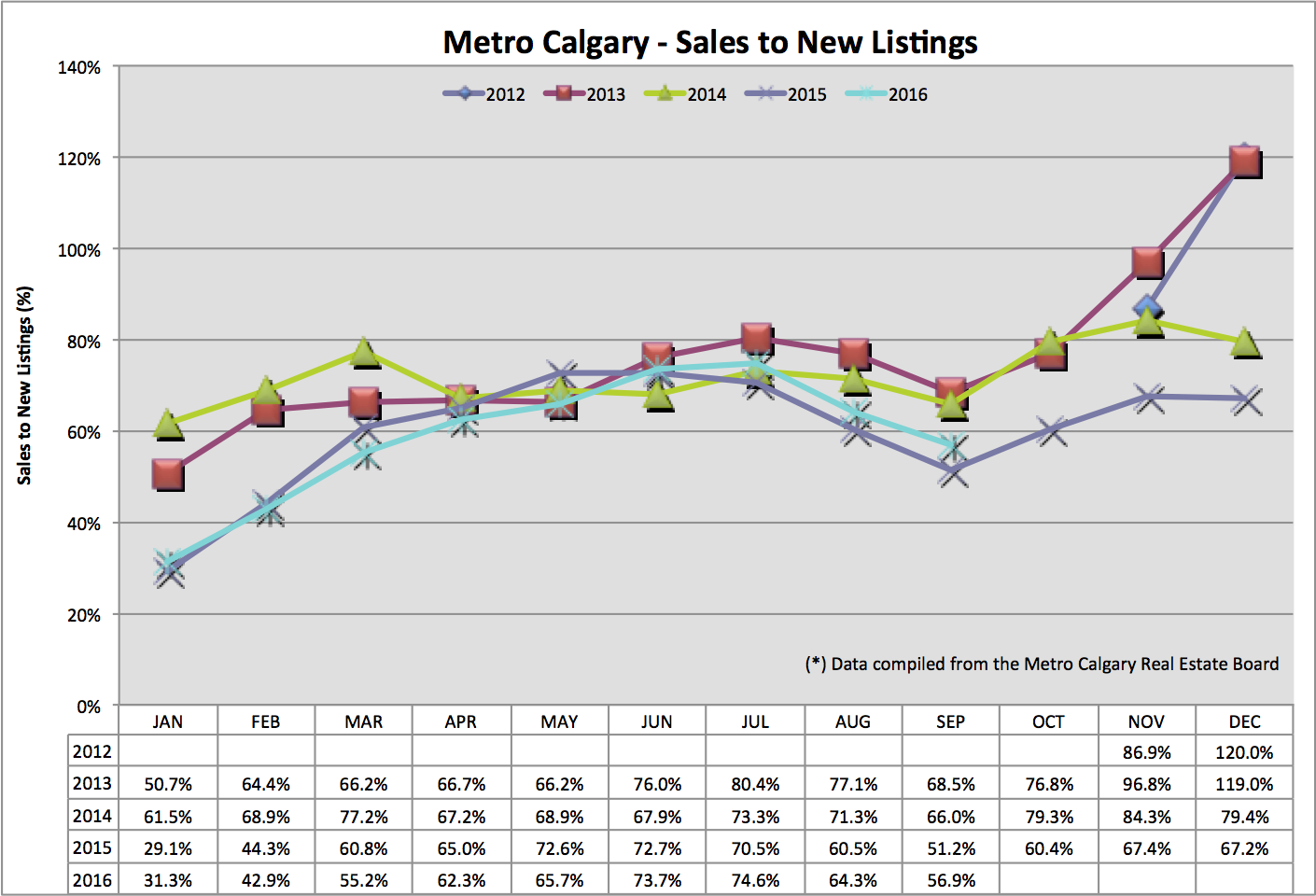

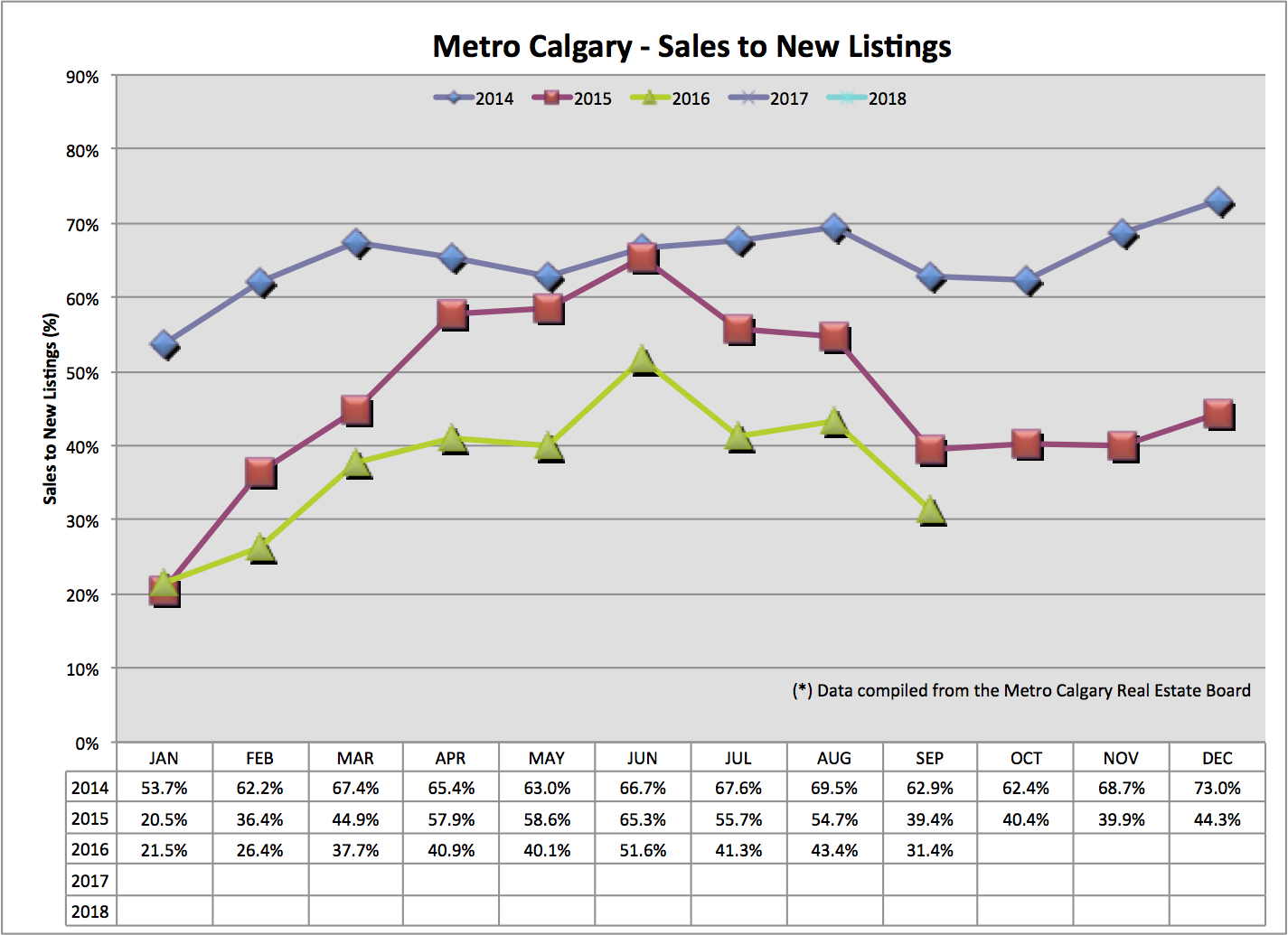

Sale To New Listings Ratio:

Understanding this ratio helps me anticipate near term Real Estate supply. Supply is the other side of the economic coin helping determine price. Increases in supply equate to downward pressure on pricing. A decreasing “sale-to-new-listing” ratio results in more future listing inventory, net of units sold leaving the market.

Detached Sale To New Listings Ratio:

Apartment Sales To New Listing Ratio:

