Naturally, with the price of oil where it is, and Calgary being primarily driven by the price of oil, I think these Calgary Real Estate Board (CREB) statistics confirm what is on everyones mind: decreasing home values are coming.

Here’s what tends to happen in this kind of scenario.

1. People thinking about buying a home enter a “wait and see” mindset. I think they’re waiting to see where oil will level off. I think they’re waiting to see what their job prospects look like in 2015. I think their confidence in the housing market has decreased (nothing wrong in feeling that way).

2. I think the statistics in the housing market are not good. I am showcasing them right now (below). As more people learn about these statistics, this confirms in many peoples mind that “now is not a good time to buy“. Their thoughts of a market price decrease are brought to fruition.

3. People wanting (needing?) to sell their home, list their home for sale in a decreasing Real Estate market. But they want to sell their home at the price their neighbour did 5 or 6 months ago. Maybe they get that price. Maybe not. If listings continue to enter the market, but there are less sales because buyers are in a “wait and see” mindset, I think home prices will continue to face downward pressure with increased supply.

4. I think buyers continue to wait on the sidelines for the market to “bottom out”. I think everyone loves to think they bought at the best time; at the bottom of the market (who wouldn’t?). The trouble with that is nobody will know when the market truly bottomed out until well after the fact.

I think there takes a certain amount of intestinal fortitude to buy a home when the market sentiment is “wait and see“. I think doing the opposite of, in the face of fear, begins with education. Understanding your purchasing options NOW and in the future.

I think the “right time to buy” is different for everyone. If I am purchasing a home, a place to live, and plan to remain on the “property ladder” for 20+ years, the market will certainly continue to fluctuate well after I initially enter the market.

If the past is an indication of the future, the long-term outlook for property values in Calgary, I think are certainly likely to increase.

[Note: all numbers are from monthly CREB statistics for single family homes. I think there is less fluctuation in this data. I also think this provides a picture of the Calgary Real Estate market.]

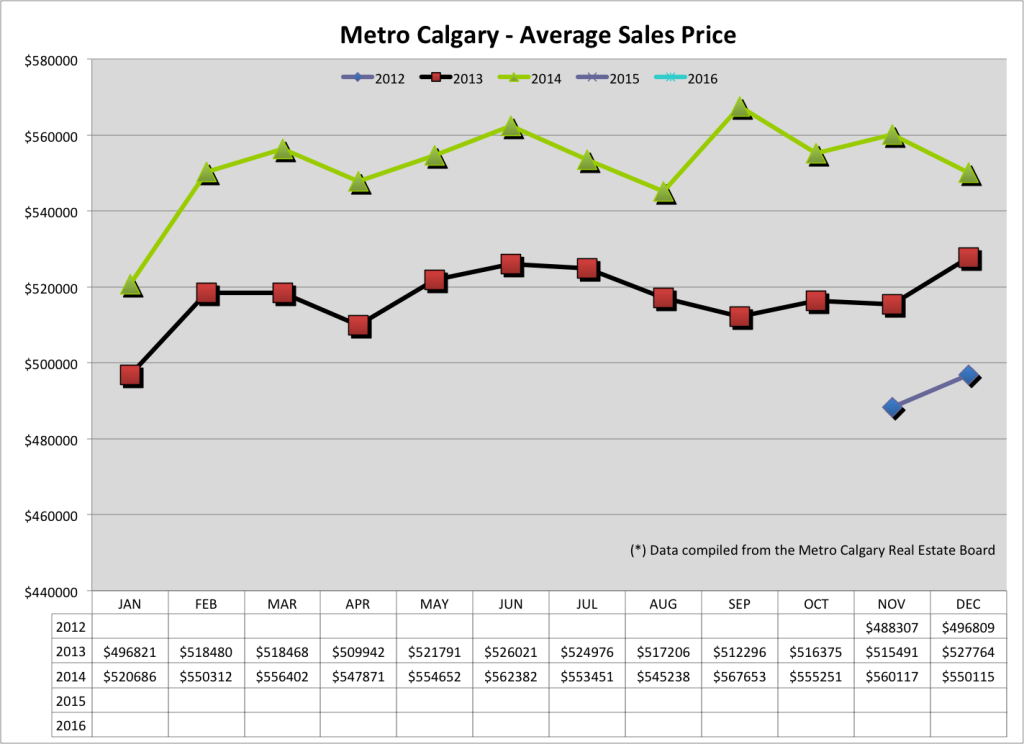

Average Price Of Single Family Homes (SFH):

The average is totalling all of the sale prices for homes in Calgary and dividing them by the number of homes sold. Ideally, I would report the median sale price, but I am unable to find this data.

The average sale price of a SFH is down month over month, but still up year over year.

