Check out Calgary’s Real Estate statistics below (from CREB):

– Sales to new listings.

– Absorption rate.

– Average/Median pricing.

When I layer this data, and add my own thinking, I can reasonably understand what’s happening in Calgary’s Real Estate market. This data also helps make an educated assessment to anticipate near term price movements.

I think this is helpful for an unbiased understanding of what’s happening in Calgary’s Real Estate market, or if I’m planning to buy/sell property.

Guys, I do this to add value to your day, stay top of mind and earn your future business and referrals.

That said, here we go!!!

Detached Calgary Homes:

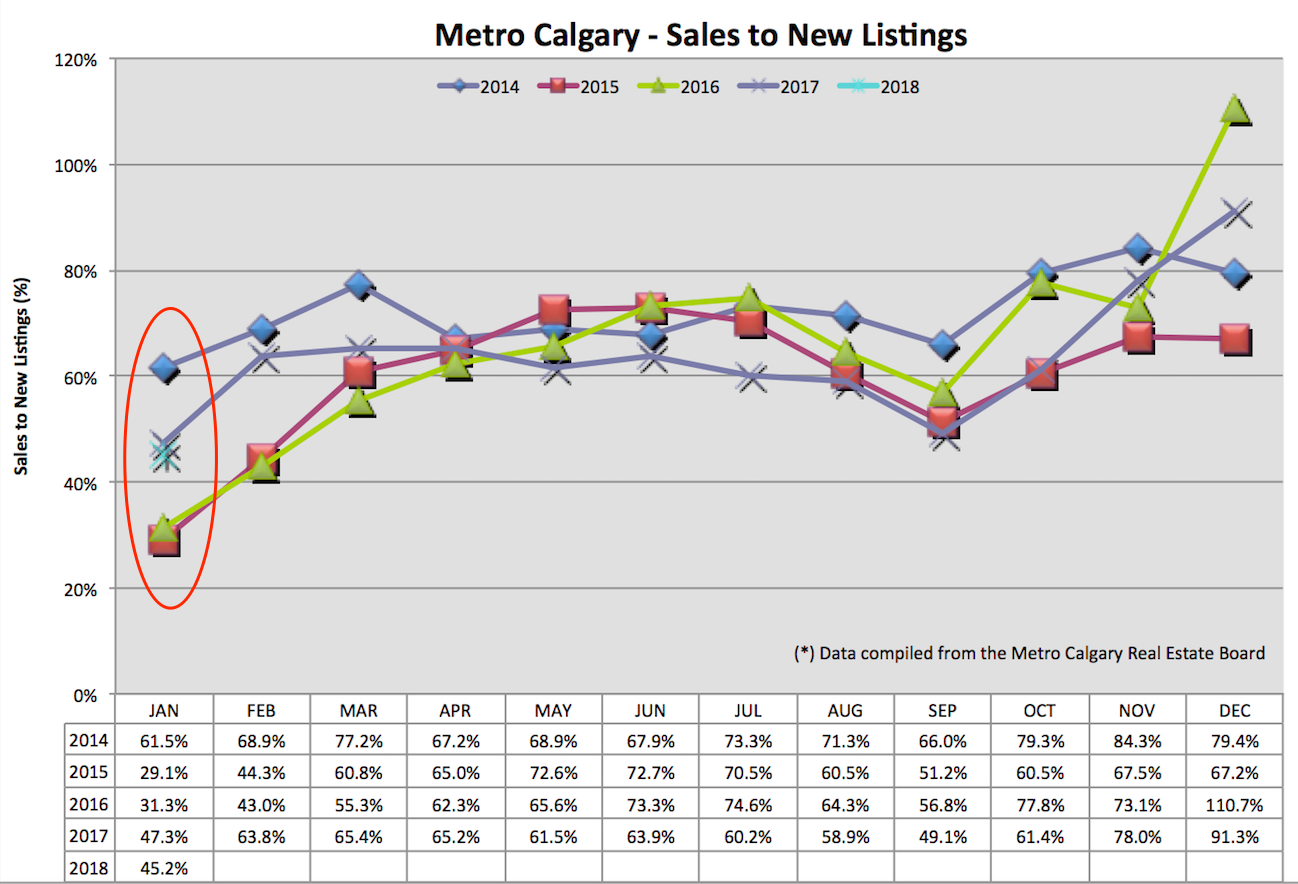

Sales To New Listings Ratio:

This data point looks at new listings coming onto the market combined with homes leaving the market (home sales).

