Hey Guys!

Here is some information I hope you find helpful:

1. Canada’s updated inflation numbers.

2. Mortgage rate update.

3. Statistics package.

This will be helpful if you’re planning a Mortgage renewal, refinancing, selling or purchasing Real Estate.

Canadian Inflation Numbers:

Peak inflation looks to have passed through our system with headline Consumer Price Index (CPI) and other core measures of inflation finally rolling over.

That is likely NOT going to derail the Bank of Canada (BoC) from another rate hike on October 26th. I think it is wise to conservatively plan for another 0.50% or 0.75% rate hike. Wow!

Bank of Canada inflation target: 2.00%

Consumer price index (CPI): 7.00% (down from 7.6%)

CPI Common: 5.70% (down from 6.00%). This is a core inflation measurement of common price changes across categories of the CPI basket.

CPI Trim: 5.20% (down from 5.40%). This core measurement of inflation excludes extreme price movement over a given month. Examples of this would be price change due to extreme weather.

CPI Median: 4.80% (down from 4.90%). The core measurement of inflation corresponding to the price change of the 50th percentile of a basket of goods.

We are still a long way from the BoC’s target of 2% inflation—these are steps in that direction though.

From the Bank of Canada:

The BoC has three points of interest that help guide their decision making moving forward:

1. Demand focus.

- Monitor global developments that effect import, exports and business development.

- Monitor Canadian spending (demand). Pandemic savings rates are high so spending, in spite of higher rates, might prove to be more persistent?

- Monitor wage growth. As excess demand fades, pressure on wages and prices, therefore inflation, should also ease.

- Watch the housing market.

2. Supply challenges resolved.

- Monitor risk of uncertain global events that might effect—or continue to effect supply chains.

- Monitor improvement of supply disruptions I.E., motor vehicles.

- Monitor supply constraints and how that translates into lower costs for Canadian firms.

- Monitor labour supply.

3. How inflation and inflation expectations respond.

- Monitor the three core measures of inflation (above) to assess how broad and entrenched price pressures are in the economy.

- Monitor near-term inflation expectations amongst consumers and firms.

Mortgage Rate Update:

Here are fixed Mortgage rates* between 1-3 years which might be helpful for some folks to know:

1 year fixed rate: 4.74%—5.24%

2 year fixed rate: 4.99%—5.44%

3 year fixed rate: 4.99%—5.44%

*Rates subject to credit, loan-to-value, income eligibility, and more.

A common conversation is what term to consider? Historically, a 5 year fixed term provides people a reasonable amount of time to be in a Mortgage contract, with the most competitive pricing.

A narrative that is becoming more common is people thinking the post-pandemic era of economic turbulence will pass in several years.

Renewing a Mortgage in several years might provide an opportunity for more favorable interest rates for clients to renew into.

I agree and assign some probability of this happening. I’ve mentioned before, it’s great to have a plan—but plans change.

Statistics Package:

Here are a couple of interesting charts and data that relate back to Calgary’s Real Estate and Mortgage market …

National Employment Data:

One of the factors the Bank of Canada is monitoring is employment. We can see below how hot the job market was in Canada. In fact, wages increased by about 5.4%—which is HIGH, but still less than headline inflation.

We can see recently a 3-month change in Canadian employment has adjusted lower rather drastically—coming off at a rate not seen since the great financial crisis.

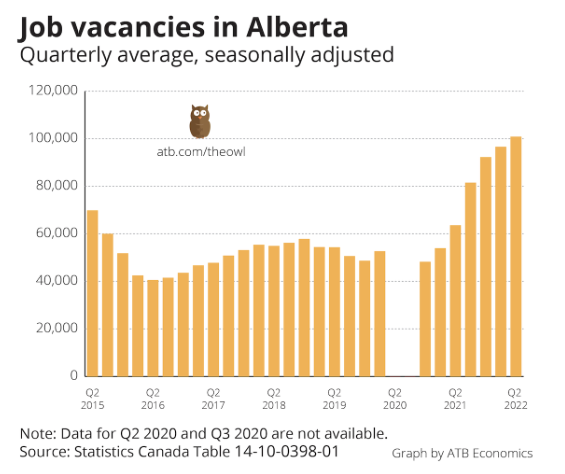

More locally, ATB is reporting a growing percentage of job vacancies meaning there is still a labour shortage. This translates into strong employment, and or higher wages for workers.

Further below is a diagram that outlines how rate hikes effect the economy over time. This is U.S. data but I think applicable to Canada and interesting to see unfold.

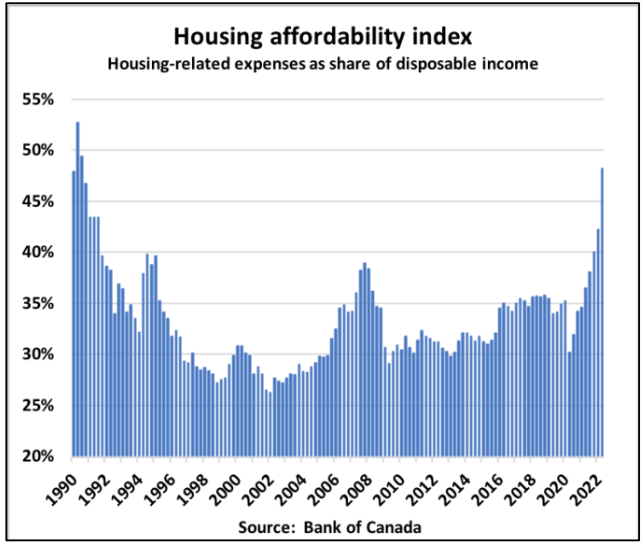

National Housing Affordability:

I know, I know—affordability in Calgary is A LOT different than Toronto or Vancouver. I get it!

I’m sharing this with you because national data influences national numbers that ARE involved with Calgary Real Estate.

I’m qualifying people for Mortgages AS IF their interest rate is 7%! Nationally, a slower housing market will be a factor in inflation data, and the BoC’s rate trajectory.

Conclusion:

The effects of rapid rate hikes by the Bank of Canada are starting to show up in our economy. The most important factor our central bankers are focused on is inflation.

Stats Canada is reporting that Canada’s inflation numbers are topping, and possibly showing signs of coming down.

There will be collateral damage (by design) as a result of higher rates I.E., housing, asset markets, employment—all leading to less economic demand (spending).

Ultimately the goal of this rate hike cycle is to softly transition the economy from over heating—due to extended pandemic stimulus—to moderation.

Many market watchers are hoping a “hard landing” (severe recession) can be avoided during this rate hike cycle.

The extent that inflation data remains sticky, will dictate how long the Bank of Canada keeps our rates at these relatively elevated levels.

I hope this update is helpful! Let me know if you have any Mortgage related plans.

Talk soon,

Chad Moore

P.S.

Hunting season is open! This is a hobby I picked up during the pandemic and am continuing.

This sport is a great reminder in the difference between achieving goals and defining success.

My goal is to ethically harvest the game animal of interest. However, I define success outside of my goal. This helps keep me motivated and having fun, regardless of my result.

For the record, my goal is not achieved this season, but my trips have been a success! Good luck to other hunters out there! And thank-you to all the spouses of hunters too—I see you :-).