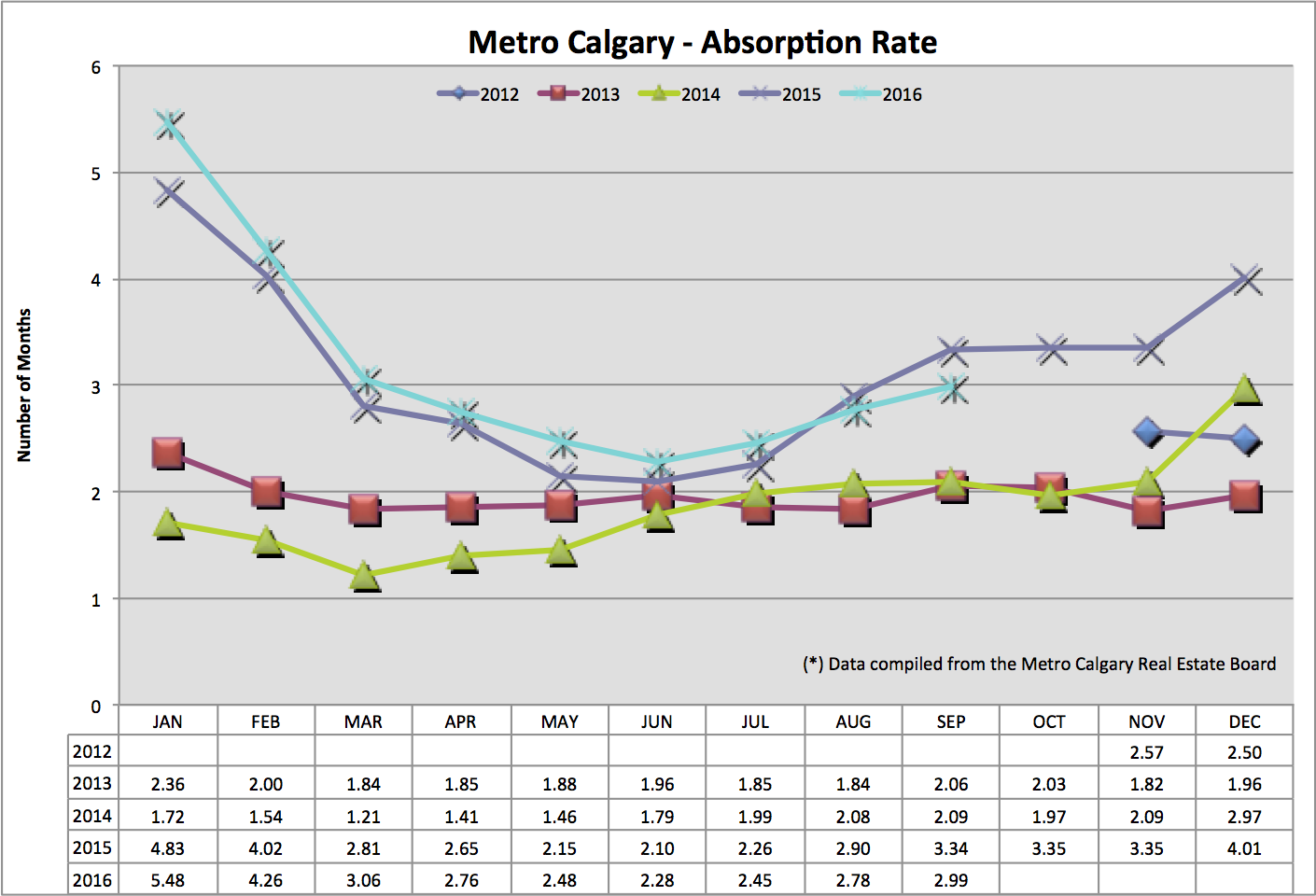

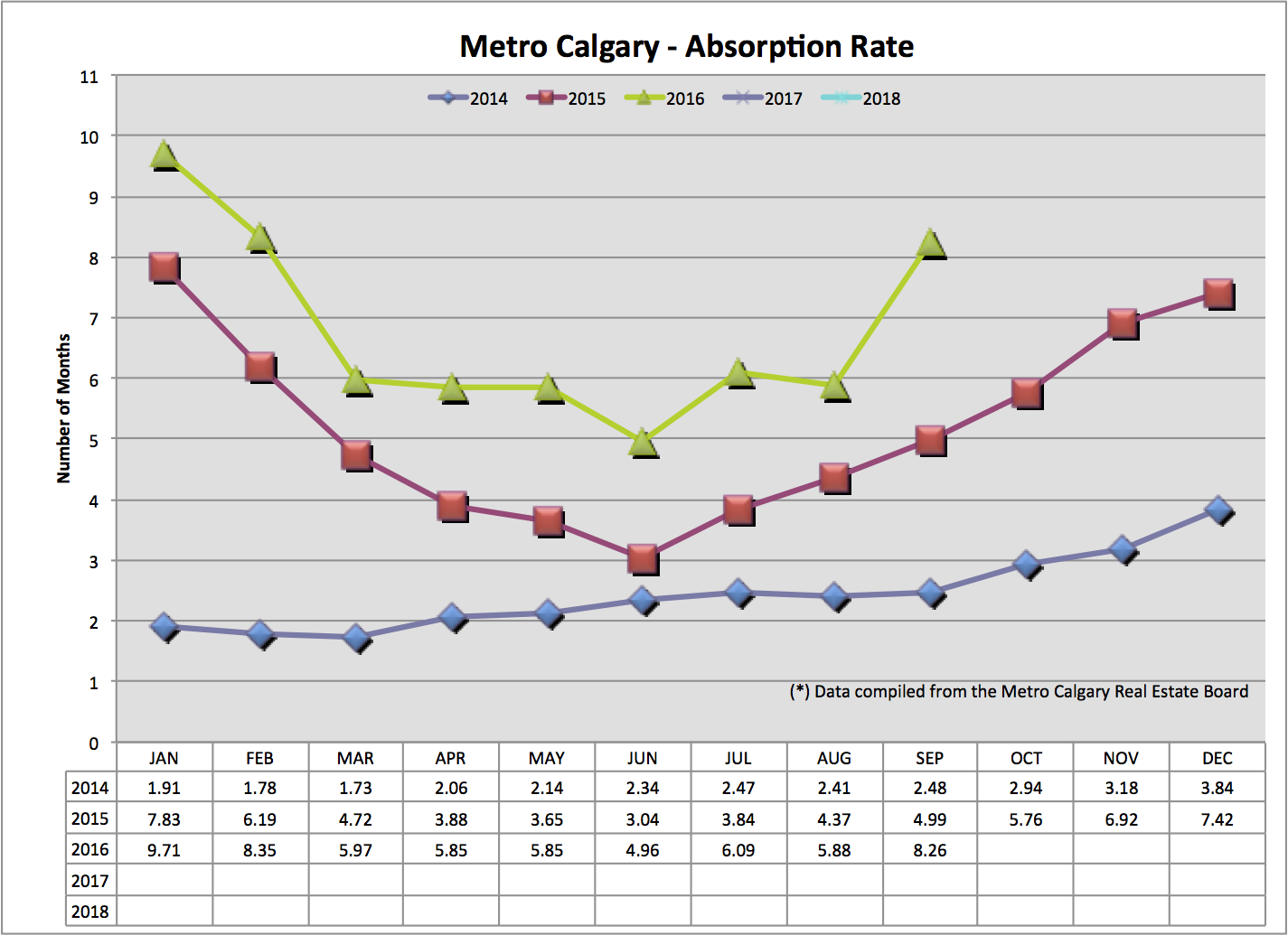

Absorption Rate:

This number tells me in months, how long it would take to liquidate ALL the inventory available, at the pace of the current months sales. This links the relationship of supply with sales volume. If we have high supply, with high sales volume, the result is some sort of balance. If we have low inventory, with high sales volume, this result is very low absorption (see 2014 data). If we have high inventory coupled with low sales volume, this results in a higher absorption rate.

Detached absorption rate is trending seasonally. I see this data point increasing month-over-month and also lower year-over-year. The attached absorption rate has rocketed north this month because of increasing supply and decreasing sales volume. Do note, attached Real Estate data fluctuates from extremes more regularly than detached RE data.

Detached Absorption Rate:

Apartment Absorption Rate:

Average & Median Price:

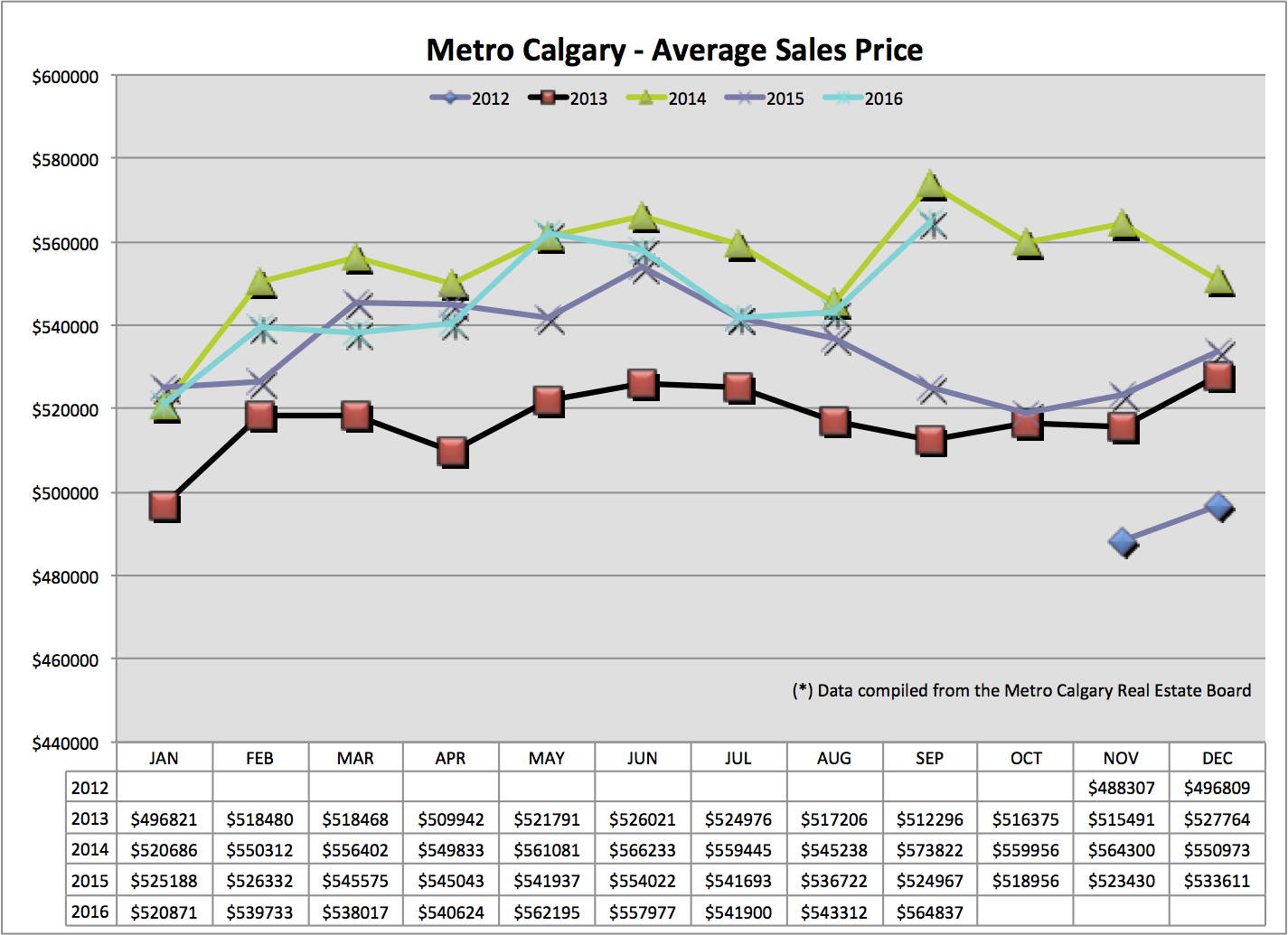

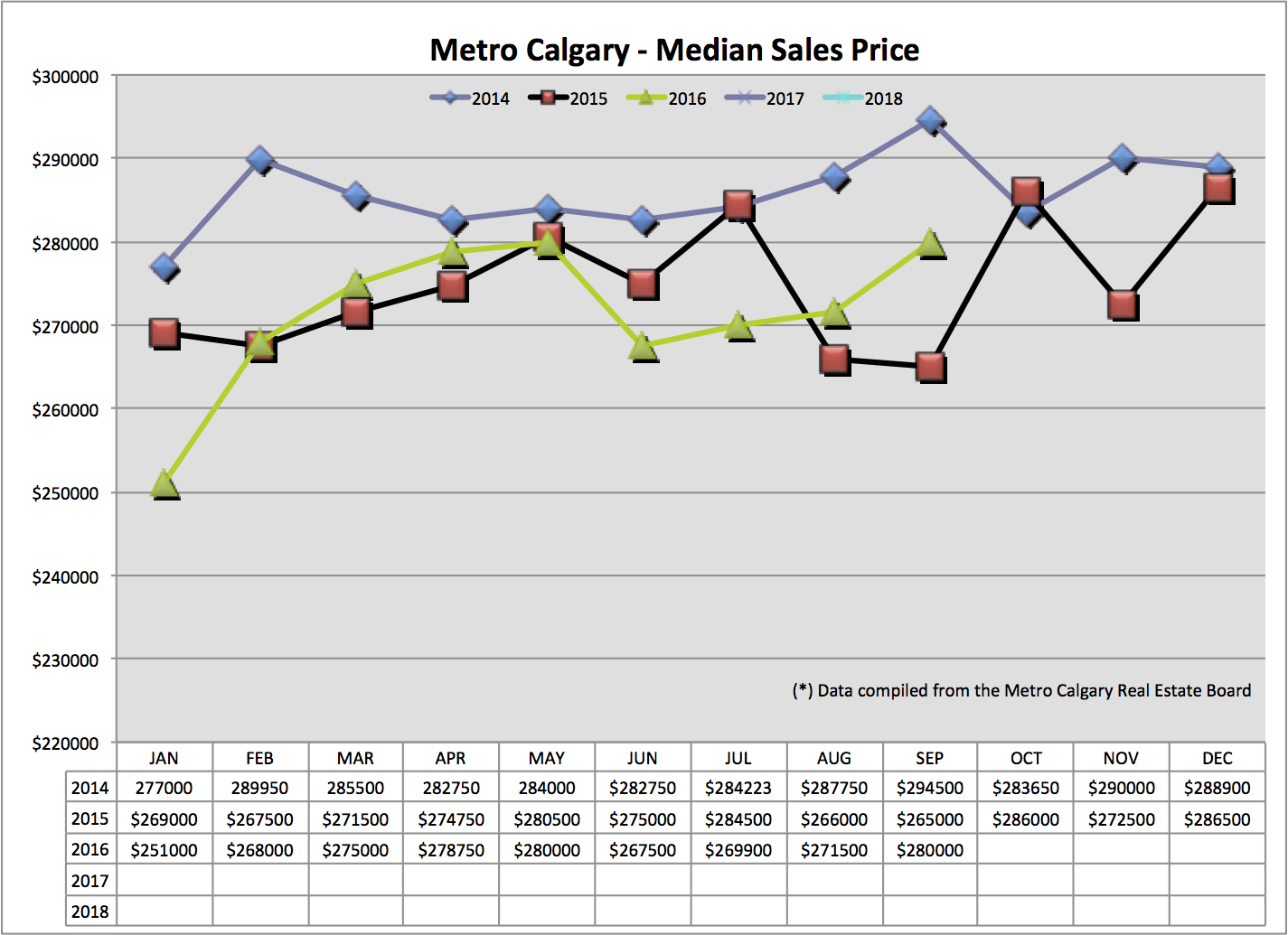

The average is found by totaling sales prices, then dividing that number with inventory sold. The median is found by lining up all the sales amounts and finding the middle number. I decided to analyze the median in apartment data to smooth out wild fluctuations.

Despite gloomy data above, the results for BOTH detached and apartment data produced positive monthly data. This might be due to an increased number of high priced units being bought, bringing up the average & median prices.

Detached Average Price:

Apartment Median Price:

Interest Rate Movement:

There are several behind the scenes factors that have a potentially huge influence on interest rates in Canada, outside of the Bond market. Below is an image of interest movement probability. Regardless of today’s movement, please consider the effect of a higher rate at your future Mortgage renewal date.

Conclusion:

You might be interested in some recent blog posts:

Looking Beyond: 3 Factors That Influence Canadian Interest Rates.

Mortgage Tightening Rules “For Dummies”.

Bank Of Canada Rate Announcement.

Despite the detached housing average and apartment median price both being higher month over month and year over year, I think the data behind the scenes still indicates downward pressure on pricing.

News of a Oil production cut also crossed my path in the news last week. I am sure, like me, that message brought temporary mental relief and more hope for our local economy to turn around. I continue to plan for a longer, slower return to economic prowess Alberta and Calgary have experienced in the past.

Thank you in advance for “Liking” and sharing my blog post. I genuinely appreciate your time reading my content. I pride myself on transparently advising my clients, before and after their Mortgage funding, so they are informed and positioned to save more money than working directly with a Bank.

Please comment or ask questions below. Alternatively, email me at chad@canadamortgagedirect.com.

Talk soon,

Chad Moore