Hey Guys!

I write you monthly about near term housing supply changes in Calgary’s detached and apartment market.

Today’s content is geared toward Calgary housing demand.

We know, the confluence of supply and demand is how Real Estate values are discovered. Well, maybe price discovery isn’t that black-and-white.

In reality, housing is not exactly traded as a commodity like oil or lumber. There is emotion is Real Estate, and that’s a factor in price discovery only you can gauge.

Here are some general areas of housing demand I think are worth noting …

1. Interest rates.

2. Qualifying rules.

3. Population.

Interest Rates:

This is important to understand …!!

1. How variable and fixed rates move up and down.

2. Review of variable and fixed interest rates.

3. Interest rates and home prices.

1. How Variable And Fixed Rates Move Up And Down:

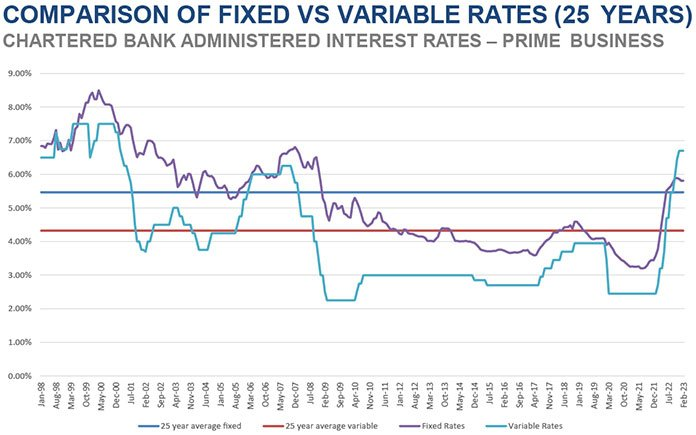

The market functions that influence fixed and variable interest rates are different.

The Bank of Canada makes eight interest rate announcements per year. At those announcements they either raise rates, lower rates, or keep rates the same.

The Bank of Canada moves the “central interest rate.” The movement of the central interest rate is connected to the Prime interest rate. Variable rate Mortgages are linked to the Prime rate.

Fixed interest rates move up and down based on bond prices/bond yields.

In general, fixed and variable rates move in the same direction. Fixed and variable rates are not a direct function of each other.

2. Review Of Variable And Fixed Interest Rates:

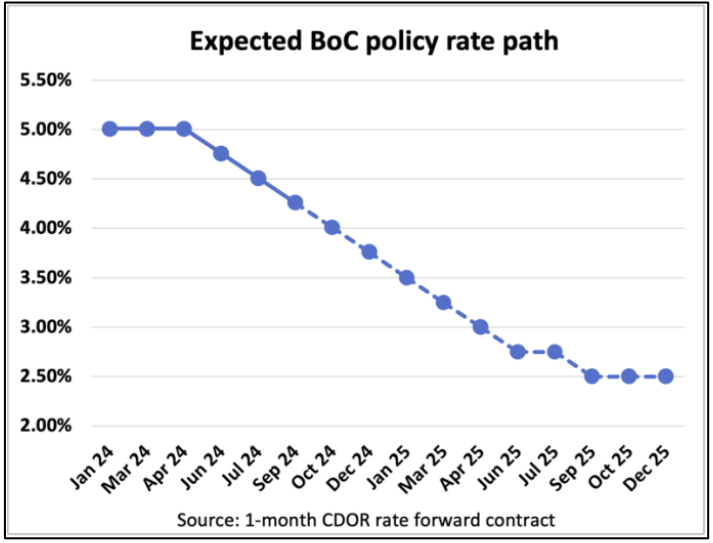

The Bank of Canada is now clearly meeting it’s inflation target mandate of 2%. This means the previous rate hike’s made by the Bank of Canada to lower inflation are now set to come back down—and that is already happening!

The last three Bank of Canada interest rate announcements have each been a reduction of 0.25%.

The next Bank of Canada meeting is October 23rd, and it is widely expected another 0.25% or 0.50% rate reduction is forecast to be announced (image below relating to BoC rate forecast, courtesy of Ben Rabidoux).

Investors are purchasing more bonds which is driving bond prices higher, and bond yields lower—bond prices and bond yields are the inverse of each other.

With lower bond yields, fixed Mortgage interest rates are also lower. Looking back, fixed interest rates likely peaked about 1-year ago (see bond yield curve image below).

