Hey Guys!

It’s looking like meaningful trends are taking hold, with reasonably noticeable divergence from past years’ data. You let me know what you think.

I’m breaking down detached and apartment home data, from the Calgary Real Estate Board (CREB), for three categories: 1) sales to new listings ratio, 2) absorption rate, and 3) average/median price.

The law of supply and demand is undefeated in Real Estate price discovery. This content is focused on near term supply changes.

Detached Homes:

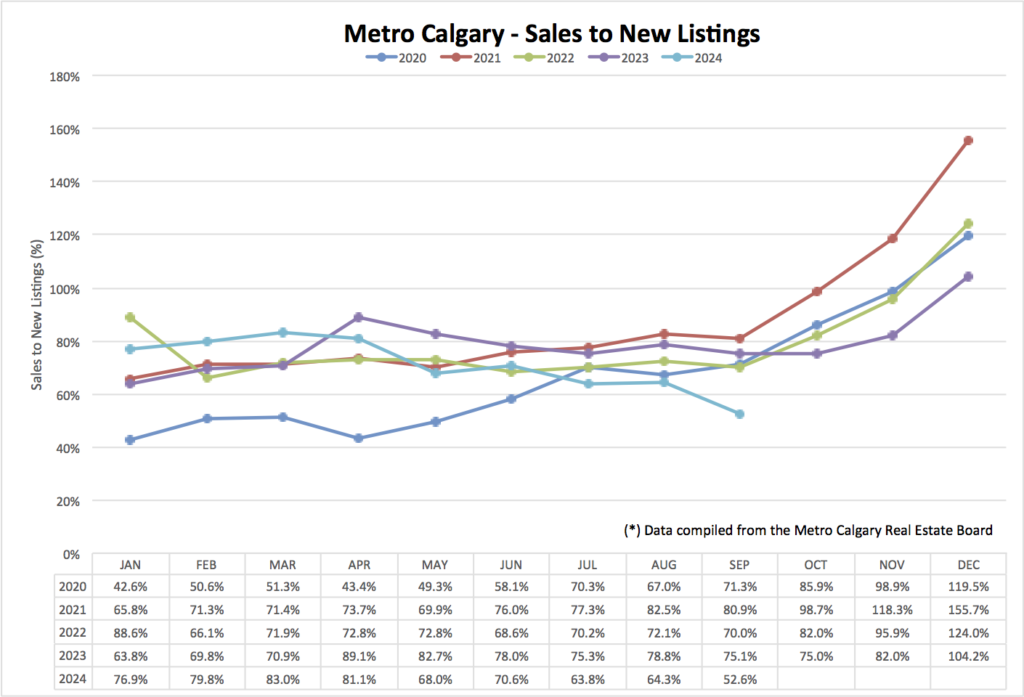

Sales To New Listings:

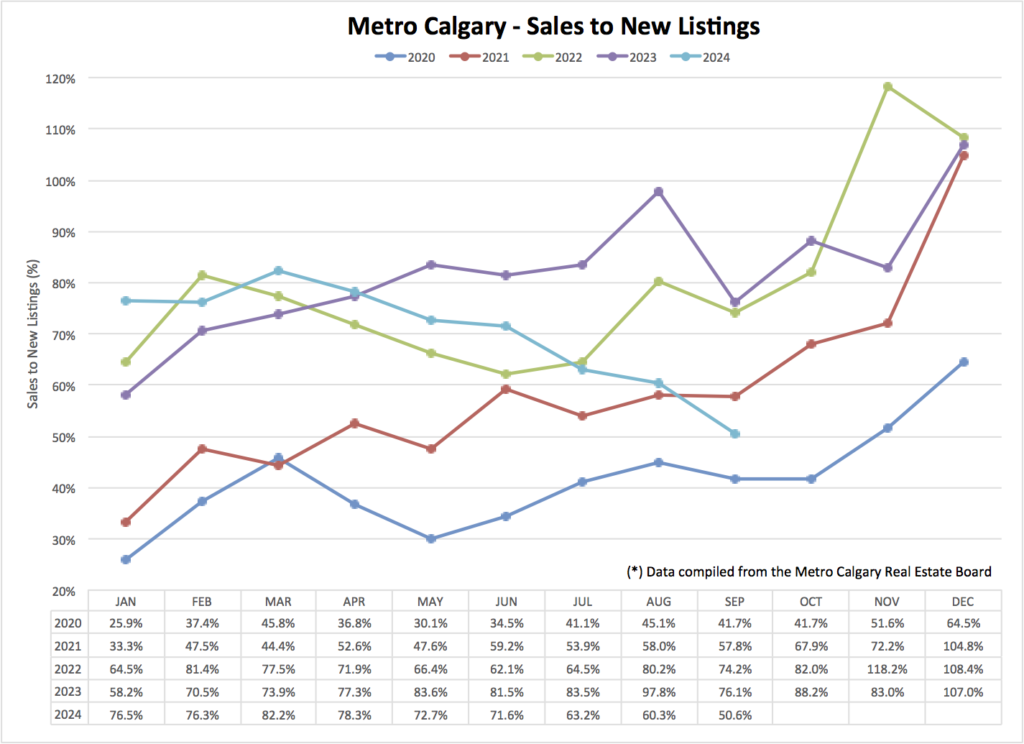

The sales to new listings ratio combines homes exiting the market (sales and expired listings), with new inventory.