For context, a decreasing trend anticipates more listings coming onto the market for sale. We can anticipate an increase to home listing supply, which creates down pressure on pricing.

An increasing trend line means less new listing inventory is coming onto the market for sale, decreasing future home listing supply. Without any change in demand, this has upward pressure on pricing.

We can see about the same data point this year as January 2017. With new Mortgage rules in effect, increasing fixed and adjustable Mortgage interest rates might result in less sales and climbing inventory?

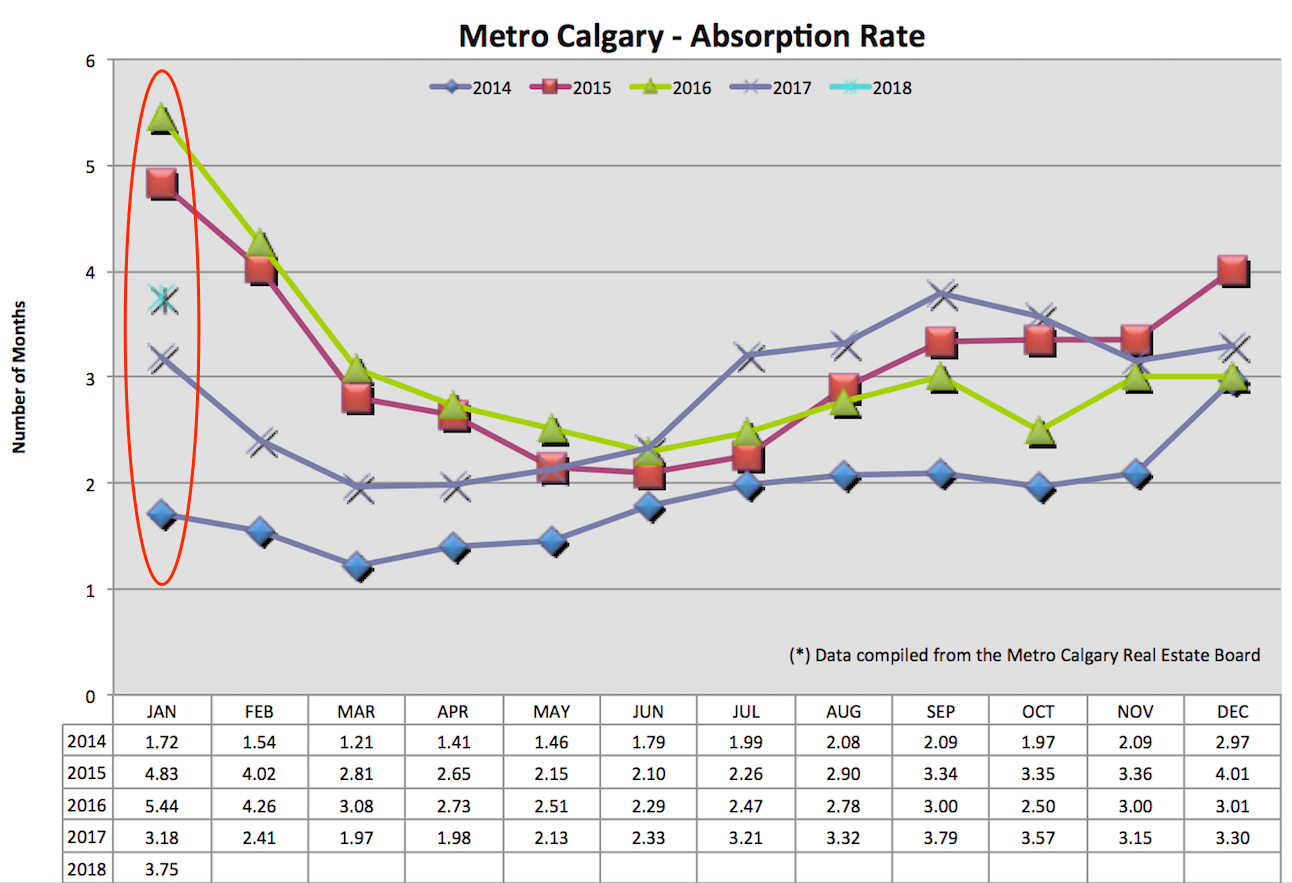

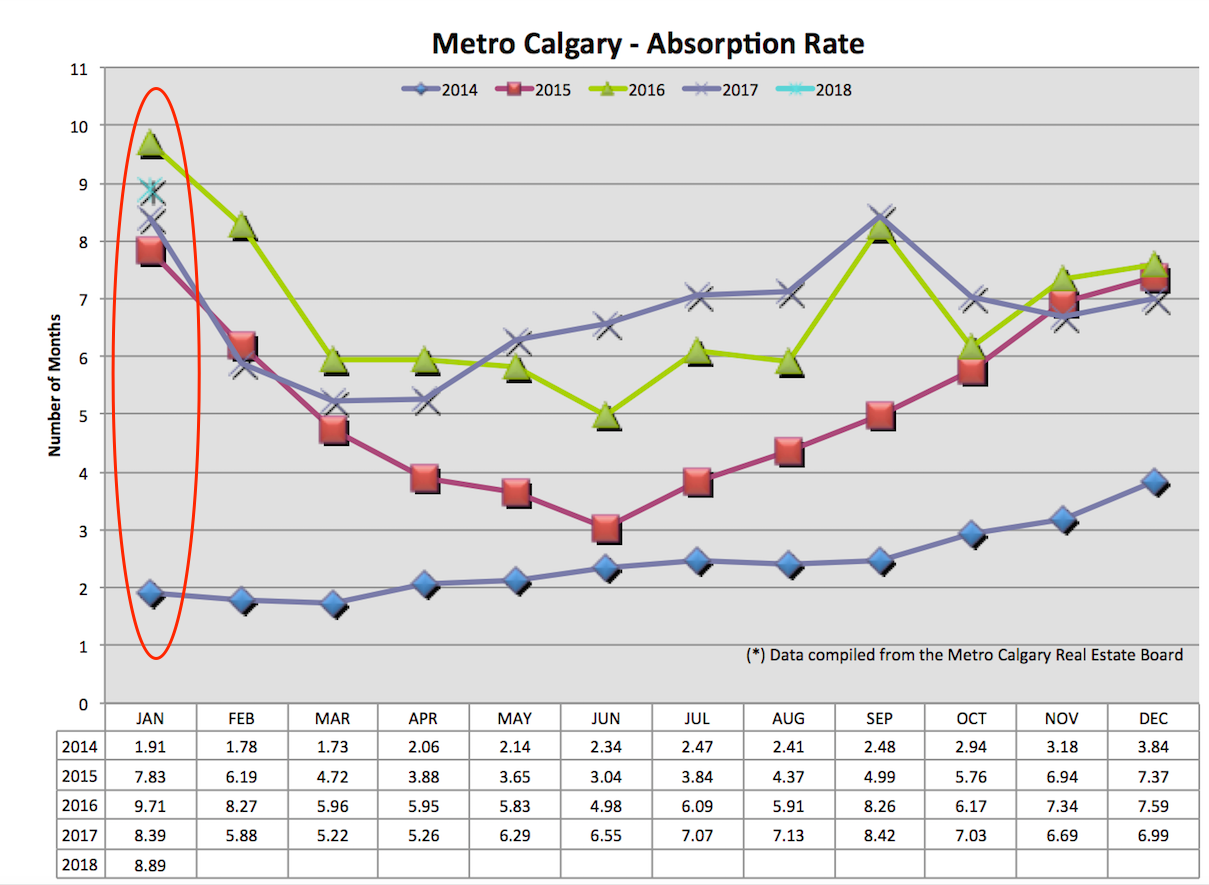

Absorption Rate:

The history of January’s absorption rate over the past five years has been quite different. One similarity is a decreasing trend line into the Spring market (good for prices). I think it’s reasonable to anticipate a similar trend in 2018.