3. Interest Rates And Home Prices:

Lower rates help spur home buyer demand. But low rates alone won’t keep Calgary’s rocket-ship values ripping higher.

Why?

All parts of the economy work together which influence buyer demand for housing (shocking ;-)).

For example, I helped a couple purchase a home in 2016 with a 5-year fixed rate of 2.39%.

Despite that low of fixed interest rate, Calgary’s housing market did not experience rapid price appreciation in that era (2016-2019).

Why?

That was a time of reasonable economic uncertainty here in Calgary. People were fearful of losing their employment, and making less money.

That’s an example of why low rates alone won’t rip our market higher.

Today, Calgary’s local economy is doing much better, so lower rates might pull some home buyers off the sidelines. The market will let me know soon enough!

Mortgage Qualifying Rule Changes:

Buyer Default Insurance Update:

Default insured Mortgages are now available to all buyers purchasing a home up to $1.5M (previously $1M).

For example, a first time home buyer can put less than 20% down payment on a purchase price up to $1.5M. A home owner can sell and purchase a home priced up to $1.5M and put less than 20% down payment.

Amortization Extension Update:

A 30 year amortization is available to first time home buyers, and all buyers purchasing new builds.

Spreading a Mortgage out over a longer period of time lowers the Mortgage payment which assists with qualifying. Note, the longer the Mortgage is spread out, the more cumulative interest is paid.

Link to Government of Canada website announcing rule changes. <–

These two changes take effect as of December 15th. This means the application would have to be submitted on or after that date to be underwritten under the new regime of rules.

Insured Refinance—With A Twist:

The government announced on October 8th home owners can refinance up to 90% of their property value for the purposes of building a secondary suite. This rule change takes effect January 25th, 2025.

I’ll have a more in-depth update on this rule change, as I see a lot of potential here for you!

Link to Government of Canada website for more information.

***

All of these recent Mortgage qualifying rule changes are intended to stimulate demand for Real Estate.

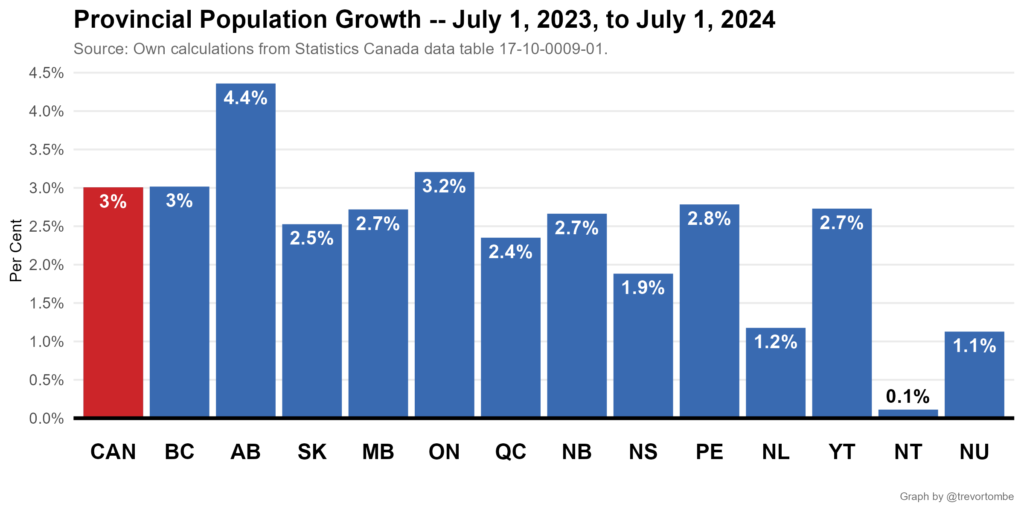

Population:

A growing population is stimulative to purchase demand for Calgary housing. Especially when new comers sell their home in a different part of the country for more money than they are purchasing here!

The first chart below is from economist Trevor Tomb (follow on X) showing AB’s population explosion from July ’23 to July ’24.

