Hey!

Housing continues to be the single most important asset class in Canada’s economy.

I think staying abreast of several key supply-side fundamental data points is worth a 5 min read (with charts :-)).

Let’s catch up on Calgary’s housing market, based on June 2022 Real Estate board data!

Below is information for detached and apartment segment homes:

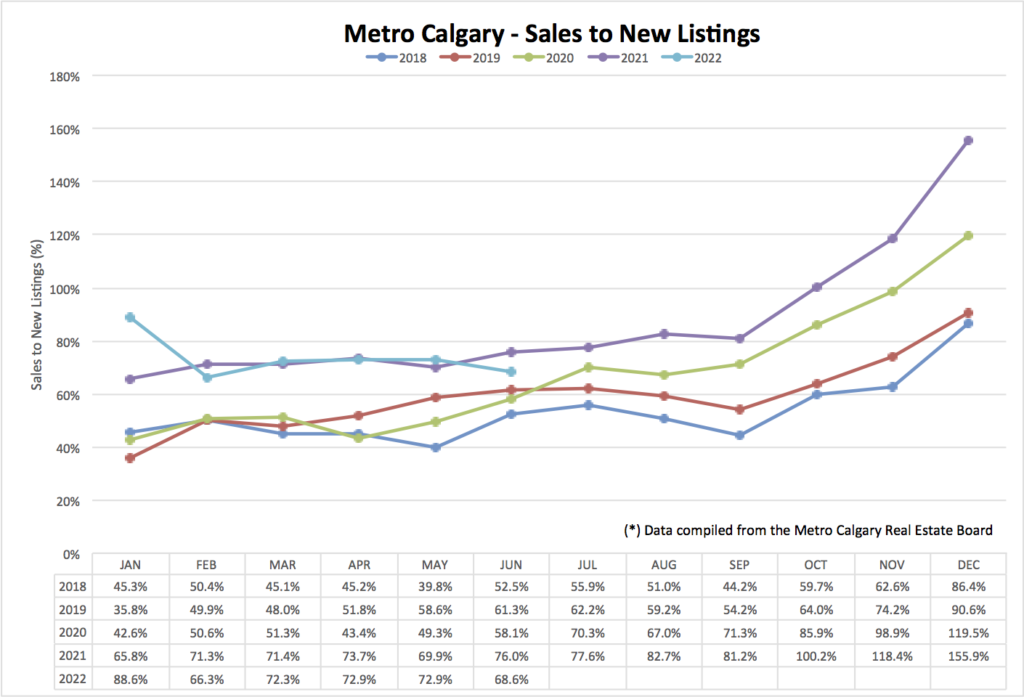

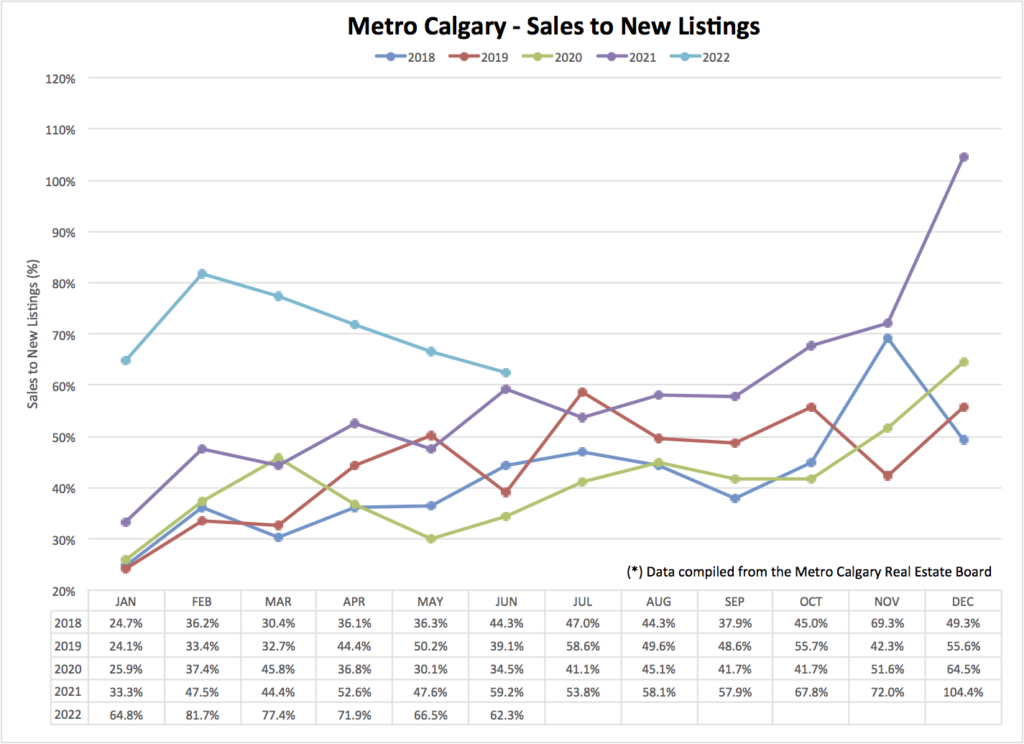

1. Sales to new listings.

2. Absorption ratio.

3. Average/median price.

Detached Home Data:

Sales to new listings:

This ratio helps anticipate near term changes in housing supply. If the trend line is down, this indicates increasing supply. If the trend line is increasing, this indicates a reduction of supply.

We can see below a small dip in the sales to new listings ratio month-over-month. Compared to years past, this data point is on the higher side (less inventory), but still relatively clustered together.

I am curious how the final four months of the year play out—setting the stage for Spring 2023 housing market. This segment of time has been a revealing indicator for the preceding spring Real Estate season.

The well documented rise of fixed interest rates and Bank of Canada rate hikes will be more entrenched later this year; possibly hissing air out of home buyer demand.

Although, should inventory also pull back, bringing equilibrium to the market, a higher pricing floor might be supported. #alleyesonsupply

Noteworthy data:

Sales May 2022: 1,620

Sales June 2022: 1,483

(down 8.5% m/m)

Inventory May 2022: 2,552

Inventory June 2022: 2,667

(up 4.5% m/m)

Days on market May 2022: 22

Days on market June 2022: 24

(up 9% m/m)