This is a percentage that indicates the accumulation or depletion of detached homes for sale.

For quick reference ….in the last four years we can see the sales to new listings ratio go above the 100% line, at various points, through Oct-Dec.

This means there was more sales than new listings—a warning sign of near term low supply. This lead each of the following years’ utterly insane spring markets.

When data points are further below the 100% sales to new listings ratio, that indicates the accumulation of near term housing inventory. And this is where a noticeable trend continues to emerge.

We can see the sales to new listings ratio peak in March, and grind lower through to September. Supply cometh.

I’ve been reporting to you for years now about the emergency low level of housing supply in Calgary. For now, there seems to be a “return to normal” supply trend emerging.

Are some listings selling over the ask price—yes. Are some listings receiving multiple offers—yes. Are some listings selling the weekend they’re listed—yes.

And some listings sit on the market, do a price reduction or two, and eventually sell below list price. This is also happening.

If you’re a buyer, be aware of your emotions. A bit more patience might prove to benefit you. If you’re a seller, be aware of your expectations. An all out bidding war, with an over list sale might not happen.

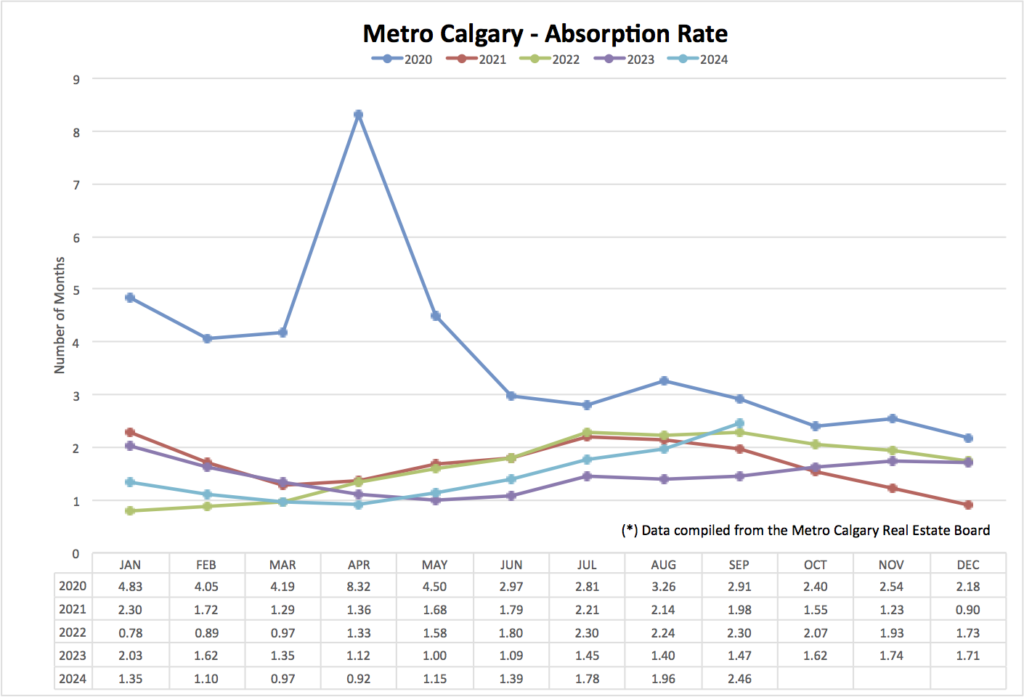

Absorption Rate:

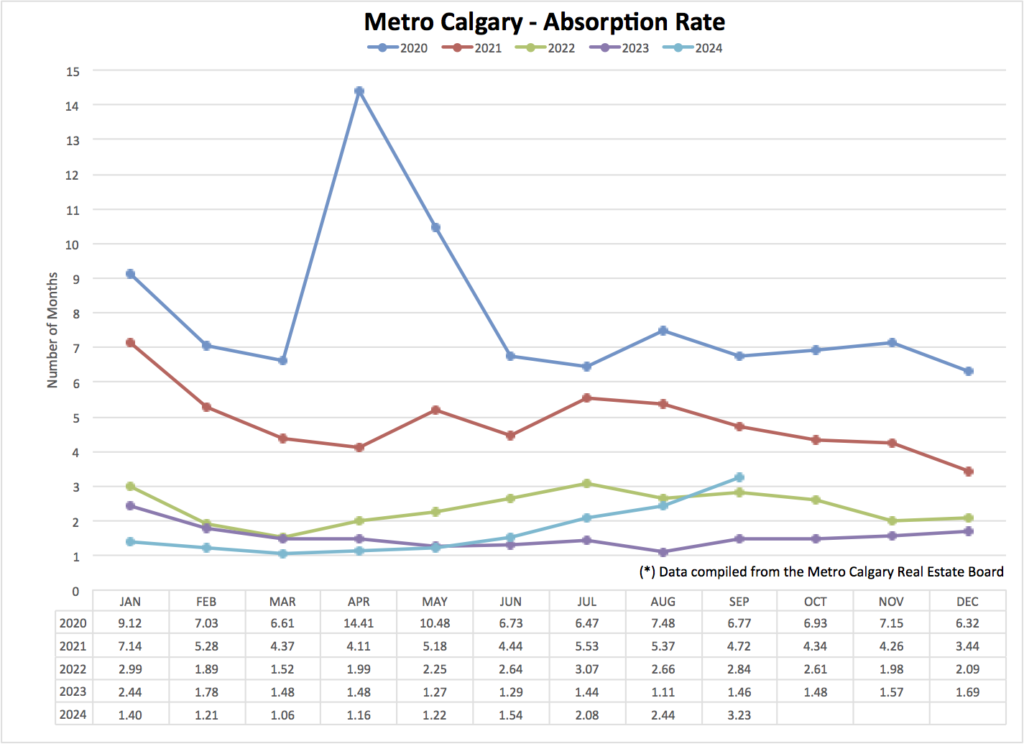

The absorption rate tells us, in months, how long it would take to liquidate all of Calgary’s inventory, at the current pace of sales.

I often layer the absorption rate and sales to new listings data together. I notice how when the sales to new listing ratio decreases, absorption rises not long after. I can also see when the sales to new listings ratio increases, the absorption rate decreases.

With that context, it’s not surprising to see Calgary’s detached absorption rate trending higher, as the sales to new listing ratio is trending lower.

Again, the supply data seems to indicate we are moving toward a more balanced market.

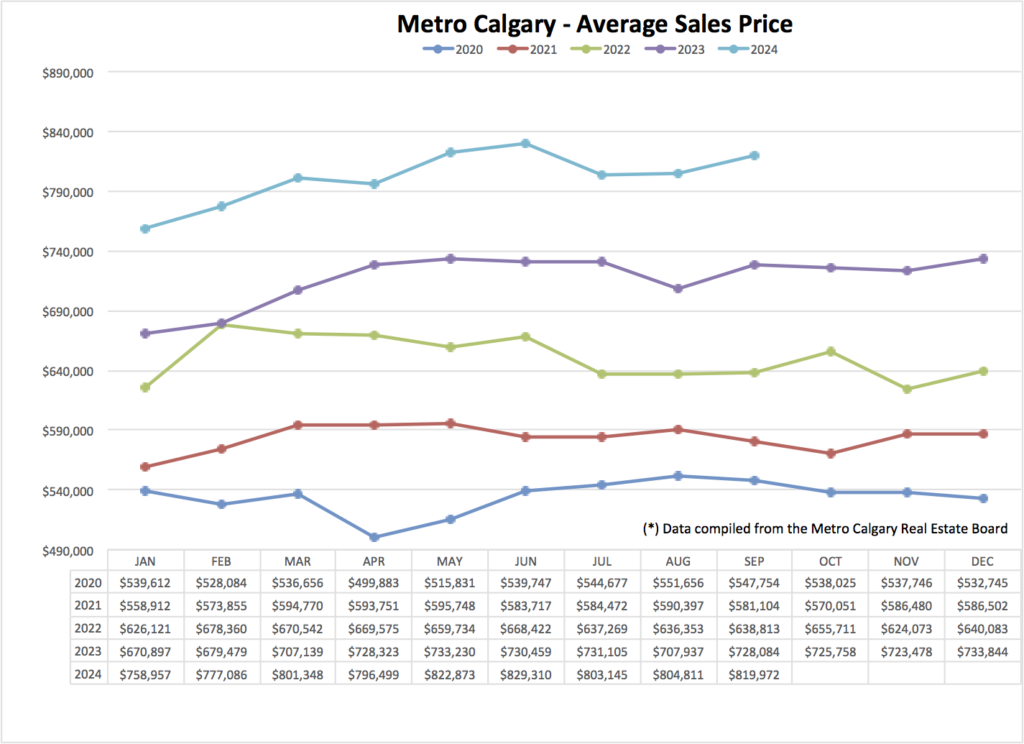

Average Price:

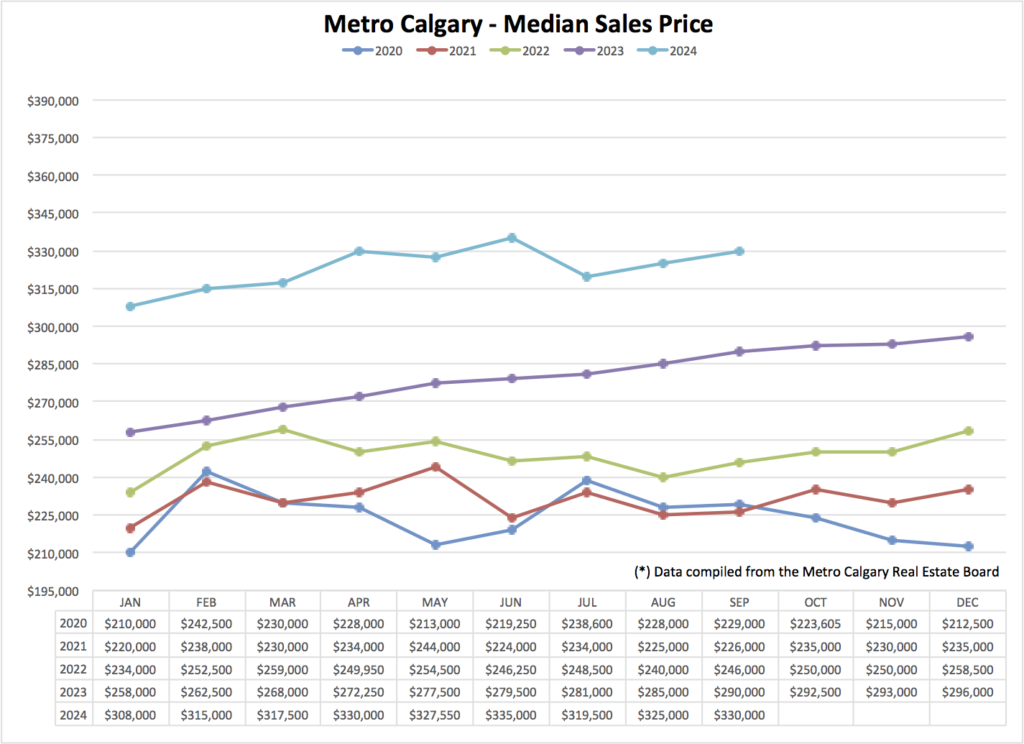

For long-time Calgaryians, we know the Real Estate market cycles.

Just look back at the data …prices peaked in 2007-2009, then again in 2012-2015, and now we are at peak pricing again.

In general, Real Estate prices take the elevator on the way up. We tend to see big price increases over a relativley shorter period of time.

And in general, Real Estate prices take the stairs down. Based on past cycles, home prices typically grind sideways or lower over years.

Where are we in the cycle? What happens next? You buyers and sellers will tell me.

Buyers …you’ll tell me by what you’re willing to pay for the home you want. Sellers …you’ll tell me by what you agree to sell your home for.

The prediction business is ruthless. All I can say is near term, it seems like the absolute insanity to “get in the market or be priced out forever” is behind us.

Apartment Homes:

Sales To New Listings:

Similar to detached homes, the apartment sales to new listings data peaked in March and has been trending lower since.

The 2024 trend line clearly stands out relative to past years’ of data. This is a clear indication of more apartment supply coming near term.

Absorption Rate:

Apartment absorption rate also bottomed in March of this year, and has been trending higher since.

The move toward a more balanced apartment market seems to be here, or very certain to arrive.

Median Price:

Median apartment price is up year over year, and about flat for the past several months.

Conclusion:

For all of you who scrolled here …the theme is more near term housing supply is coming.

If demand remains about the same (and it is always changing) that should balance our market out.

I think a balanced market is a healthy direction …making a rushed decision to purchase a home, in most cases well over half-a-million-dollars, within minutes of a single viewing, and with no conditions (not advised, ever) isn’t ideal.

Please note, I’m not against buyers making quick Real Estate decisions and knowingly assuming risk they understand and are comfortable with. I get those decisions, and am here to help.

The demand side of the equation is dynamic …we have easing Mortgage qualifying rules taking effect December 15th (simulative), interest rates are trending lower with clear near term certainty (simulative), and other Real Estate markets in Canada are experiencing near term pricing corrections (likely leading to less local demand). A lot happening.

I hope this content has been helpful. If you know people planning to purchase in the next couple of months, they might like to read this.

If people are planning to sell, this content and The Ultimate Home Transition Blueprint—Checklist might be helpful.

Talk soon,

Chad Moore

P.S.

Elk hunting. Came close, but no cigar.