The absorption rate, tells us in months, how long it would take to liquidate all of Calgary’s inventory at the pace of that months sales. A traditional balanced market is between 2-4 months. Higher absorption rates indicate a buyers market (down pressure on prices because buyers have negotiating power). Lower absorption rates indicate a sellers market (sellers can be picky with buyers, waiting to get their asking price).

January 2018 data is starting higher than last year, but not as high as previous years. Depending on how steeply this trend line decreases will tell the tale of the coming Spring market. With a tighter lending market and higher interest rates, relative to last year, I think this trend might be similar, but above 2017’s data.

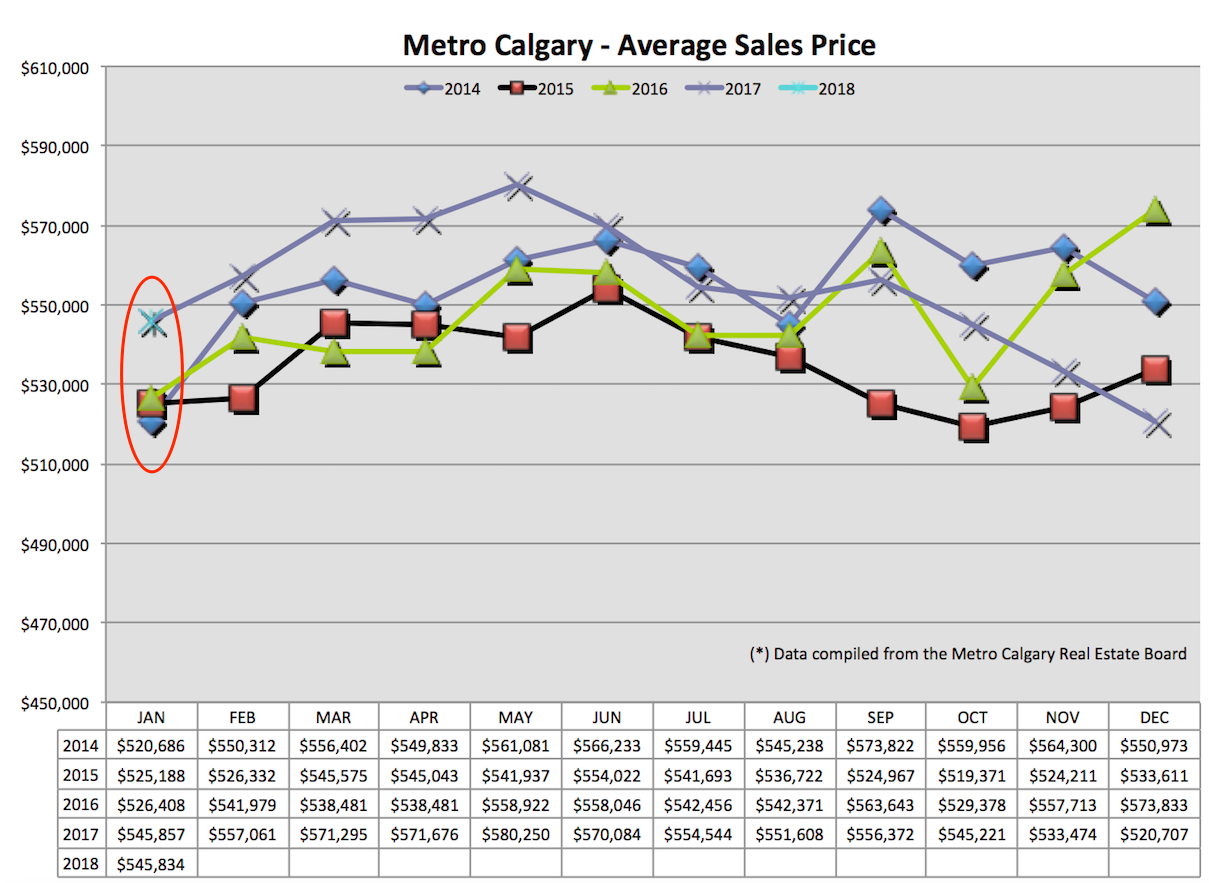

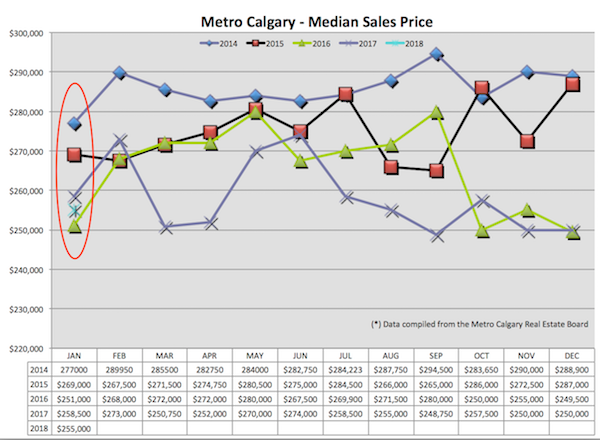

Average Price:

The slide in average price stopped this month! January 2018 & 2017 data points are nearly identical. Based on the previous two data points, I think it is reasonable to see similar clustering of the average price in the coming months (and year).

Calgary’s demand metrics (jobs, migration, wage growth) don’t seem to have major swings in either a positive or negative direction on the horizon. I think housing supply will continue to be a major determining factor to pricing.