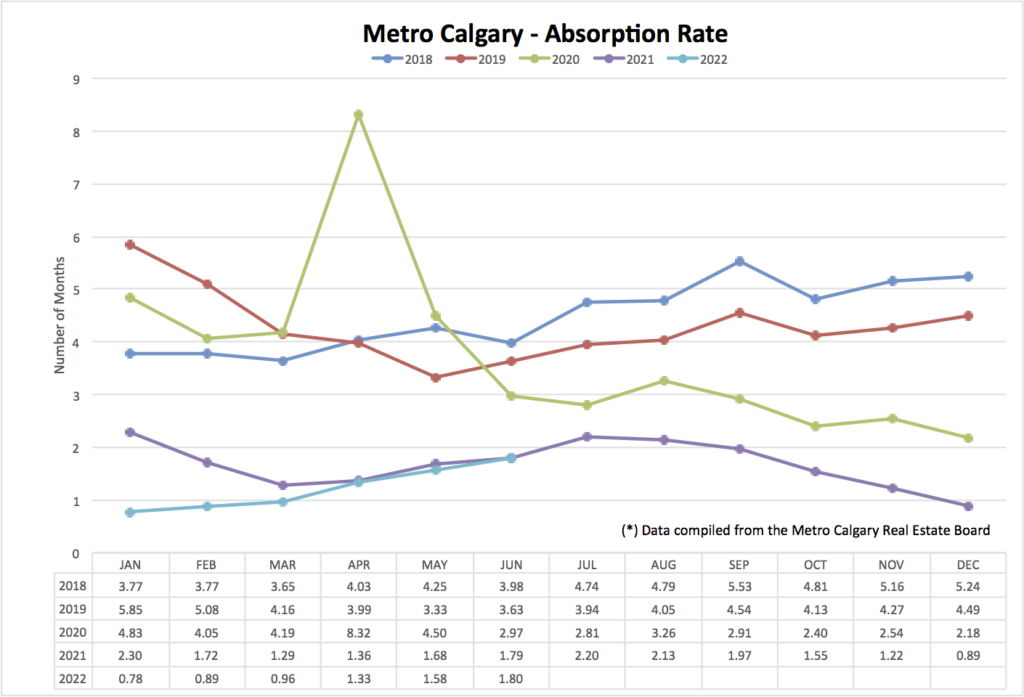

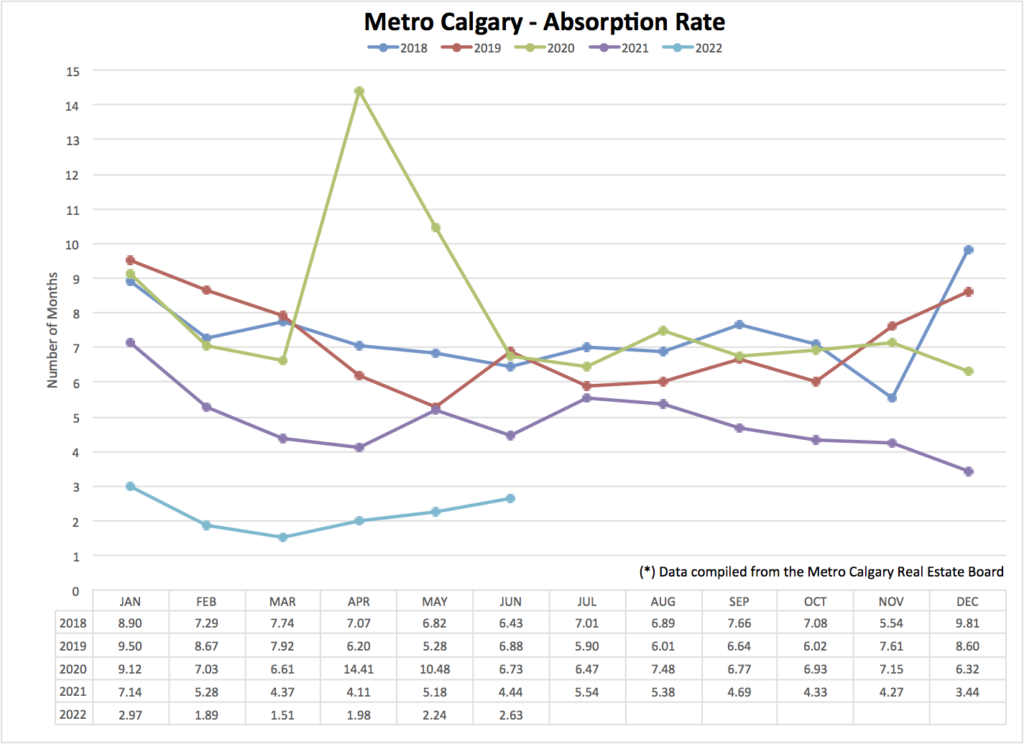

Absorption Rate:

The absorption rate let’s us know how many months it would take to liquidate all of Calgary’s detached home inventory, at the pace of the current months’ sales.

This one simple data point speaks to the “health” of the housing market. Lower absorption rates typically indicate lower supply and or higher sales volume. Higher absorption rates indicate the opposite.

We can see below, Calgary’s detached absorption rates are off the crisis level lows we saw back in January—March.

With a unencumbered Summer season, and higher fixed interest rates, I anticipate lower sales volume AND less new inventory coming up for sale this Summer.

The balance of sales and new inventory is a important market mix to continue watching. Thus far, 2022 absorption is tracking with 2021 absorption.

