Hey Guys!

Let’s look at some leading economic indicators to help us understand where inflation might trend, and relate everything back to Canadian Mortgage interest rates.

Read below:

- Inflation expectations and consumer data.

- Variable rate update.

- Fixed rate update.

- Conclusion.

This information is a part of the short term debt/credit cycle. In case we needed a reminder, this cycle (loosening or tightening of monetary policy) is a primary driver of the Real Estate market.

Inflation Expectations and Consumer Data:

I think in many people’s mind the Bank of Canada lost credibility as we are exiting the pandemic because of:

- Being the federal government’s piggy bank. The Bank of Canada’s holding of government debt grew in direct correlation to the government pandemic spending.

- Promising no rate hikes until the end of 2023. There were several very clear and direct messages to all Canadians of this forward guidance.

- Trumpeting early signs of inflation as transitory. I found there was a lot of mixed messages in the market during this era. Some market participants were clearly in the “inflation camp” and others (including our central bank) was in the “transitory camp”.

- Focusing blame of inflation on the war/supply chains. To be clear, I think the war/supply chain issues are influencing inflation. I’m not reading or hearing the BoC taking ANY responsibility for contributing to inflation due to the significant increase in the money supply.

It seems the Bank is now regaining their credibility by forcefully raising interest rates to brow-beat inflation back to the 2% target. Collateral damage in the economy (I.E., housing) is an afterthought—the mandate of 2% inflation is the goal.

I think the Bank will achieve their inflation target sooner than they plan, which is by 2024. Just as quickly as money can be created out of thin air (I.E., creation of money through credit); money can also be destroyed with debt pay down. With the cost of borrowing going up—this is exactly what is happening!

Here are some indicators of possible peak inflation, and more:

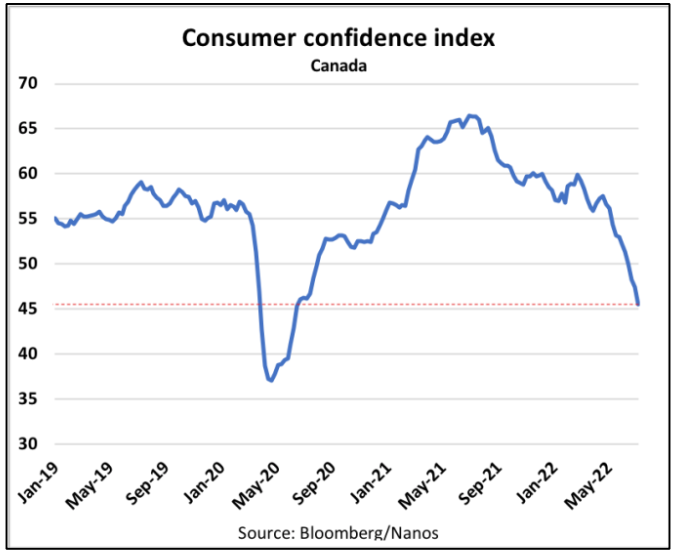

- Think back to the onset of the pandemic. Do you recall how uncertain your economic future was? The stress you felt? Well, consumer confidence is dropping close to that level—again.

As a consumer, with low confidence in the economy, I take out less new debt, I am incentivized to pay down my debts, and I spend less disposable income—saving more. These are all deflationary forces. - The Industrial Product Price Index (IPPI) is a pricing index of goods leaving manufacturing. This can be viewed as a leading indicator of the consumer price index (CPI)—the primary measurement of inflation. The IPPI dropped by 1.1% indicating a roll over of inflation related goods. This is a loose and very early indication we could be at peak inflation.

- Canada’s inflation print came in lower (8.1%) than expected (8.4%). No one is celebrating this decrease, rather noting the difference.

- Commodity prices, tracked in the Goldman Sachs Commodity Price Index, are down about 11% since mid-June.

