What’s Happening In The Bond Market?

Essentially, there’s been a sell off of Canadian Bonds causing the yields of the Bonds to rise.

When Bond yields rise they simultaneously shrink the spread between yields and Bank interest rates. When bond yields rise, so do interest rates.

Here’s one easy way to conceptualize this …think about two walls closing in on each other …when the encroaching wall becomes too close, the other wall expands.

As bond yields rise, they shrink the profit margin Banks make. As a result, interest rates rise so Banks retain their profit margin.

Just like ANYTHING in our economy, the cost is passed onto the end user.

What Effect Does This Have On Canadian Real Estate?

Two major things:

- Mortgage interest rates rise. I think now that Canadian’s are qualifying for their Mortgage based on the Bank of Canada’s Mortgage Qualifying Rate (MRQ), a market rate increase doesn’t have the same weight of impact it once did.Mind you, people’s Mortgage payments DO increase once they’ve overcome the MRQ hurdle and their Mortgage has funded. And this rate does take more aftertax dollars our of Canadian’s disposable income pockets. So it’s not nothing.

- Bank posted rates rise. The Bank of Canada’s MRQ is formulated by combining all the large Bank’s posted 5 year interest rates. Yes, as the Bond market spikes, resulting in higher market Mortgage rates, each Bank posted interest rates is sure to increase as well.Ultimately, this trickles into consumer Mortgage qualifying.

- It’s a kick in the pants. As more and more stringent Mortgage qualifying rules come into existence, Mortgage applicants now face unexpectedly higher Mortgage interest rates.

How Much Are Interest Rates Rising?

I’m seeing 15 basis point increases to interest rates. RBC released an article last week stating their rising as much as 35 basis points higher! Yikes.

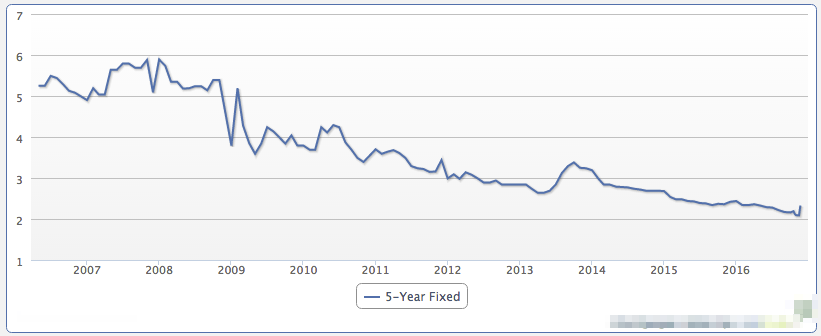

I think it’s beneficial to have a simple context of where interest rates are, relative to the past 5, 10, 15 and 20 years. This helps provide me perspective.

What’s Next Chad?

Here’s my truth …I have no idea!

Really, I don’t recall anyone anticipating this bond sell off. I don’t recall the US election polls predicting a Trump Presidency. I don’t remember people anticipating Britain voting to exit the European Union. Even the last Mortgage rule change announcement, in mid October, caught many people by surprise.

What’s next? I don’t know. What I can do is reasonably look at the data I have today, look at the data of the past and make my best judgement moving forward.

Here’s what I do KNOW with 100% certainty. It’s this …

Our future is going to be a mix of opportunity and difficulty. Really, it’s been this way since the beginning of recorded history. Opportunity mixed with difficulty. Count on it.

If you are thinking of purchasing a home, refinancing or renewing your Mortgage in the next 3-8 months, I think TODAY is best to initiate that process with my teams services. Email or call me directly.

Cheers,

C. Moore