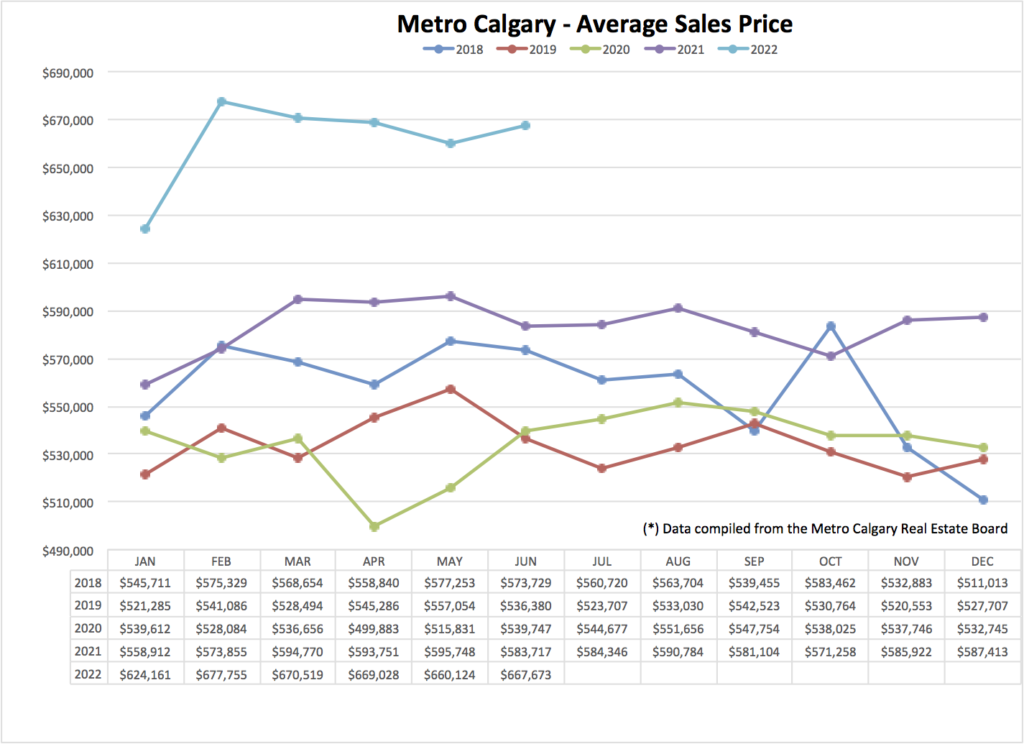

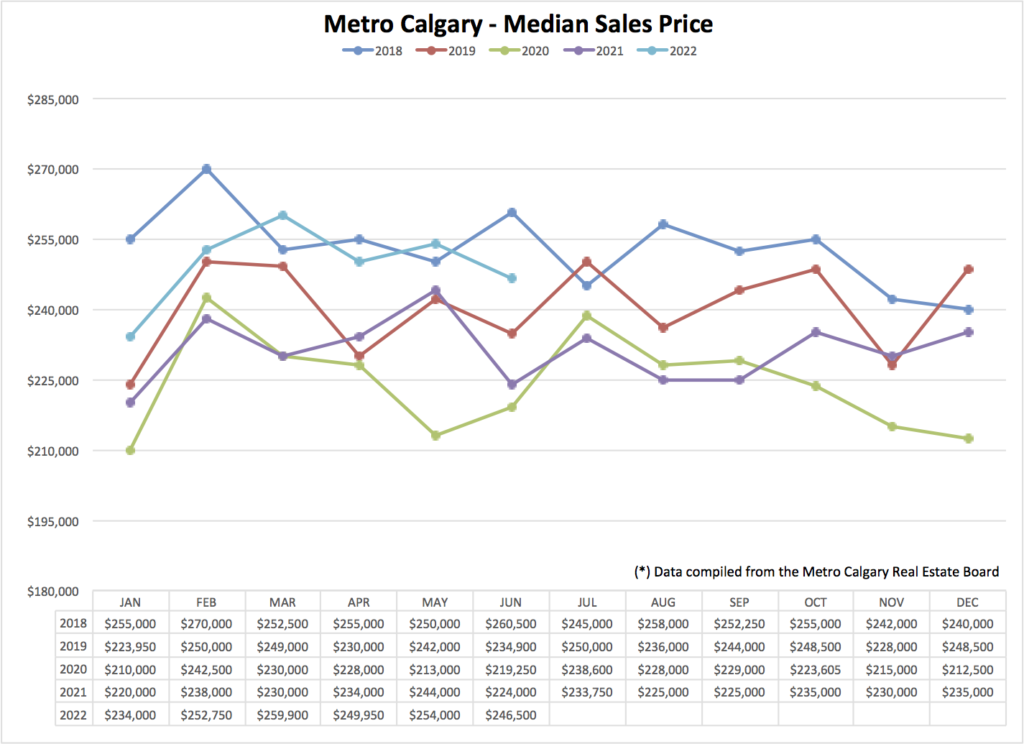

Average Price:

Based on current data mix, a new higher average price floor is being established.

I think it’s safe to say, the pandemic induced upward pressure on detached home prices is behind us. As our return to (new) normal unfolds (I.E., return to work, interest rates, reduced stimulus, less personal restrictions etc) so are detached home price movements.

I’m seeing the return of accepted offers below list price, buyer purchase conditions (financing and home inspection) and listing price reductions. The possibility of these kinds of offers being accepted by sellers, only a few months ago, were very rare—if at all possible.

For now, the average price is holding. However, the market can quickly turn back on itself should interest rates remain at today’s elevated levels.