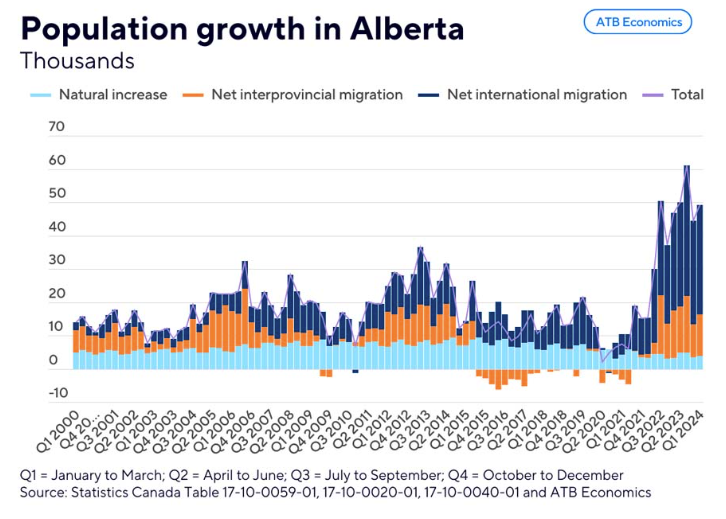

The second chart below is a further history of Alberta’s population up’s and down’s (image from ATB economics).

What I see in this second chart is a rather noticeable trend of population growth, followed by less population growth.

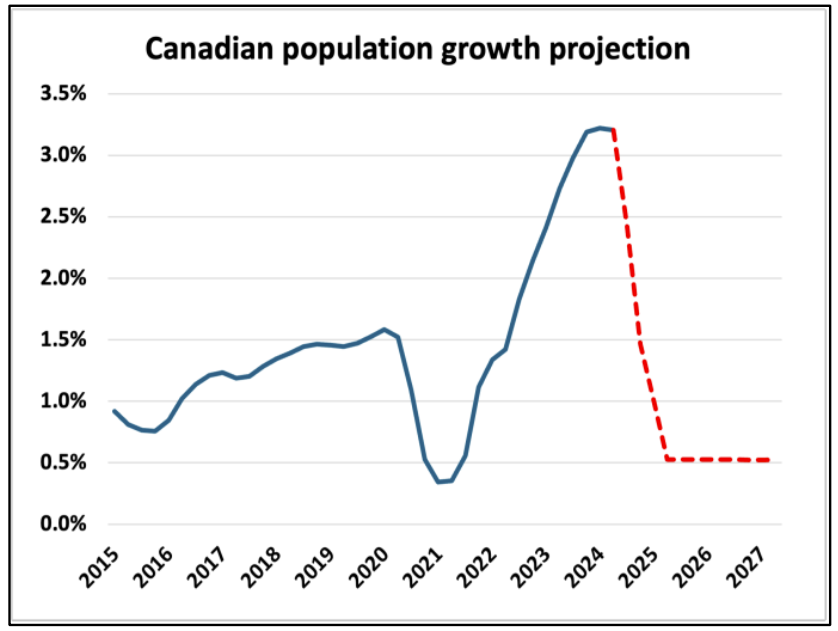

The third image below is a projection of Canada’s population growth. Let’s monitor how this might trickle into Alberta’s population growth.

Conclusion:

There is a noticeable trend of listing supply slowly increasing for detached and apartment homes, over the near term.

Fixed and variable interest rates are well off their peak from a year ago. The Bank of Canada seems to be in the middle of a rapid rate cutting spree. Fixed rates have been dropping quickly since the summer, but recently bounced higher.

The government of Canada is unrolling stimulative Mortgage underwriting policy to help spur Real Estate demand. Why these policy changes now?? Calgary’s market remains healthy, but Ontario home owners/buyers are being reminded that values eventually cycle. Long time Calgary Real Estate players know this well.

History shows us Alberta goes through boom and bust cycles of population growth. And it seems like we’re just finishing a super-boom cycle of growth. What happens next—likely continued population growth, but less volume.

What does this all mean?

Near term, we are trending to a more balanced market with signals of increasing supply and it seems that super-charged demand cooling.

Long term, our market will behave like it has in the past—prices will move up and down.

What do you think?

I hope this summary has been helpful. Please note the difference in data, and my personal opinion.

Cheers,

Chad Moore

P.S.

It’s been a while since I mentioned a huge “thank you” to all my repeat clients, and people referring.

P.P.S.

Charcoal grilling. I bought a charcoal grill from FB Market place about a month back. The brand is Napoleon and I was targeting this make of grill because it has a nice cast iron grate to cook on. Charcoal grilling is significantly more involved than propane or natural gas, so it’s personal choice. Maybe I’ll update you guys in the winter …I might be wishing for something a little simpler?

P.P.P.S.

Home owners planning to sell—Check out The Ultimate Home Transition Blueprint Checklist. I’ve written a 30 point checklist, along with an expanded e-book for those wanting more.