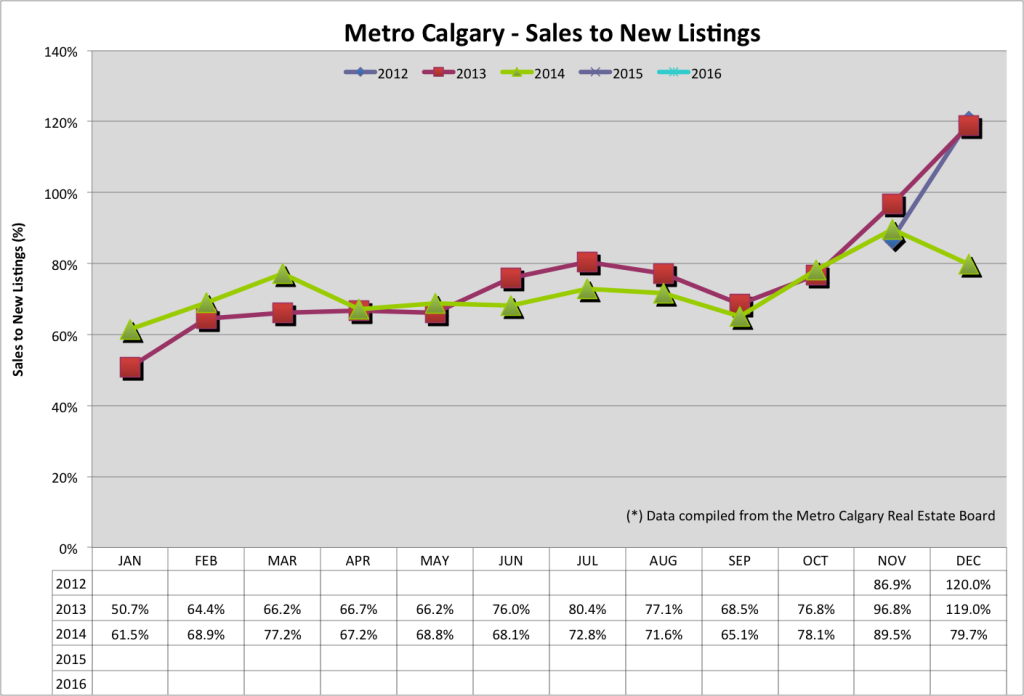

Sales To New Listings Ratio:

This ratio is found by dividing the number of sales into the amount of new listings, for each given month. You’ll see December 2014 is moving the opposite direction of the previous two years. This is due to year over year DECREASE in the amount of sales and an INCREASE in the amount of listings coming onto the market.

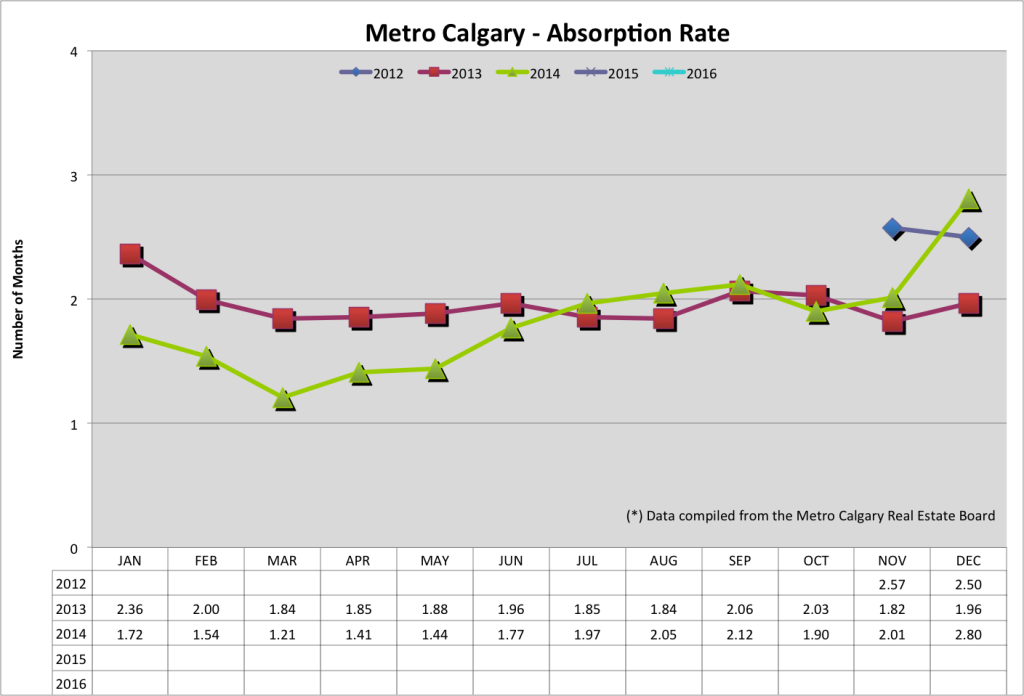

Absorption Rate:

This is the amount of time, in months, it would take to sell ALL active listings based on that months sales numbers. You’ll see the absorption rate has significantly increased because of higher total inventory for sale on the market and decreased total monthly sales.

I think this is people (sellers) thinking the market has peaked and they want to sell their home for top dollar. I think this is also buyers pulling back on purchasing a home now, for reasons mentioned above.

Conclusion:

I think this data is a strong indication of decreasing property values.

If you’re thinking about purchasing a home in 2015, I think understanding your purchase and Mortgage affordability is the first step towards your goal. When you understand this you’ll save time in your home search, become more aware of price changes in your a affordability range and understand the reality of how movements in this price effect your purchasing power.

Please visit this link to begin this first step in your Real Estate education.