For the past three years I’ve consistently reported on Calgary’s housing supply to anticipate any near term price movements. My most recent blog post on this matter is here. Come back to see the newest data I’ll be releasing next week.

I’ve recently read two articles by ATB that speak to the parts of the demand side of Real Estate.

Before we go there , let’s back up for a second …My basic thoughts on Real Estate pricing that I think you’ll agree with:

- Real Estate is traded as a commodity.

- Supply and demand directly influence commodity pricing.

- Real Estate is an emotional beast.

In addition to looking at leading indicators to anticipate supply, I’m also looking to leading indicators to anticipate Real Estate demand.

Here’s what I’m learning about:

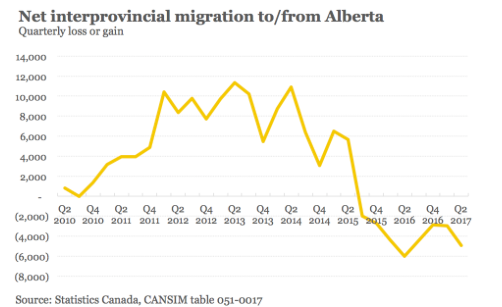

People Are Leaving Alberta.

More people are moving from Alberta to different provinces, compared with people moving here. Today, Alberta’s economy is quite cyclical and I think moves with the ebbs and flow of the price of oil. Not really a stretch. I think this is intuitive to anticipate that people will flow where work is and away from where work isn’t.

With people MOVING to Alberta, that decreases rental vacancy rates, and adds more people to into the pool of potential home buyers. This shrinks housing supply, creating upward pressure on home pricing. Our Province gained 130+ thousand people from 2010 – 2015. Our Province has lost 30+ thousand people from 2015 – 2017.

As economic conditions improve (diversify?) in Alberta, look for this net loss to shrink and then become positive.

I personally think Alberta, Calgary in particular, offers an excellent quality of life (outside of a cyclical economy). Isn’t their always tradeoffs :-).

Worker Income.

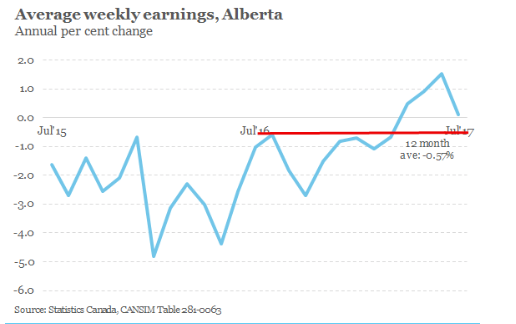

I think this data point is critical to watch in Alberta’s economic recovery and moreso as a leading indicator for Real Estate demand.

First, national employment has been improving, which I think is positive. National wage growth, however, has been less than expected, thus far into Canada’s economic recovery. I think this is to the bewilderment of many economists.

Provincially, wages are about flat over the past two years. This quantifies Alberta’s job market is still recovering. Continued lackluster wage growth does not bode well for any increase in Real Estate demand.

Conclusion:

I encourage you to continue to review my blog posts on the most recent Calgary Real Estate Board data, framed in a way of anticipating near term housing supply.

I am also continuing to post content on data that I think influences Real Estate demand.

Fixed interest rates have been recently increasing, due to upward pressure on Canada’s Bond. If you plan on purchasing a home in the next 2-4 months, or think that might be a possibility, please connect with me to help you hold an interest rate.