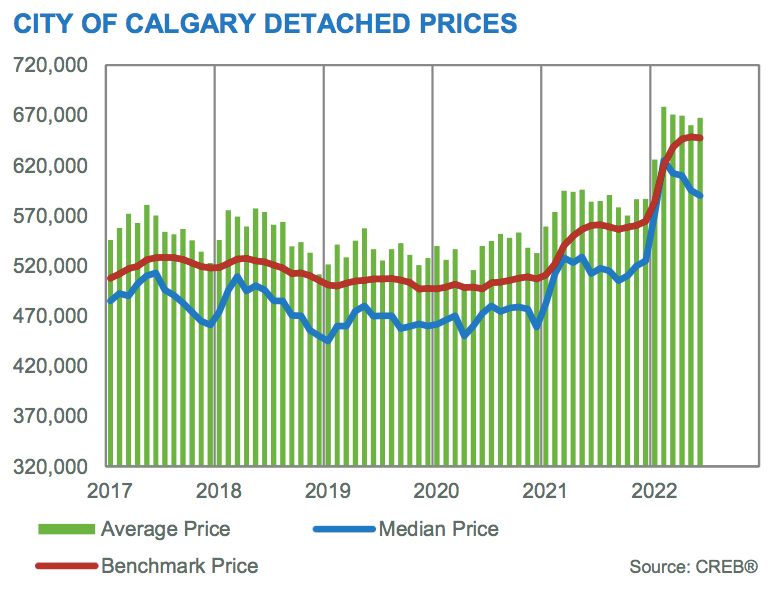

NOTE: The CREB report does show detached median price has diverged rather distinctly from the average price data. The last time this kind of divergence took place was Q2 2018—that period of time lead an average price decline.

Apartment Housing:

Sales To New Listings:

This ratio is making a bee-line to historical numbers. Here are some data points driving these results:

May 2022 Sales: 631

June 2022 Sales: 581

(down 7.9% m/m)

May 2022 New Inventory: 949

June 2022 New Inventory: 932

(down 1.8% m/m)

May 2022 Days On Market: 34

June 2022 Days On Market: 34

If this combination of decreasing sales and constant addition new listings continue—a growing number of apartment units for sale will put a cap on price appreciation.

Absorption Rate:

Calgary’s apartment absorption rate is firmly below historical numbers, but rising slowly.

Total apartment inventory in May 2022 was 1,416 growing in June 2022 to 1,526 (7.8% m/m growth).

Again, let’s watch how supply plays out over the near/medium term as an influencial factor to price direction.

Median Price:

As with nearly every segment of Real Estate across Canada, Calgary apartments are past the peak of Feb-March 2022.

The influencial factors of supply are a main factor to watch.

Conclusion:

In each of the above segments of Calgary home type (detached and apartment) sales are slowing with inventory building (not at a rate to be alarmed about). New trends are beginning to form.

I think this natural easing from peak euphoria (Jan-March earlier this year) is healthy. Remember these months?? I’m sure you heard multiple stories of the insanity …Calgary saw crisis levels of inventory, historically cheap money and insatiable demand for Calgary housing.

Speaking of demand …without any specific data, I think a meaningful portion of recent buyers were from outside of City limits. Canadians looking to sell at peak values in Ontario and B.C., were opting for cheaper Calgary housing. Will this trend continue?

I’m planning to send my clients an email update on interest rates soon. I think we have all been reminded, of all demand related factors that influence Real Estate, the short term rate cycle is THE BIGGEST factor. More coming …

If you find this content helpful, let me know and or share it with a friend. Thank you in advance.

Any Real Estate plans on your mind? Reach out—I receive your emails and like to hear from you guys.

Talk soon,

Chad Moore

P.S.

John Dutton …errr …Kevin Costner is our parade marshal tomorrow. I’d gladly take Rip as a substitute. Lost here? Watch Yellowstone!

P.P.S.

I’m headed on a multi-night canoe trip next week. I’m leaving the back half of Stampede to you folks! I’m paddling from Nordegg—Rocky Mtn House on the North Sasky. Big rapids, beautiful scenery and heart-pounding adventure!

P.P.P.S.

I finally am around to reading the second book in the Outlander series; Dragon Fly In Amber. I’m about 100 pages in and building a dictionary word list—about 33 words now!

Let me know what you’re up to! Talk soon :-)