One fascinating fact about inflation is how influencial inflation exceptions are—which relate to consumer spending. If I think prices will be higher in the future, I pull forward my spending (consumer/business). This, in and of itself, is inflationary because more money is spent driving prices higher. I’m keeping an eye on business and consumer inflation expectations. So far, they remain above the BoC’s 2% target.

And this brings us back to the Bank of Canada’s credibility …if people really think the BoC will hike rates into a potentially slowing economy just to bring inflation to heel—spending decisions are likely to be altered (I.E., lower). This will bring inflation down, regaining credibility. Question: are you changing your spending habits because of higher rates (yet)?? I am.

Of all the news articles relating to inflation/BoC monetary policy etc, I found this one very clear and simple. I like that ;-).

Variable Rate Update:

Let’s start with two fundamentals, which are understanding:

1. Adjustable rate Mortgages (ARM).

2. Variable rate Mortgages (VRM).

Adjustable rate Mortgages (ARM) adjust when the Prime interest rate moves up or down. The clients Mortgage payment changes which retains their repayment timeline (amortization).

Variable rate Mortgages (VRM) have a static payment. The payment does not change with the movement of the Prime rate. When the Prime rate increases, less of the clients payment goes to principal pay down with more going to interest.

This can be a problem though. Here’s why …

The trigger rate!

What’s this? A trigger rate will only apply to VRM in an increasing interest rate environment. Here’s how a trigger rate would come into effect …if the Prime rate increases to a point where the clients static Mortgage payment does not cover the interest cost of the payment. In this scenario, the Mortgage would GROW, and not be paid down. The lender will then call to fix this scenario requesting either a) a lump sum Mortgage payment to lower the balance of the Mortgage, or b) a payment increase to cover more of the required interest payment.

VRM lenders are:

- RBC.

- CIBC.

- BMO.

- TD.

- National Bank

- ATB.

Heads up—with another Bank of Canada rate hike planned for September, trigger rates could be enforced. Ask people in your network if they have a VRM or ARM. Then ask them if they are prepared for a trigger rate. If you have a VRM, I recommend increasing your Mortgage payment before being forced to.

Realtors reading this email—tell your past clients about this possibility and to connect with their lender. Surprises in Real Estate are not good, even as a homeowner.

Fixed Mortgage Rate Update:

The super sized interest rate hike by the Bank of Canada was met with a blank stare from the bond market.

You see, the Bank of Canada is chasing a lagging economic indicator, inflation. And they need to at this point. However, the Bond market is forward looking and bond yields are not moving.

I’m seeing some lenders cut fixed interest rates in response to bond yields falling.

Conclusion:

I am thinking of this inflationary period like a bell curve (not necessarily symmetrical though). You know the one—low on the edges, rising in the centre. I think it is possible our current inflationary data is near the middle chunk of the bell curve right now. I’m keeping an eye on leading inflationary indicators for you.

With higher rates, variable rate Mortgage holders could face a trigger rate scenario. I’m reading this would likely be a shock to many—in terms of knowledge AND finances—but not a massive cash-call or payment hike.

Fixed rates seem to have plateaued, and are even grinding lower at some lenders for the moment. This provides some relief for Mortgage renewals, and new buyers.

I hope this is a helpful update for you! Reply to this email with any questions or concerns etc. Your emails come directly to me.

Talk soon,

Chad Moore

P.S.

This is a bumper year for mosquitoes hey! My canoe trip was great, but man did I have to deal with a lot of bugs. I’d prefer bugs versus a dry/fire summer with smoke in the air!

P.P.S.

I was successfully drawn for a special hunting license for this Fall! I’m pumped about that!

P.P.P.S.

August long plans—what are you up to??

P.P.P.P.S.

B.C. Real Estate just implemented a mandatory “3 day cooling off period”. This means buyers can back out of a Real Estate purchase within the first three days. At this time, I do not see anything like this looming for Calgary’s Real Estate market. Link to the press release below:

https://news.gov.bc.ca/releases/2022FIN0026-001134

*If you find this newsletter helpful, pass it along. Thank you for your new business, repeat business and referrals*