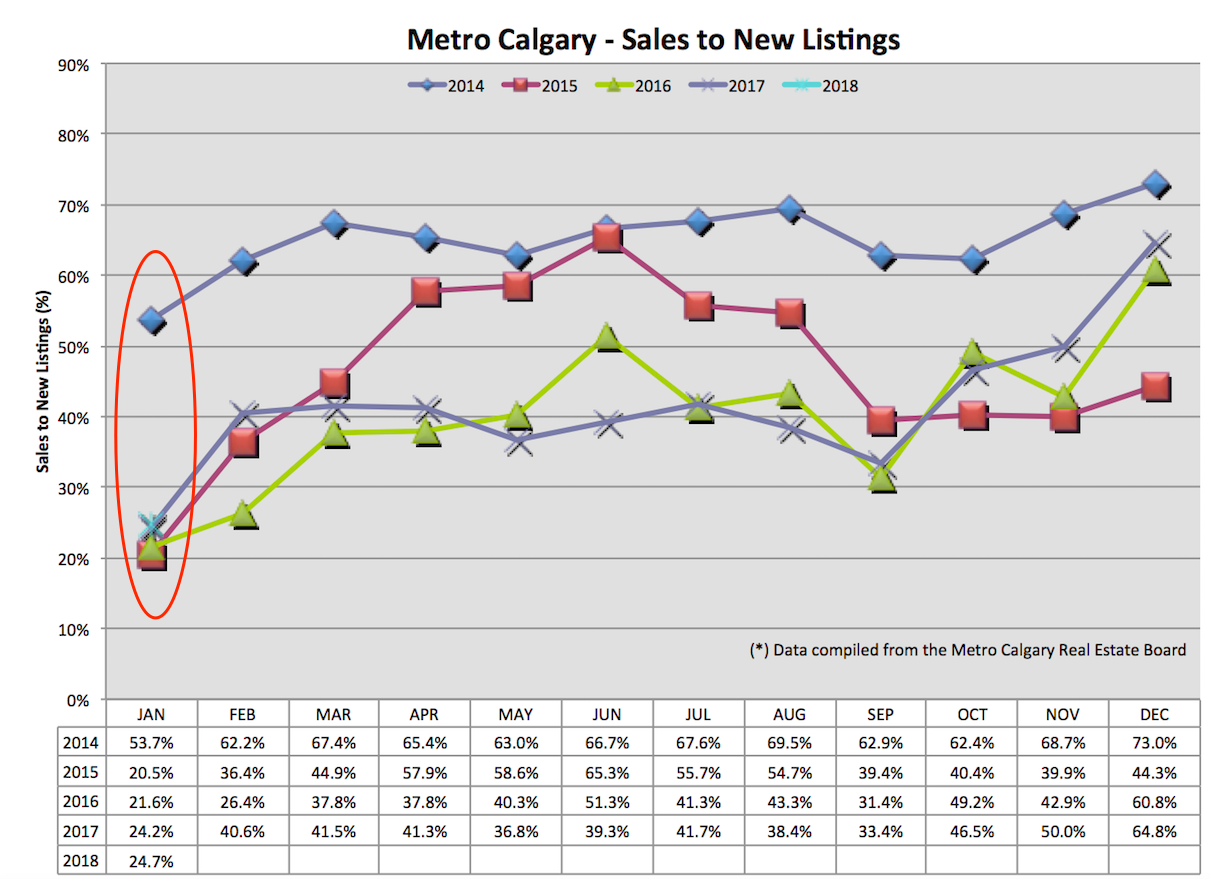

Calgary Apartment Data:

Sales To New Listings:

January 2018 data is about the same as the previous three years. I think it’s reasonable to anticipate a similar upward trend coming into the Spring market as more sales happen. The context of 2014’s apartment numbers are still available for comparison which reflect a much different market than today.

Absorption Rate:

An absorption rate of close to nine months is a little scary. However, I anticipate a similar absorption rate decrease in the first couple months of 2018. I think persistent high inventory levels will remain which create down pressure on pricing.

Median Price:

January 2018 starts off with the second lowest median price on the timeline of this graph. Due to lower numbers of sales, swings in data make anticipating trend lines more difficult. Condo listing inventory, without any change in demand, will keep pressure on prices.

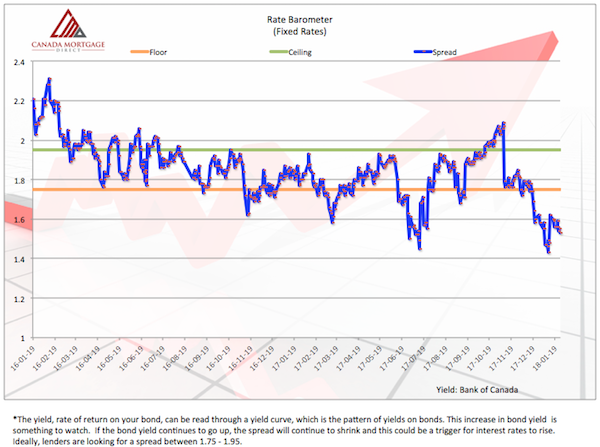

Canadian Fixed Interest Rates:

The blue line below shows the 5 year Canadian Bond yield where 5 year fixed interest rates are priced. A decreasing blue line indicates upward pressure on fixed interest rates. Today, I’m seeing Mortgage lenders email stating rates are in fact increasing.

If you, or people you know, have any need for a Mortgage (refinance, renewal, sale/purchase) please be in touch with me.

Conclusion:

Calgary is seemingly facing an uphill battle in the housing market. Mortgage rule changes, increase fixed and adjustable interest rates, flat or decreasing home buyer demand AND flat to increasing housing supply.

I ask myself, what’s the opportunity?

If I’m selling a property, I think initial pricing is KEY. If I’m purchasing a property I think leveraging market data in my favour, and being patient can help create long-term wealth through Real Estate.

What’s happening with you? Reply to this email and update me! I honestly like to hear :-).

Talk soon,

Chad Moore

P.S

I did it.

I was in a high-energy state and made a decision. I booked a trip to Colombia, flying into Bogota on June 25th! My trip is one day short of three weeks!

If you’ve been, or know people who have been, or know people in Colombia, let me know. I’m a one-man-wolf-pack down there and need some help :-)

P.P.S

If we speak on the phone, and you know Spanish, knock off any rust you have too! I’ve hired a woman from Bogota to teach me …and wow, it’s like I’m an infant learning to speak again. #humbled

P.P.P.S

Forward this email to those people you know who might like reading this kind of information. Thank you!